Welcome to Trading Research Hub!

This substack is focused on helping traders and investors finding ideas on how to approach markets, from someone actually trading them.

In this newsletter, at least once a week, I will provide a brief article with:

A full trading/investing strategy

Performance of the strategy

Occasional python code used for backtesting the strategy

If you're struggling to find ideas for your trading/investing business, I'll ensure this is the place to discover them.

Pedma’s Story 👋

7 years ago I decided to leave my full-time job to start trading my own small capital at the time.

What I thought would be a few months of pain, before learning the game, became years of losing money and consistent stress.

I eventually dug my way out of the hole, and by doing so, I accumulated many lessons that I still carry with me today, as I trade the markets.

I’ve written in detail about my story here:

I eventually became profitable by trading “sensible” things and focusing on a few core principles that guide me to this day.

My goal with this newsletter is to provide a space where I can share my thoughts, research and learnings from being an active trader in the market.

I’ll do my best to ensure that every article written here provides value to you, the reader.

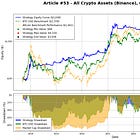

The Best of Pedma’s Newsletter 📈

Research Article #19: Relationship Between Bitcoin Price and $MSTR Stock Price - X (Former Twitter) Link

Research Article #18: Periods of Positive and Negative Momentum in Crypto Markets - X (Former Twitter) Link

Research Article #17: Pairs Trading/Statistical Arbitrage with 12-Month Formation Periods - X (Former Twitter) Link

Research Article #15: Pairs Trading/Statistical Arbitrage Between Correlated Coins - X (Former Twitter) Link

Research Article #14: Crypto 21-Day Breakouts - X (Former Twitter) Link

Research Article #13: Adaptive Trend Allocation (ATA) - X (Former Twitter) Link

Research Article #12: Ichimoku Cloud Breakout - X (Former Twitter) Link

Research Article #11: ROC's RSI - X (Former Twitter) Link

Research Article #10: MACD Crossover - X (Former Twitter) Link

Research Article #9: EMA Positive and Volume Expansion Strategy - X (Former Twitter) Link

Research Article #8: 20-Day High Breakout - X (Former Twitter) Link

Research Article #7: Day of Week Seasonality - X (Former Twitter) Link

Research Article #6: RSI as a Mean Reversion Tool - X (Former Twitter) Link

Research Article #5: Volatility Contraction Effect - X (Former Twitter) Link

Research Article #4: EMA Crossover OHLC Dip Entry with ATR Exit Strategy - X (Former Twitter) Link

Research Article #3: Short-term Volume Contraction Effect - X (Former Twitter) Link

Research Article #2: RSI Mean Reversion Strategy - X (Former Twitter) Link

Research Article #1: Hammer Bar - X (Former Twitter) Link

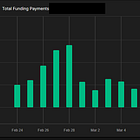

My Portfolio Performance

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.