The Volatility Paradox: Cryptocurrency Trading - Research Article #58

How Lower Volatility Led to Superior Risk-Adjusted Returns

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Introduction

The relationship between risk and return continues to challenge traditional financial paradigms.

Today’s article examines a systematic trading approach that demonstrates how strategic risk management can generate substantial risk-adjusted returns in the crypto market.

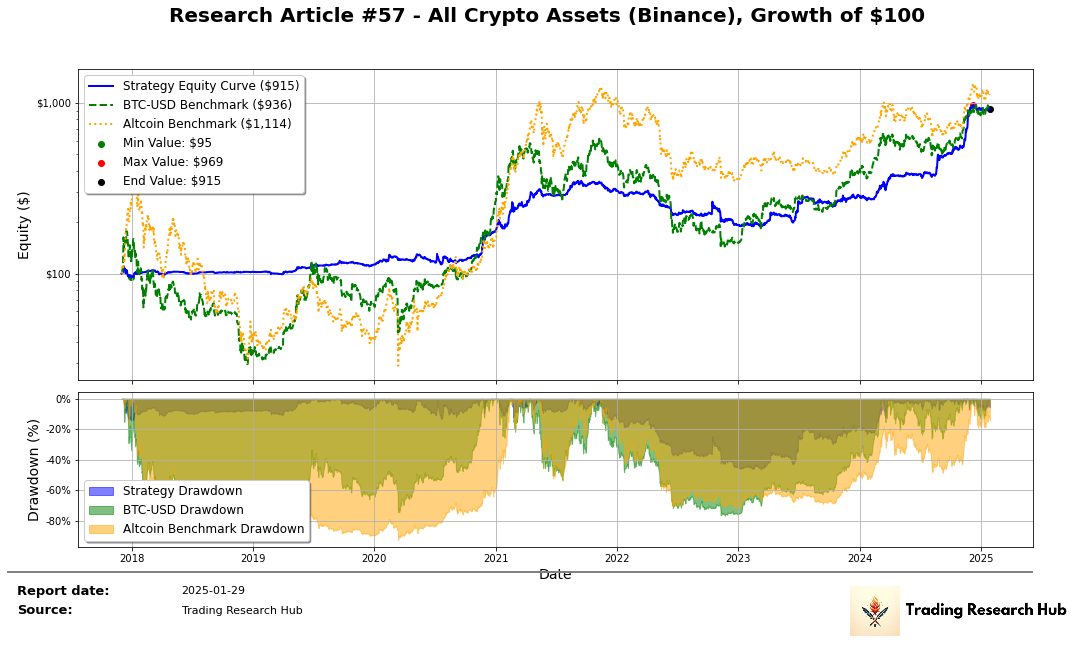

The strategy's performance metrics reveal a compelling narrative: while delivering a total return of 814.96%, it achieved this with remarkably lower volatility (25.40% annualized) compared to both the benchmark and broader cryptocurrency market.

With a Sharpe Ratio of 1.29, substantially exceeding both the benchmark (0.80) and total altcoin market cap (0.83), the approach demonstrates superior efficiency in capital deployment.

This performance is particularly noteworthy given the cryptocurrency market's characteristic volatility and continuous trading nature, where traditional risk management approaches often prove insufficient.

We begin with a detailed methodology discussion, followed by an in-depth performance analysis across multiple market conditions.

Index

Introduction

Index

Strategy Thesis

Research Paper Highlights

Data Sources and Processing

Methodology Framework

Example Trade Scenarios

Performance Analysis

Conclusion

Strategy Thesis

The low volatility anomaly represents a significant departure from traditional financial theory, which posits a positive relationship between risk and expected returns.