Here’s My 2024 Trading Performance Review as a Crypto Trend Follower - Research Article #56

An honest look at my trading performance in 2024.

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Trading trend-following in crypto has its ups and downs.

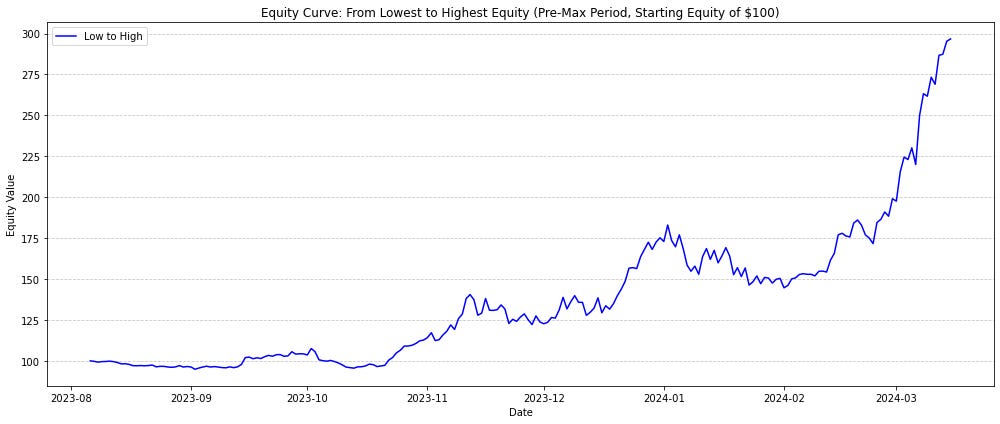

Sometimes you are making an unbelievable amount of returns…

… but then reality hits, and you realize that you are trading trend, so most of the times, you’re just losing money.

(The returns above are real % net returns from my portfolio by the way. I just adjusted it to a starting equity of $100 for demonstration purposes.)

That is the nature of positively skewed models.

What is positive skew? It’s just a fancy way to say that most of the trades are losses, and sometimes, I win big on a few trades.

Well, usually at the end of the year, people that invest/trade for a living, have the habit of going over their performance, and thinking through what went wrong and what could have been better.

2024 is over and it’s that time to review my performance in-depth.

During 2023 to early 2024, I was outperforming on a consistent basis both Bitcoin and the Altcoins benchmark I’ve designed.

By early 2024, I even qualified as top 99.53% trader in Binance.

But something changed during 2024…

I was no longer outperforming the market.

Here’s my performance, net of fees (blue line), up until the end of 2024:

So several questions naturally come up:

Why am I underperforming?

Is my model’s edge decaying?

Should I change strategy going forward?

That is what we will find out today.

I hope to share with you how I think about drawdowns and losing periods, from a rational perspective, so that we do not allow emotions to cloud our decision-making.

Trading is a really hard game, and anyone that says otherwise is trying to sell you something.

Underperformance doesn’t necessarily mean that you are doing something wrong, but it can, so we need to figure out if we should proceed as we are, or something has to be changed.

1-year is not enough data to figure out if a model continues to produce returns, especially not in the low frequency model types that I run. However, there’s multiple red flags that I have been not addressing that are the main sources of concern:

Acquired Knowledge: I have built this model in 2021, which with the experience I’ve gained in the past 3 years, I know it is pretty naive. I have mostly disregarded them because the model was indeed outperforming, and I find it hard to change something that is working well.

Reliable Simulations: There’s no way to reliably test the entry signal because I am trading as the asset breaks out of a consolidation. It’s really hard to match reality to a simulation when there’s a “moving” signal throughout the day.

Fundamental Filters: There’s no filters for liquidity and/or market cap. This means that I am trading anything that comes up, and as we’ve seen in previous articles, this is extremely important in crypto. The lower the liquidity a coin has, the easier it is to move it around and affect sustained trends, which is what we’re looking after.

Equity Volatility: Volatility is not controlled. This in itself is not a bad thing, there’s plenty of old school trend followers that use one entry, one exit type models.

Ok now let’s get into analyzing the performance and finding out why or if I REALLY underperformed in 2024.

Index

Introduction

Index

Core Objective

Benchmarking Performances

Worst Period of Performance

Best Trades

Changes in 2025

Core Objective

If we want to know if we are underperforming, the first thing we need is accurate benchmarks.

In simpler terms, we need to test our strategy against others that are similar to they way we trade.