The Art of Strategic Drag - Research Article #69

Using short-leg drag to safeguard and stabilize your cryptocurrency portfolio.

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

In the pursuit of the most profitable trading strategies, we often overlook a counterintuitive truth—sometimes the most valuable parts of our strategy are the ones that appear to make very little or even lose money.

This paradox lies at the heart of sophisticated trading, where individual components work in concert to create something greater than the sum of their parts.

As traders, we're naturally drawn to strategies that show consistent profits in backtests. We chase the perfect system optimized for maximum returns while inadvertently creating fragile strategies that collapse under real market conditions.

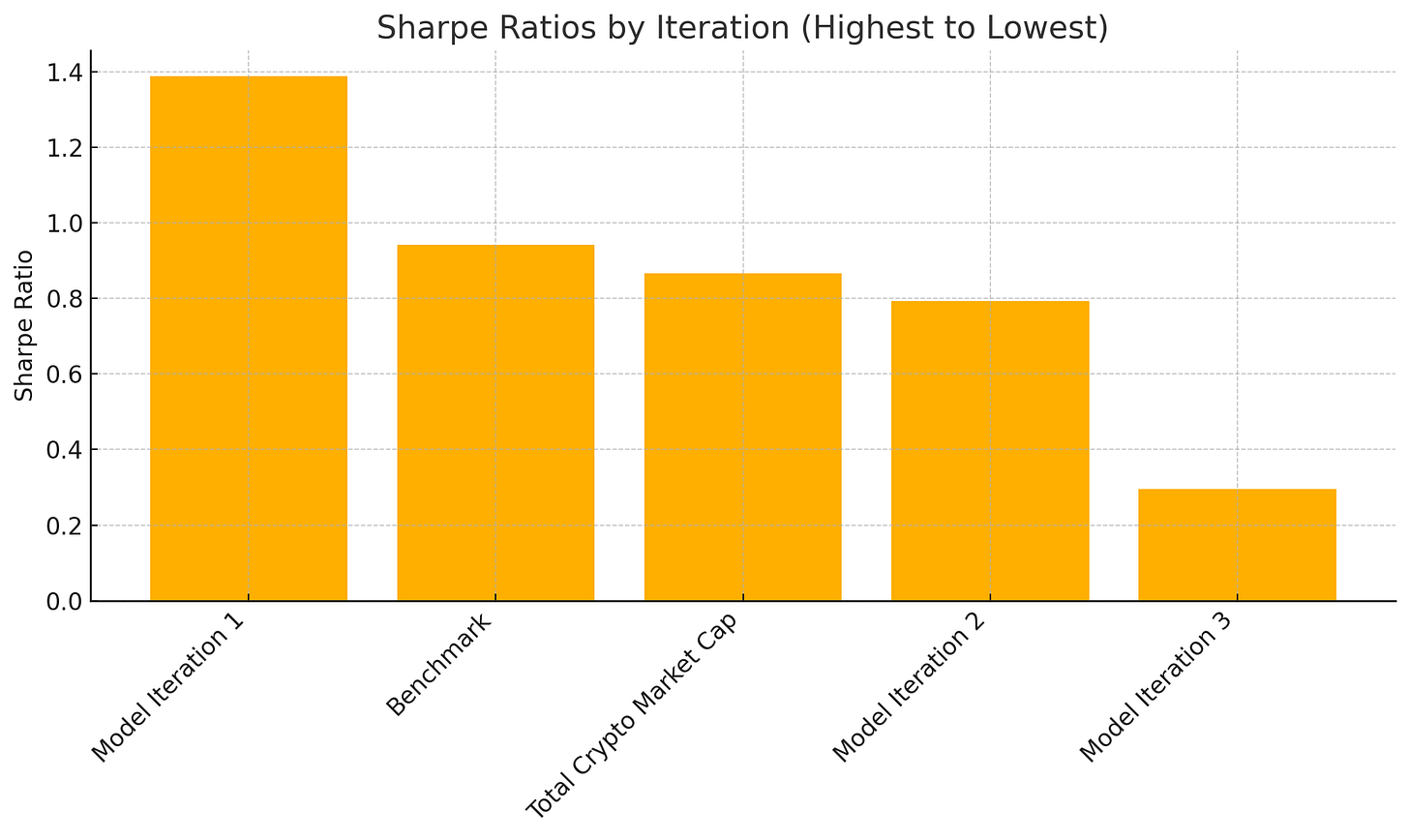

The data tells a different story - one where seemingly underperforming components can actually enhance overall portfolio performance, as evidenced by our strategy's Sharpe ratios ranging from 0.29 to 1.39 across different market conditions.

Consider the short-only performance of the trend-following signal we’ll be looking at today. In isolation, it might appear to be a drag on performance, regularly posting small losses during strong bull markets.

However, at the same time, providing crucial downside protection during market crashes, allowing the overall strategy to maintain significantly higher risk-adjusted returns, when benchmarked against its long-only counterpart.

This is not just theoretical - our analysis shows how these "losing" components can actually reduce portfolio volatility and enhance long-term performance stability.

Let’s dive into today’s article!

Index

Introduction

Strategy Thesis

Data and Methodology

Performance Analysis

Conclusion

If you’re interested in 1-1 consulting with me, I am opening a few spots this year to help traders develop their own portfolio of systematic trading strategies. If you’re interested, book a free call and ask me any questions: https://cal.com/pedma/15min

Strategy Thesis

The counterintuitive power of this trading strategy lies in its approach to combining seemingly unperforming components to create a more resilient portfolio.