From €535/Month to Full-Time Trader: My 7-Year Journey

What 7 Years of Trading Taught Me About Markets

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Introduction

In today’s article I will tell you the story of how I went from just having a high school diploma, working as an electrical technician, making €542 euros a month at my full-time job, to a full-time trader.

Today I spend my days managing my trading portfolios, doing research to improve my trading models, writing about that research and thinking about new ways to find edge in the markets I trade.

The whole article will be about how I used to think about trading, and how has that evolved to how I trade today and think about finding true edge in markets.

Over the years I have:

Traded a diverse set of markets such as currencies, U.S. equities (micro caps and large caps), futures and cryptocurrencies.

Blew up a few of my portfolios.

Traded profitably on an online prop firm, who later on forced me to close the account.

Self-taught coding to help me research and build trading models.

Deployed multi-strategy automated models in crypto and equities.

Built a brand in systematic trading with over 50,000 subscribers/readers and 60,000,000 views in 2024 across platforms.

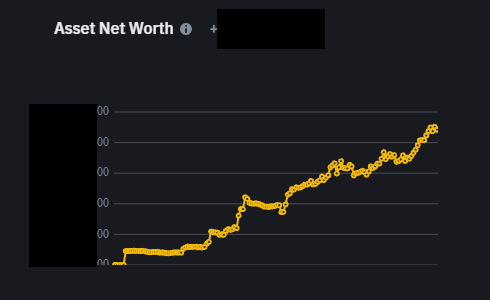

In fact, earlier this year, I was in the top 99.2% of traders on Binance, measured by percentage of assets increase during a 30-day period:

I wrote about it here: https://x.com/pedma7/status/1768649477634531760

Before the current crypto cycle started, I bought Bitcoin (and other altcoins) from as low as $17,000 in early 2023, all timestamped on twitter and my articles.

Here’s the link to the tweet: https://x.com/pedma7/status/1864627946809393166

And I’ve built models that are decently successful that have made me money on a yearly basis:

I’ve been sharing personal portfolio performance reports here: https://tradingresearchub.com/t/research

This isn’t a story of getting rich quick. It took me more than 7 years to get to a place I feel comfortable with my own trading.

It’s not been an easy journey as you will read about below. There were a lot of times that I wanted to quit, frustration is a constant, and uncertainty will always be there.

By my third full year, I had deposited in my trading portfolios over €20,000.00 and I hadn’t seen a penny in returns.

This might not seem like a lot, but by that time I was earning a little over €12,000 net of taxes a year at my full-time job. So this accumulated deposit was more than 2 years of income.

What led me to turn this around was sticking to a few principles that I hold today about markets and maintaining an edge trading them.

Even though I won’t disclose how much capital I have under management today, I can say that is well beyond the 6-figure mark, and my goal is to achieve 7-figures in assets under management within the next few years.

Today I have the confidence that I can always make money trading, in any market. It’s all about knowing what the principles are and focusing on what makes money, not elaborate theories that never realize into returns.

Given this, my goal for 2025 is to finish building and release a fully automated multi-strategy portfolio, with transparent and open track records.

Everything here written is my own experience trading for the past 7 years.

Let’s get into it!

Index

Introduction & Background

2016: The First Taste of Trading

2017-2018: Finding My First Edge

2019: Trading Edge

Mid 2020: Trading at a Prop Firm

Late 2020: The End of the Winning Streak

Late 2021: Crypto Trading

Extra: Example of a Good Crypto Trade

2022: A Year to Build

2023: A Year of Performance

2024: Building a Brand and Trading

Bonus Section: Key Lessons

2016: The First Taste of Trading

It was summer 2015, I was 18 years old and I had a diploma to work as an electrical technician.

I was doing an apprenticeship in a construction company during the end of school that year, but I hated the job.

I remember being at work, in this really hot summer day, extremely tired from a day that I spent breaking a wall, in a construction site we were working on. The working day was coming to an end, and as I was leaving the construction site, I remember seeing this man leave a nearby building, dressed up really nicely, and stepping in into his fancy Mercedes. I remember thinking:

I wonder if I could be him if I tried.

That single idea was planted in my mind from that day forward. At least as far I can remember. I thought I was a pretty smart kid, did pretty well in school when I wanted to, but the problem was that I wasn’t interested in many of the topics there discussed. So I always slacked and didn’t care that much.

I ended school with a score of 13 out of 20, which is pretty average.

In any case, I thought that if I put my mind to anything, I’d get it. I don’t know where that idea came from if you ask me, maybe my video game past as I was pretty competitive there, or something of the sort, but I’d be just guessing.

After looking at a few courses, it was brought to my attention the course to be a certified “Specialist in Accounting and Taxation”. I didn’t want it at first, but eventually I went through with it.

This time I ended school with a score of 17/20, which was well above my previous high school experience. Finally I found something that I was interested in, that I could excel at, and be top of my class.

After I had finished the course, I began working as a bookkeeper. At at the time I was earning a net total of €542 a month. Yes it’s a full time job. At this time it was the minimum pay in Portugal.

It was a lot of work, and I learned a ton, but I had always been entrepreneurial, and I wanted to learn something new.

I tried a bunch of different ways to make money:

Making electronic music

Dropshipping

Building websites

Affiliate marketing

Selling electrical bikes online

And a bunch of other stuff I can’t even remember.

All up until the point I saw this youtube video of a guy trading these weird “binary options”.

I was intrigued by it…

He turned a small amount of money, into multiples in a few minutes of the video. As a naive kid, wanting to try something better than my job, I went ahead and opened an account.

These “financial instruments” (if we can call them that) were basically ways to gamble on the movement of an underlying asset. They are no longer allowed in Europe, which is a good thing, because there was a lot of shady stuff happening on the backend.

I dropped my first €10 in there to test it out

.. and to my surprise, I turned those €10 into over €600 in a matter of hours.

It was crazy.

I was already making plans on excel, how much I’d make if I had the same rate of return every day. Classical naive newbie behavior right?

Obviously, that didn’t last long and I began losing money. So that prompted me to try and find a system to this madness.

I ended up withdrawing only €360, but I still had an incredible return in such a short period of time.

I went into online forums and boards, in the attempt of finding someone with a perfect formula, that would make me a profitable trader.

Right there, I made the wrong assumption that someone with a high returns model, would willingly share it online for free!

I tested dozens of ideas, and none of them seemed to work. The authors always blamed relatively abstract concepts like psychology or discipline, so that we would be on their loop for longer.

After all, it wasn’t me not having edge, I could blame something else at fault.

I thought that if I put the right combination of signals together, it would eventually produce me a profit.

Right?

As a naive new trader, it made perfect sense. A robotic rules based way to trade, where everything would be explained by a formula. I just had to find it.

Even though that has a component of truth, it is mostly wrong.

To this day, I still have hundreds of pictures of different systems from those days.

I came to the conclusion that short-term price movements were too hard to predict, so I was moving to higher and higher timeframes.

I obviously never found a solution.

Because the truth is, there’s never a solution to the markets. Only imperfect estimates.

I kept bleeding money every month, until I eventually decided to take a break from “trading”, and focus on my job.

Lessons Learned:

There’s a lot of scammers online, especially in the finance niche.

No one is sharing the best trading models online but some share useful variations.

Making money trading once, doesn’t make you a good trader.

A system is required but not the final solution.

2017-2018: Finding My First Edge

After a few months of break, I was starting to get the “itch” to trade again.

I start searching online, but this time I wanted to find proper ways to trade. I eventually find this video of a guy that was selling courses on trading U.S. micro cap equities. He claimed that he already had multiple millionaire students so I proceeded to watch all of their interviews.

I guess you know who am I talking about if you are familiar with the U.S. micro cap space.

He was truthful in the sense that some of his students indeed became millionaire traders, but I think they achieved that success by their own means. But that’s a conversation for another day…

By this time, I had some experience in the trading niche, and knew that this person, most likely, was just another one trying to sell a course, while providing close to 0 value, like all of the others.

Looking back, this was a good assumption to make.

Nonetheless I had no knowledge, so I had to start somewhere. At least this guy seemed to have some success in what he was doing, so I watched all of the interviews and free content he put out.

After studying and getting all of his ideas together, they actually made some sense, but at the time I didn’t know it.

Here’s some good things about what he was trying to teach:

He was trading a capital constrained market. This meant that big players usually stayed away from it, which made it more inefficient and the competition less skilled.

A lot of the major moves in some of these stocks, were based on overhyped narratives, promotional news that were as close to illegal as one could get without getting caught, pump and dump schemes and retail hype.

Fundamentals of these companies were extremely weak, and many of them were basically bankrupt.

These companies tended to raise capital, diluting existing shareholders.

Informed traders could spot manipulation in the news flows quite fast and in the SEC filings.

So these companies had the tendency to go up by a lot and fast, usually during premarket, over some news or speculation. When this happened, more than 70% of the times, they would almost completely revert the next day or a few days after.

And you could make a decent amount of money if you were on the right side of these trades.

Obviously there’s no free money laying around, there was risks:

You had to borrow shares every morning. By 7am New York time, for a lot of the “juicy” trades, you would need to borrow in advance, otherwise most brokers would run out of shares. The problem here is that you don’t know if you’ll get an entry during the day using a systematic model. So later on, I ended up paying a lot of money on borrow costs that I never ended up using.

There’s a lot of volatility intraday. Some of these stocks could spike 20%-40% in the first few hours of trading. It was not abnormal for them do that. There were offerings mid day, trade halts that could get you stuck in trades for months, etc.

Since there was so much short interest during the day, things could get really bad if you happen to be in one of those trades that continue to go up. I remember being stuck in one of these halts, with a decent short on, not knowing where it would open. To say the least, it was scary.

I did trade this market mostly discretionarily, for the better portion of 1 year and half.

I had a data component to it, but it was only used to understand the biases within a single day, and not about executing systematically.

I gathered massive amounts of data at the time and tested every little component of my edge.

These are just some pictures I found on discord chats with trading friends from back then. I have 100’s of GB of data stored from that time.

The results from all of this work?

Still negative though.

I was losing money every month.

Even though I had a massive fundamental edge behind my trading, I didn’t have something else.

A mechanical way to trade that edge.

I was fundamentally allowing my discretion, to dictate my exposures. Which is a bad bet for most people, and for myself included.

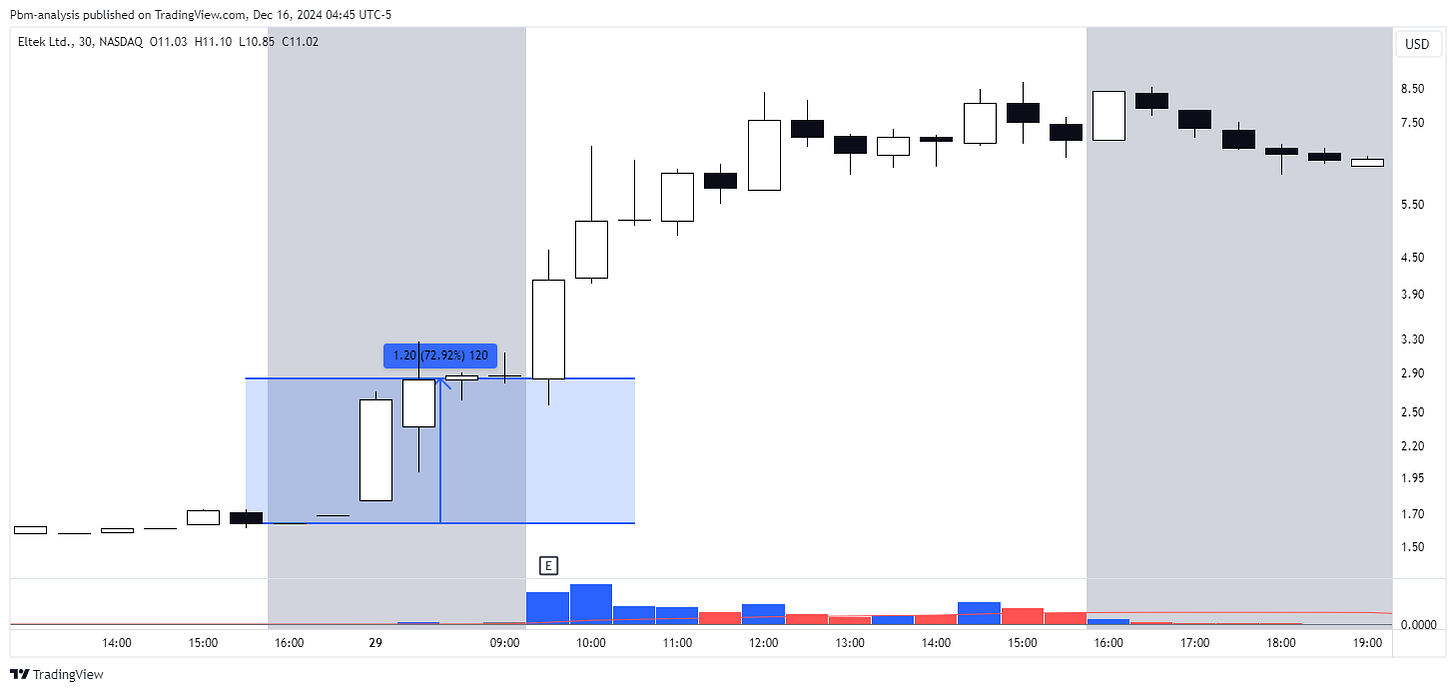

Here’s an example of trades I was making discretionarily.

Despite this specific trade having a decent amount of edge over time, it’s not all times!!

And when you get emotionally attached to a trade, it’s really hard to remove yourself and come back to trade another day.

A classical newbie mistake!

Lessons Learned:

We need a fundamental idea driving our edge.

Having some data around that edge is useful to have a bias.

More data is not the solution, but can be useful.

Required a systematic approach to execution, in order to control emotional reactions during the trading day.

2019: Trading Edge

There’s two things any successful trading model needs:

Fundamental rationale to corroborate your estimate of edge.

Mechanics to execute the positions so that you can maximize the returns for that edge.

Don’t worry if it seems abstract, it’s definitely not, and we’ll get deeper into it during this article.

There’s traders that I personally know, that can get away by not having a mechanical way to trade, but even then, they still have some rules on where to execute, based on things that they want to see happen.

These traders are rare, and most people can’t replicate their natural intuition on how to trade.

Trading just based on “feels” or what you “read on a chart” is the surest way to the poor house I know. To me that’s mostly gambling, and not a successful, sustainable business model.

That’s fine if your purpose in markets is to gamble, but there’s more fun ways to gamble, in my opinion.

If you are a good business person, you wouldn’t open a coffee shop selling whatever came to your mind each day, instead of selling specific things that you know will drive revenue. At least not a person that wants to make his business a success.

I only figured this out in mid 2019, when my largest loss up until that point had come.

The ticker was “ELTK”.

It was up more than 70% during premarket, from the previous close, which was one of the rules us short sellers looked for.

I shorted that initial morning spike, which was my original plan, and waited for it to fade back to the target level that I had set beforehand.

My account was up a lot in the morning. I remember being at the work office, and was feeling pretty good.

Around 10am, I make the assumption that the move might not be over, and perhaps I could short a little more to exit lower.

I short it, but then I am forced to close it for a small loss.

As the day progressed, the stock starts trending higher and higher.

This looked like an amazing opportunity.

If my initial model told me that this stock was going lower today, and it’s now higher than my initial entry, it should be a better short now that it is higher, right?

I had no concept of expected value behind my decision making.

Expected value is the average result you’d expect if you repeated the same action many times. In this case, shorting this stock, for this specific reason.

I had no reason to short it, thus my EV being completely random.

I then proceeded to short and cover, and repeating higher and higher.

I nearly blew my account that day.

I was learning this game almost for 2 years, and here I was again, almost destroying the portfolio it took me so much time to build, in a matter of a few hours.

I still feel the pain of this day as if it was yesterday.

I was sick of losing money every day. I was studying and studying and I couldn’t see any results.

I see some results here and there, but it was a 1 step forward, 2 steps back, kind of situation.

And all of this was due to my inability to control my emotional reactions every time I was wrong, and more importantly, a lack of edge in my decision making.

That needed to change.

I read a book called “Trading in the Zone” by Mark Douglas. Even though there’s a lot there that I disagree with today, that book was instrumental for me to start thinking more mechanically about my exposure.

So I went to work.

I began building a systematic model to trade these U.S. micro caps intraday. I eventually came to an interpretation of a simple momentum model, that I began trading.

It was really simple, I only tested it in an excel, but it worked. In an inefficient market, simple systems can yield interesting returns, when there’s a fundamental edge backing it up.

Things began to improve. I didn’t make much money during this period, but at least I stopped losing it.

That was a signal that I was at least starting to do something better than negative. I saw the light at the end of the tunnel. But there was a problem.

Borrow costs…

Borrow costs are the fees you pay to short a stock. In order to short it, you need to borrow the shares from someone else, so that you can sell them first, and then buy back them later at a lower price.

I was borrowing shares every morning so that I’d have available in case I had a trade.

Why? Let’s think about it logically.

If there’s an opportunity to make money, and we assume that there’s professional traders waiting to maximize returns on capital, what do they do?

They take as much as they can carry in their books.

When they don’t see a large value in the trade, they don’t borrow as much, so naturally there’s more shares available when the trade wasn’t that good.

It isn’t as linear as this, but it’s a good principles in market behavior anyways. When it’s easy to execute an apparently good trade, you must ask yourself:

Why am I the only one seeing this?

Anyways to get back to the story, the problem at this time was that not every opportunity had a trade signal during the day, using my new mechanical model.

So I was sinking a bunch of cash in costs I was not getting an ROI on.

Also my assumptions for slippage were, let’s call it fairly naive, to be kind to my younger self. Those costs, that are not always obvious, were piling on and it seemed that every progress I made, was being absorbed by costs.

It was so frustrating, but I kept digging.

In the fall of 2019, I noticed that a lot of big caps were having massive intraday moves.

Stocks like TSLA were having massive volatility and I decided to allocate some time and capital to deploy the same system, but in this “more advanced” sector.

Remember when I said that there’s 2 things to make a good model work?

On micro caps I had the strong negative fundamentals driving my returns. But I had no model for the execution.

On large caps I made the reverse mistake.

I had a model for execution, but I didn’t know what fundamentals drove my returns.

This wasn’t a problem, up until it was…

Lessons Learned:

Trading needs to be based on a statistical approach with estimates of expected value.

Costs can take a large chunk of the returns, be sure to calculate them into the expected value of the trade.

The best trades are often those that are hardest to execute on.

2020: Finding Consistency for the First Time

By 2020 I shift my complete focus to trading this large caps intraday momentum model.

It was so naive and simple I still have a hard time believing it worked.

But it did work.

And as you’ll see below, it was not because I had some massive edge, but because of something else that was fundamentally driving my returns.

Here I began finding some consistency, and after that, my trading grew exponentially.

I’ll briefly describe the rules of the model, with a recent example on AAPL stock.

Again, I want to make clear that this is not a good model, it happened to work during a great time to be exposed to the market, but it probably doesn’t anymore.

The basic idea of the model was a mix of trend, and a bunch other stuff that doesn’t make sense together.

The timeframe used was the 10-minute timeframe. As my entry trigger, I wanted to find a higher high. A higher high was defined by:

A high that is higher than the previous bar high and the next bar high.

Then I wanted to find a lower low, which is defined as:

A low that is lower than the previous low and lower than the next low.

There was a caveat though.

The previous bar low, needed to be below the 2-minute 20 simple moving average.

Why? I assumed it would give me entries on proper consolidations, and avoid parabolic moves (whatever that means).

After that, my signal would be the breakout of the higher high, and then I’d either sell at:

1.5x the total risk of the trade. The risk of the trade is defined as the entry price minus the lowest price before the breakout, and after the higher high. And then I’d add it to the entry price.

Or at the stop loss, which was the lower low.

In this example:

Entry Price: $249.99

Take Profit: $250.68

Stop Loss: $249.35.

This was the model.

Going through it right now, I can understand the naivety of what I was doing, but at least I was headed towards the right direction by stopping gambling and having some semblance of a structured system.

I had some naive backtests around it, that were filled with biases, but that gave me confidence to move forward.

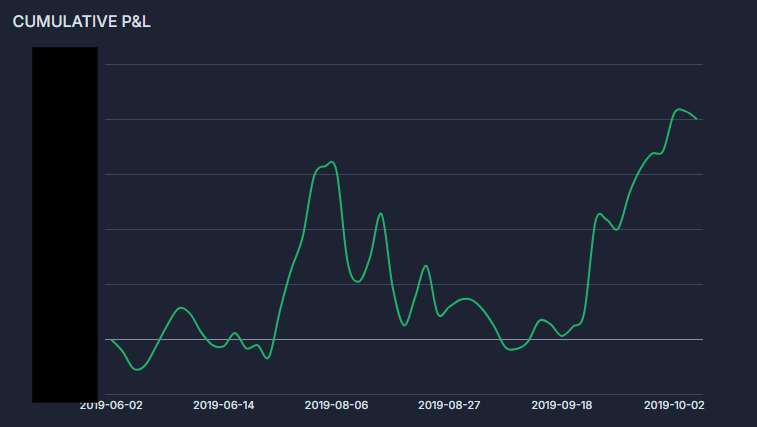

These were the live results after it was deployed.

I actually had a person I knew offer me a 6-figure account to manage. I am so glad I was scared to accept it, and didn’t!

Why was this model wrong?

I was trading on naive assumptions around price data. When you negotiate in the market, you want to be selling something cheap, per your estimation of value, and selling it at higher prices, right?

For this I needed to know:

How predictive are my entry rules of future returns?

Does my take profit and stop loss rule indicate a decay in expected value (if not, why am I removing exposure)?

I had no estimates for any of these features I used to trade.

So I am not playing by the dynamics of the market, I am using whatever seemed to work on limited sets of data, to inform how I should trade.

This is not the way to trade!

In order for me to sell a position, something about my signal must have changed. My forecast of returns must have changed negative or to a point that’s not worth holding, for me to change my view of the market.

And none of that work was done here.

I was using pseudo-rules, that I thought were smart at the time, but had nothing to do with market participation.

Yet, I still made money during this time. But why?

U.S. equity momentum was exceptionally strong. As the saying goes, "A rising tide lifts all boats."

This chart of the S&P U.S. Equity Momentum Index illustrates how the broader market's strength created favorable conditions for my strategy to succeed.

Lessons Learned:

A naive model, given the right conditions, can still make money.

Every decision must be backed by a change in expected value.

The measurement of expected value must be robustly calculated to ensure it remains true when the model is deployed.

Mid 2020: Trading at a Prop Firm

Despite the decent returns, I still had a lack of capital to trade with. Remember, by this time I was still earning around €1,000 monthly, at my full-time job.

Since I was making money consistently, I decided to look for ways to increase my tradable capital, and these prop firms were attractive for someone who didn’t know any better.

I opened an account with them, bought one of their programs, they gave me capital, and I kept 70% of the profits.

It wasn’t much money, but it was enough for me to add another revenue stream, on top of my small account. Since my trading was mostly mechanical, it just meant that I had to insert orders on two platforms rather than one. So it didn’t increase the work load that much, and it seemed like something to try.

And I was making money every month at this time.

At one point, since most of these online “prop firms” are shady, they started executing my positions differently. I noticed I was getting a lot more slippage than before, and when I confronted them about it, they were dismissive, and almost directly asked me to close the account.

Basically they didn’t want any profitable traders there, just people who bought the packages with the illusion that they would make money with no risk on their own capital.

You have always to consider the incentives when you are dealing with a counter-party, in trading and also business.

They were running this model where you’d trade CFD’s on demo accounts, and they claimed that if you were profitable, they would match your trades on their side with real capital.

When losing traders went under a certain drawdown limit on the account (and most of them would), they had to re-purchase a new program. Since all accounts were demo, they didn’t spend a penny and just made money on the program itself.

The thing is, profitable traders made them lose money.

Their business model was not to make money with profitable traders. Our incentives were not aligned.

This was my first taste of how shady the online prop firm industry can be.

In any case, I took a decent amount out of there and later put it on my portfolio.

This helped me trade a bit more than what I was trading before, which was nice.

Lessons Learned:

Always consider the incentive of your counter-party. If it’s against you, it probably isn’t wise to do business with them.

Late 2020: The End of the Winning Streak

As I’ve alluded to before, there’s 2 things that a strategy needs.

By this time I didn’t know that.

I was just going with the flow, because the strategy was indeed making money.

Since I was winning for the first time, I didn’t make any research or advanced on how I thought about models.

This was a bad move.

I was enjoying my summer in Algarve, Portugal.

I made the classical newbie mistake of thinking I had found a way to make “easy” money every month, and that it was now to be a permanent situation.

How naive I was…

But by the end of 2020, I went from making money every month, to losing money every month, once again.

When I decided to pull the plug, I was only able to take €7,000 from the account.

I spent the next several months digging and digging into data to try to find what went wrong.

Why did I go from a strategy that was literally printing me money every month, to a strategy losing money every month?

It just didn’t make any sense.

I can’t estimate how many hours I spent around this problem, and I didn’t find the real answer probably until late 2022.

3 years into the game, spending more than 8h every day after work, and still I was negative overall.

By this time, I almost quit.

I spent many months not doing anything trading related. Not even opening my charts as it was quite painful to remember that failure.

I was really close to quitting up until I found out how crazy the crypto markets were acting…

Lessons Learned:

Nothing is permanent, remain vigilant, keep researching and improving how you think about models.

Always consider what truly is driving your returns, and don’t just assume that it is your amazing skills as a trader.

Late 2021: Crypto Trading

In the fall of 2021, I see traders posting massive returns on twitter trading these crypto markets.

I had heard about it before, but I was pretty busy during 2020 trading that equities model, so I didn’t care that much. By 2021, the sector was all over the news, sports, media, etc, and it was hard to ignore.

Especially now that I wasn’t trading.

As I dig into what these traders were doing, I thought it would be fairly simple, compared to what I had learned in a more efficient market.

Again, making naive assumptions.

After all, I had put thousands of hours by this time into the game, how hard would it be to make money in a less efficient market?

I have the bright idea of taking that same model we discussed above, and apply it to crypto.

But instead of using profit targets, since these things could run so much, I used trail stop losses to allow the trends to run.

With the benefit of hindsight, this was a better idea, I just didn’t know why at the time.

I was using a lot of leverage at this time. I had no concept of why using too much size can actually hurt you in the long-term and the massive risk of ruin it adds to the portfolio.

I went into the technical details about how over-sizing can hurt you in the long-term here:

At a certain point, I had 61 positions opened in only 1 exchange. I was trading multiple exchanges, and across all the things I was doing, I probably went to over 100 open positions at a single time. And no, I was not managing that risk appropriately.

Also looking back, I should have asked myself, what’s the quality of a signal which provided me with 100 different positions at one time? Were there so many positions with similar degrees of positive expected value?

I doubt it. But again, I was not measuring it appropriately yet.

There’s nothing wrong with having a lot of positions opened at the same time. The quality of a signal is not measured by the quantity of signals. One could have 100 open positions, with high quality signals, trading many markets, but that’s definitely not what I was doing here.

I was just using leveraged exposure to the sector I was trading at.

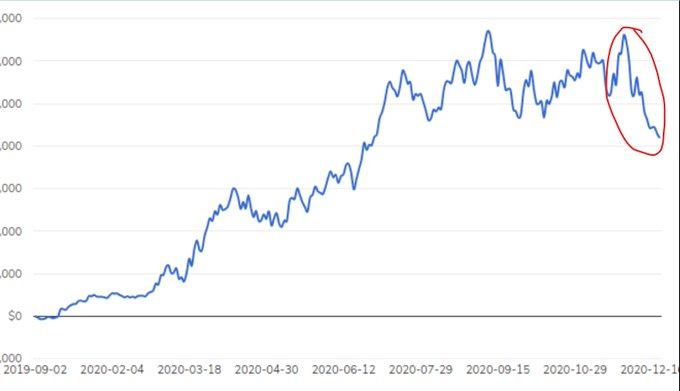

The returns were pretty bumpy but we did make some money.

I was irresponsibly exposed to the market.

I had not learned the lesson of why trading too large is a bad thing yet.

But I was about to…

Momentum is quite a strong factor in crypto and I caught the wave of it, even though I didn’t conceptually understand it at this time.

Do you notice the trend during this article, of how many times I made the mistake of confusing skill as a trader, with something else driving my returns?

Yeh, that’s a very important concept I want you to remember.

And the time came when this model began to lose money.

Even though that by the end of 2021 this portfolio was no longer a trading one, but more for hedging and testing other models, I still gave back a decent chunk of the returns.

Once again, I was back at the drawing board.

Lessons Learned:

Playing in less competitive markets is definitely the best bet for individual traders, but don’t underestimate how hard it will still be.

Too much risk will hurt the portfolio.

In a broad spectrum of available signals, some signals are better than others.

Always consider your risk exposure to a single market. More returns are not correlated with higher degrees of edge.

Extra: Example of a Good Crypto Trade

Let me give you an example of a smart trade I did, where it captured strong behavior from other market participants, that I could anticipate, and profit from.

This was late 2021, and we were reaching the peak of the bull market.

There was this protocol that was giving massive yields to users that bonded assets in their protocol.

I’ll explain how it worked, but keeping it simple and short.

Bonding allowed users to purchase native tokens, at a discount, by providing other assets to the protocol’s treasury. For example, you’d provide the protocol with stablecoins (DAI, USDC, USDT, etc), and you’d get back in return the protocol’s native token, at a discount of what was offered.

The protocol's main claim was that each native token would always have intrinsic value, backed by a baseline of treasury assets (e.g., at least 1 DAI per native token).

People then would take those native tokens and stake them in the protocol, to get rewarded with more native tokens, as an incentive to hold them. The protocol, in order to pay those rewards, they would mint (or create out of thin air) new tokens.

These led to an inflation of the token pool, which diluted current investors, and in order to hold its value, it required both the demand of the native token, and that the investors didn’t sell.

But it’s crypto, and when things gain a narrative they can really fly. The protocol went from around $25M market cap in April 2021, to over $4b until the end of the year.

This is a massive value increase.

Naturally this caught the attention of the market.

Not so long after, people started to launch copies of this protocol. In order to attract users, they’d use massive unsustainable yields.

When I say massive, we are talking about millions of percentage APY (yearly rate of an investment, accounting for compounding).

Since the price was going up a lot, every time there was a distribution of tokens, it was a really good incentive to hold and stake.

The problem was the protocol's reliance on continuous demand and investor retention.

But there was an interesting behavior.

When these new clones launched, they launched at really low valuations, and proceeded to increase massively over the next few days.

Why?

Because buyers wanted to speculate on the early high incentive pool, to get extraordinary APY, while speculating on new projects that could come close to the main protocol.

This lead to a dynamic where it attracted a lot of price insensitive buyers.

And this is what we want when we are talking about finding edge:

A fundamental thesis about an inflow of buyers/sellers that we can help provide liquidity to.

Now all we needed was a way to find new protocols before they launched, and sell our inventory to the buyers.

I used twitter advanced search, and found everyone mentioning keywords around these protocols.

I had a few rules, mostly discretionary based on what I observed:

The website needed to be decent, so that at least I knew they put some investment in and were not quick cash grabs.

They needed a decent amount of engagement on their discord or telegram. So that I knew people were excited about the project and could advertise it on their socials.

I would join their discords, wait for token launch, and just buy them at the market open, and sell them a few days later to late buyers.

One of the best ones opened around $30, and it went to a maximum price of high 300’s.

Obviously these all faded to irrelevancy as these dynamics don’t last and people lose interest. So the edge eventually eroded as the main protocol naturally failed, and no capital was flowing into these trades anymore.

But I had gotten a taste of what true edge looks like.

Similar to what I had in U.S. micro cap equities, here we had a group of price insensitive traders, looking to buy at any price, just to get exposure to this new protocols, in the hope they’d become as large as the main one.

And I was happy to take on the risk of acquiring early inventory, and sell it to them at later prices.

Finally, a thesis that made sense.

Here are the results of this trade back then:

Here I am writing about it in 2021:

Link: https://x.com/pedma7/status/1461968759531442182

Lessons Learned:

Find price insensitive buyers/sellers and facilitate their transactions (fundamental edge).

Large edges have the tendency to decay fast, so one needs to move fast to capitalize.

2022: A Year to Build

2022 was peak crypto bear market, so there wasn’t much to do other than avoiding destroying my portfolio. So I was able to really dive into my coding skills that I had not yet fully developed.

By the end of 2022, I had a small portfolio in FTX, but was lucky enough to pay attention and remove my capital in time.

2022 was a wild year for crypto. There was nothing but negative news everywhere.

So I used this time to dig deep into model development like I never had before:

I researched a lot of new trading models and ideas.

Tested effects like intraday seasonality.

I built machine learning algos from scratch.

Built automated models on FTX (low size testing).

Traded NFTs.

Began sharing my experiences on twitter.

2022 was really a year to build.

I was doing a lot of things that were smart, but others that weren’t that smart, yet helped me build a good intuition about what works and what doesn’t.

I was also doing some services on the side, holding payments in Bitcoin and I did pretty well in my long-term holdings.

By the end of 2022 I solidified everything I had learned into a single thesis of what would make a good trade.

So I first went for the most obvious edge.

Trend following.

Trend following leverages a well-documented market phenomenon—the tendency for assets that are already moving in one direction to continue that momentum.

In simple terms, if an asset has been going up, it often keeps going up, and if it's been going down, it tends to keep falling.

Why does trend following work?

There’s several factors that could be reasonable to assume:

Herd mentality: People tend to pile in when they see prices rises or sell when they see prices falling. Think the last time you saw TSLA stock, or NVDA, or any other stock with massive returns and you felt like you could also get in? Now imagine that same behavior but at scale.

Delayed Reactions: It takes time for markets to fully process and react to new information. Institutional investors often adjust their positions incrementally due to liquidity constraints, while retail investors may act slower or in waves. This creates trends as prices gradually converge toward a "fair value."

Momentum: Winners tend to keep winning. This is extremely well-documented in stocks, futures and crypto.

Risk Premium: Trend following could work because investors demand a risk premium for holding volatile or speculative assets over time. The strategy capitalizes on this risk-taking behavior.

Structural Inefficiencies:

Markets are not always efficient. Supply and demand imbalances, macroeconomic cycles, and the behavior of different market participants can create prolonged price movements, which trend-following strategies exploit.

Also there’s a lot of documented evidence of this being a sustainable effect.

Trend following has been studied for decades and shown to work across many markets.

The famous early trend followers, known as the “Turtle Traders”, were trading this effect already back in the 80’s, and some of them, like Jerry Parker, still manage their own CTA funds with similar variations of the same strategy.

This is the performance of another famous trend follower Paul Mulvaney:

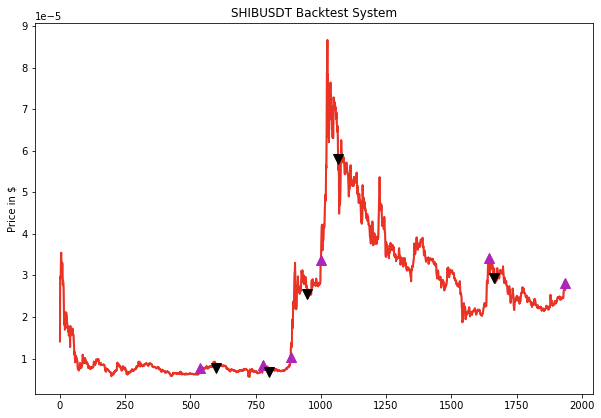

Here’s an example of a simulated trend model returns in crypto:

There’s a lot more evidence to put together to validate our idea, but you get the point.

There’s no “obvious” edges without caveats of course. These edges tend to be extremely noisy and have something that sucks about them.

It’s pretty logical that this happens right?

If everyone knows about it, why does it still exist? Why would there be “free money” for you to pick up?

It exists because it carries inherent risks or constraints, or doesn't offer returns that are attractive enough for large, sophisticated investors to pursue at a scale that would eliminate the remaining profit potential.

And we, as smaller traders, are fine carrying and managing that risk for the compensation that the market gives us.

So I developed this crypto trend model on a weekly timeframe.

This time I had my risk management pretty much fixed, and I was going to limit my exposure to leverage by only trading spot.

This is the combination of services, some trading (although not much due to bear market), and holding Bitcoin during this time.

Lessons Learned:

Start by focusing on clear, robust edges as the primary source of income before delving into more “speculative” forms of edges that only happen once in a while.

Every edge that has not completely decayed has some inherent risk/constraint associated with it. Otherwise, other players would have already closed that “gap”.

2023: A Year of Performance

Even though Bitcoin had a strong start of the year, that wasn’t the case for altcoins. The altcoins market only began trending after the summer ended.

This meant that my trend model was stagnated, because we didn’t have many sustained trends.

As a trader, you will go through many losing periods. It’s normal. Your initial models will be mainly driven by market conditions. And so, if the conditions for your model are not there, you shouldn’t expect to make returns.

Remember my U.S. large cap equities trading? It was mainly driven by the market, but that ended in time…

This is an important distinction. Losing money isn’t always bad, and it doesn’t mean you’re a bad trader. It just means that it’s not your season.

Picture a beachside restaurant in the summer, filled with people.

During the summer, their revenues naturally sky rocket. A lot of people are on vacations and the beaches are filled due to the amazing weather.

Even mediocre beachside restaurants make a lot of money, just due to these dynamics.

But sooner rather than later, off-season arrives, and their revenues often drop 30%-70%.

Does it mean that the food there suddenly became bad? Did anything fundamentally change about the business itself?

No, it’s just a different season, and it doesn’t drive as many customers.

The restaurant owners now need patience and resilience, to make it to the next season, where there will be plenty of opportunity to maximize returns once again.

The same dynamic happens in most models in financial markets.

Back to my performance, only until the later part of the year, did I begin to see some returns.

During this period of stagnation I was not sitting around doing nothing.

I discovered something important. I discovered that by networking with smarter people than myself, I could boost my career much faster than if I was going to do it all by myself.

Remember when I said I was writing about what I was working on?

Well, in 2023 I had managed to gather a 5,000 follower audience, and this allowed me to ask questions and network with other people far more advanced than I was at the time.

I also started publishing more regularly and with more depth than I was used to.

By providing whatever value I could offer at the time, other people were kind enough to offer constructive criticism that led me to new discoveries.

All of these old research tweets and research articles, are all documented on this page: https://tradingresearchub.com/about

Following my attempts to increase my network, I discovered a lot of new things that made me a better trader.

I eventually came to the conclusion that I was, once again, approaching research mostly wrong. At least conceptually.

I thought that it was because of my backtesting work that my models were successful. I eventually learned that a backtest is not a research tool but rather the last component of the modeling process.

But I had been using backtests all of this time. I basically almost set it as the number 1 rule to any successful trader!

It’s pretty embarrassing looking back, because this is not how true edge is found in the markets, as we’ve learned through my own experiences.

This was probably one of the most important concepts that I had learned up until that point.

Why? I go into a lot of detail here:

We can get into the technical details, but for the purpose of keeping this article as short as possible, I’ll simplify.

A backtest only tells you that whatever combination of rules you’re testing, happened to work in the past.

Imagine that you want to make a soup, and you have to choose from a random universe of ingredients.

The method you use to choose the ingredients is random. Just by using basic probabilistic thinking, if you run this experiment enough times, you will end up with a pretty decent soup somewhere down the line.

It doesn’t mean that you are a great cook, it just meant that you happened to be lucky with your choice of ingredients.

Now, if you study why each ingredient is important, break it down by what kind of flavor it adds to the soup, then you start to understand why this ingredient is important.

The same with building models.

We want to find out what kind of information we get from each signal, why does that signal offer forecasting power (based on our fundamental principles about market behavior), and then get an estimate after cost for the predictive power of this particular signal.

Backtesting alone is extremely path dependent and prone to luck as our soup example.

The way retail traders use backtests, is by adding a bunch of rules and tweaking those rules, until something works. By having no basis on fundamentals drivers of what makes a good model, it’s highly unlikely that the model will be useful.

Remember the principles we discussed earlier in this article?

The most important principle is having a fundamental driver of our returns. Something that makes sense about human behavior in free markets.

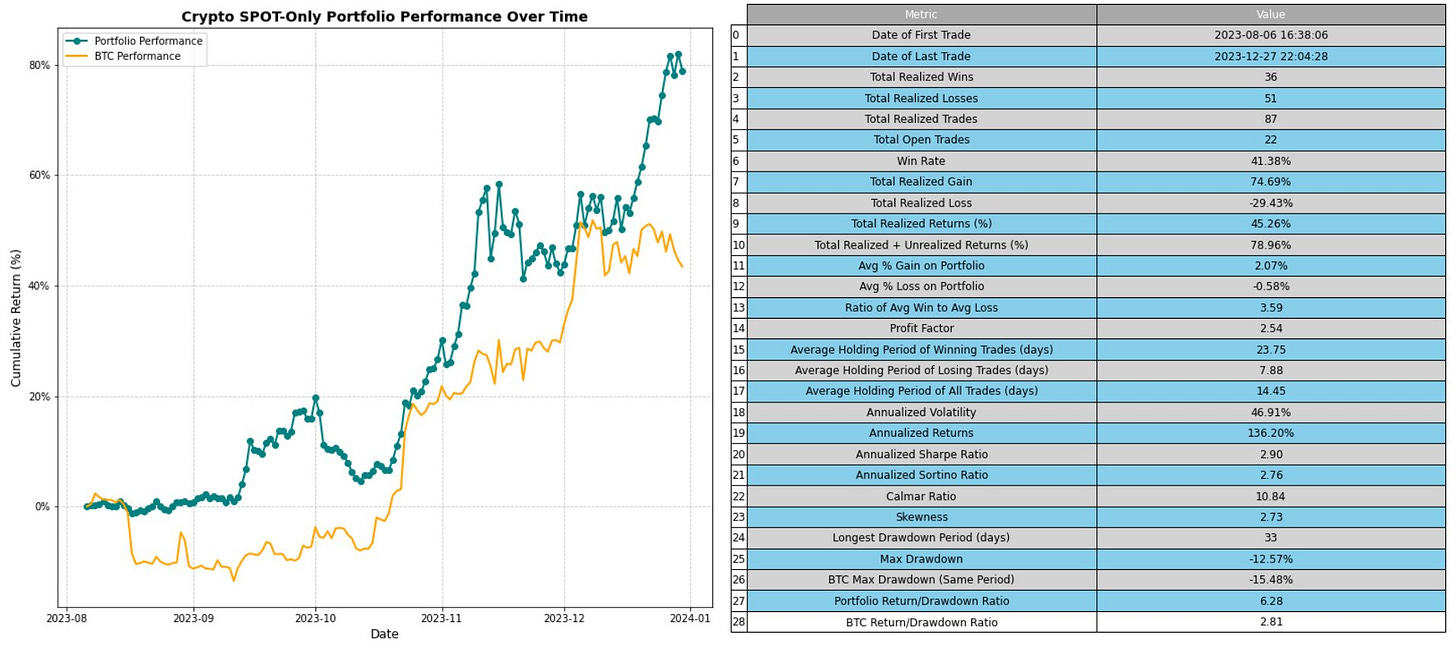

After I had incorporated these lessons into how I think about research, and the market began trending again, my portfolio started to grow with it.

For the first time, I was able to capitalize on a solid opportunity because I had a sound system driving my returns.

By the end of 2024, I was up around 80% on my initial capital.

I wrote about it on twitter: https://x.com/pedma7/status/1741093136414183435

And I also I wrote about it on my newsletter:

Lessons Learned:

Networking is more powerful than you think. Be humble, ask people questions, and always assume that the other person knows something that you don’t.

In trading, there will be seasons where you make money, lose money and stagnate. Losing money doesn’t necessarily make you a bad trader, it can just mean that it is not the appropriate season for your model.

Backtesting is not research. It’s mostly useless, up until the point you need to get some estimates about risk, portfolio allocation, and general path of returns.

2024: Building a Brand and Trading

After you have a solid model, trading becomes pretty robotic and boring.

It’s about executing orders each day, keeping risk in check, and doing most of the same.

I had all of these people asking me questions about how I was trading, my thoughts, etc.

So I decided, why not diversify a bit of my risk, and start building a brand and help people out as I go.

Documenting my journey in a transparent way, in an industry where transparency comes at a premium.

I started to post more regularly, more frequently, and testing all kinds of content that people enjoyed and found valuable.

My most engaged post had over 5M views.

As of today I have over 45,000 followers on twitter, and have generated over 62M impressions in 2024 alone, while writing about a niche subject which is systematic trading.

I also began publishing regular research articles on models and ideas I am working on for my own trading.

I wrote 53 articles so far, and many more to come.

Doing this, I grew an email list to over 6,000 followers this year.

What I discovered was that by having to write my thoughts publicly, I had to make them much more robust than what they were before.

Writing is a form of consolidation of scattered ideas we have on our minds. Sometimes we don’t truly understand a subject, and we assume we do. But when we have to write about it, we find out all sorts of gaps that we can’t connect.

This helped me immensely to be more thoughtful about my claims.

2024 so far went great in trading as well.

There was this decent drawdown during the summer, but that is to be expected from a trend model.

These returns do not incorporate everything that I’ve done, which I will write about in a future continuation to this article.

There’s a lot of things I want to improve in this model.

It does make money, and I’ve outperformed most traders in the last 2 years. But it is still a very basic implementation of the trend model I created in 2022. These 2 years I’ve acquired more knowledge that I am using to create better models.

As I said in the introduction, I am also working towards deploying a multi-strategy portfolio and making the performances publicly available.

This has been quite challenging on the engineering side as there’s many moving parts to this. But I love the challenge and will get it through the finish line.

Lessons Learned:

Writing is a form of consolidating our thoughts. Don’t neglect the importance of having to explain a topic to an audience with writing.

Conclusion

I truly hope you got some value from this rather longer article. It’s meant as a consolidation of my own ideas that I’ve acquired over the years, and a path for other solo-traders, in a sea of useless content, and people that only pretend to trade.

My goal is to document my journey to 7-figures in capital management, and push the boundaries on what can be achieved as a solo-trader with no background in finance.

I won’t say that everyone can make it as a trader, because I don’t believe that. There’s a lot of days that are really hard, and you must embrace the volatility and the unknown as the primary reason why you get paid in this business.

There’s no guarantees, no matter how good you think your model is.

When people told me this in the past, I always neglected it, and thought that they were exaggerating.

But no. Today I find this to be completely true.

The game didn’t become any easier, I just got comfortable with the uncertainty that comes with it and carry on.

If you still decide to try trading on your own, remember that will take a lot of time, thousands of hours, and consistency to do smart things every day.

If you at least have the strength and resilience to do that for many years, you might eventually do well.

There’s a lot of work to be done, but I am excited to what the next 7 years will bring.

I hope you’ve enjoyed my story and took some value from it!

Bonus Section: Summary of Key Lessons

If I had to go back there’s a few things that I’d tell my younger, naive self:

Start with an Edge, Not a Technique:

Always begin with a clear edge or market opportunity.

Avoid the temptation to focus on tools like advanced backtesting without understanding the market edge.

Focus on Testable Ideas:

Only pursue strategies or approaches that can be objectively tested.

Avoid relying on untestable theories or discretionary patterns.

Understand Assumptions:

Always question and test the assumptions behind your strategies.

A good starting question is: "What must be true for this to work?"

Disprove Quickly:

Research should focus on disproving ideas rather than proving them.

Move fast to eliminate bad concepts and iterate on potentially valid ones.

Risk Management is Critical:

Always prioritize staying in the game over chasing profits.

Avoid trading too big or too often; both lead to losses either rapidly or through gradual erosion.

Be Adaptive to Market Realities:

Markets are highly non-stationary, and strategies must evolve with changing conditions.

Historical trends are not guarantees of future opportunities.

Simplify Where Possible:

Use straightforward analysis tools.

Avoid overly complex models unless the edge justifies it.

Trading is a Process, Not a Solution:

Trading success is about consistently executing repeatable processes rather than solving the market.

Discipline to follow the process without external enforcement is key.

Build Realistic Strategies:

Focus on trades that align with your skills, resources, and constraints.

Solo traders should avoid competing in areas dominated by highly sophisticated players.

Learn from Setbacks:

View losses and failures as feedback, not as personal inadequacies.

Use them to refine your approach and improve decision-making.

Maintain Perspective:

Trading is a long game; patience and perspective are necessary for lasting success.

The Importance of Relationships:

Building strong networks opens doors to opportunities and collaborations that can accelerate learning and growth.

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

Fantastic article. Lots of very hard work over the years. Great to hear it’s paying off.

Muito bom o artigo. Parabéns, Pedro.