Traditional Trend-Following in Crypto Markets - Research Article #70

Which model type is better?

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Would you rather have a strategy that:

Has higher absolute returns but a lot of volatility?

Has lower absolute returns but lower volatility?

Is there even a correct answer?

Well, that has been a big argument between the traditional trend followers, and modern trend followers.

I spend a lot of time listening to trading podcasts, including trend-following ones. In my view, both have similar beliefs on the persistence of trend-following as a reliable long-term edge, but they differ on how to get exposure to it and extract returns.

To understand where the differences lie, I will briefly go through the historical emergence of trend following, both as an investing philosophy, but also as it gained grounds as a sound systematic trading strategy, and eventually to the modern CTA style models we have today.

Then we will test both variations in crypto, and find out if we find the same properties that we find in other mature markets.

Should be a good one!

Trend-Following Philosophy

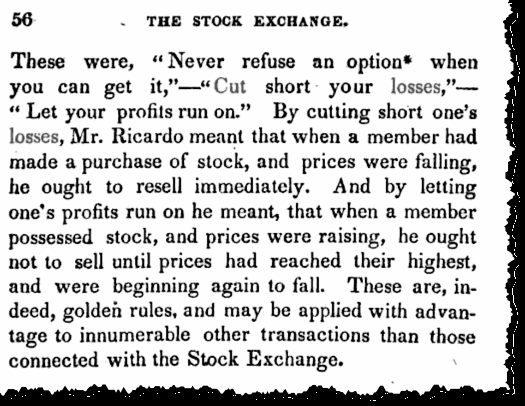

The philosophy behind trend following can be traced back as far as 2 centuries ago. The classical economist David Ricardo wrote in 1818:

“Cut short your losses; let your profits run.”

In the early 20th century we have the famous trader Jesse Livermore. He’s one of the most famous traders in the retail trading circles due to his achievements. It’s no surprise because at one point he became one of the richest people in the whole world. If you read “Reminiscences of a Stock Operator”, you’ll find that one of his core principles was:

“The big money is in the main movements, not the fluctuations.”

He also added that:

“Buy right, sit tight. Big movements take time to develop. Men who can both be right and sit tight are uncommon”

If his story had any influence in the upcoming trend-followers, I can’t say for sure, but my guess is that it did. But the reality is that this strong philosophy around letting winners run, cutting losses short, is constant across time.

Jumping a bit ahead, in the 1970’s, Ed Seykota developed one of the first computerized trading systems for futures. His whole system was on riding sustained market trends using standard technical indicators such as moving averages. Here’s some things he said about trading:

“If you can’t take a small loss, sooner or later you will take the mother of all losses.”

“In order of importance to me are: 1) the long term trend, 2) the current chart pattern, and 3) picking a good spot to buy or sell.”

“Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.”

There’s one more story to add to the history of famous trend-followers and that is the turtle traders. The turtle traders are one of the most famous trend-following origin stories due to Richard Dennis, who pioneered the experiment of taking relatively “normal”, or non-trading people, and turning them into traders by giving them a very strict trend-following system.

I’ve wrote a bit about them here:

Once again, their philosophies were quite similar to the ones we’ve described so far. Here’s a few quotes from Richard Dennis:

“A good trend following system will keep you in the market until there is evidence that the trend has changed.”

“You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.”

“When you have a position, you put it on for a reason, and you’ve got to keep it until the reason no longer exists.”

If you know how modern trend-followers trade and think about volatility, and how they try to tame it, you understand how the their beliefs differ. Let’s take a look at how modern trend-following is done.

Modern Trend-Following

Imagine that you’re a fund manager and you want to attract capital. What’s the one thing that your investors care about more? I have never been a fund manager but I’d be confident speculating that it is maximizing returns with the least amount of volatility. And that is exactly what modern trend-following addressed.

There’s another argument that I find quite compelling is that we should have our positions reflect what “confidence” we have in a specific signal, and not what the market forces on us.

Imagine that we hold 2 assets with the following exposures:

Asset A: $5,000

Asset B: $5,000

For the sake of argument let’s say that their volatilities are equal and don’t change. Imagine now that the position in Asset B increases by a factor of 2, and we now hold:

Asset A: $5,000

Asset B: $10,000

Asset B is now contributing 2x the amount of volatility that Asset A is. You may wonder why is that a problem. The problem is that any movement in Asset B is now 2x more significant than Asset A’s, and if your confidence in Asset B has not changed, why does it carry such weight on your portfolio?

In the 80’s the development of statistical models for volatility emerged, and provided the quantitative foundation to estimate volatility. Volatility is one of the things that is mostly trivial to estimate because it’s sticky. More volatility usually means more future volatility and vice-versa.

We’ve shown this relationship with some nice scatter plots (ah!) in our Research Article #65.

Now if you have a nice correlation of volatility with future volatility, it’s trivial to adjust your size so that we get a contribution of volatility that matches what we want. Let’s say that we just want 20% volatility in our portfolio, and we expect 40% of volatility in the future, we adjust our positions by half of what would be a normal expectation.

Practically this means that we’re decreasing our exposures when our future expected volatility rises, and we’re increasing exposure when our future expected volatility declines. Many times this means we’re selling as our positions grow larger, and buying as they grow smaller.

Remember the old trend-following philosophy of letting winners ride? Well, as you can see, this goes right against it.

This is why so many old trend followers stay away from it, and keep the “purity” of the old models.

But we haven’t reached the conclusion yet of who’s wrong and who’s right. Is there even an answer to that question? Well, let’s dig into the data now.

Trading System Parameters

Before we move on to our data, let’s first define the rules of the trading models we will be testing.