This Is How You Know If You Can Trade Full-Time

How capital, returns, taxes, and expenses determine the sustainability of a trading business.

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Most people that try to make it in the trading business, at some point aspire to trade full time.

Yes, trading is a business, and we must treat it like so. Although many people do it for entertainment, gambling, or just to pass time, for us, that try to do this professionally, we must treat like any other business.

If you open an online shop, or start doing contractor work, even if you have a full-time job as your main income, you’d expect one day to make it your main gig right? Same with the trading business.

I had the same goal when I started trading back in late 2017. But let’s face it, starting out with $500 isn’t a real viable plan right?

But today we’re not here to talk about scaling small accounts.

The question is, when are we ready to trade full-time?

This depends on a multitude of factors, that I believe can be defined into a formula. That formula is something that I personally use to guide my own trading business.

Over the past few years, as I’ve increased my capital, this question has become a more important concern to me.

As of today, trading is my main source of income, and it’s my business to think through its viability.

For a variety of reasons, I prefer to keep my trading business AUM (assets under management) private. Maybe in the future I’ll reveal how much I manage, but that’s not the point of today’s newsletter.

In the past, I was not as detailed with my capital as I should’ve been. Imagine running a business where you don’t know where your cash is, or really how much you have. Having a basic balance sheet is super important. So I had capital scattered everywhere, and today is hard to go back and get the real returns from each allocation that I’ve done over the years.

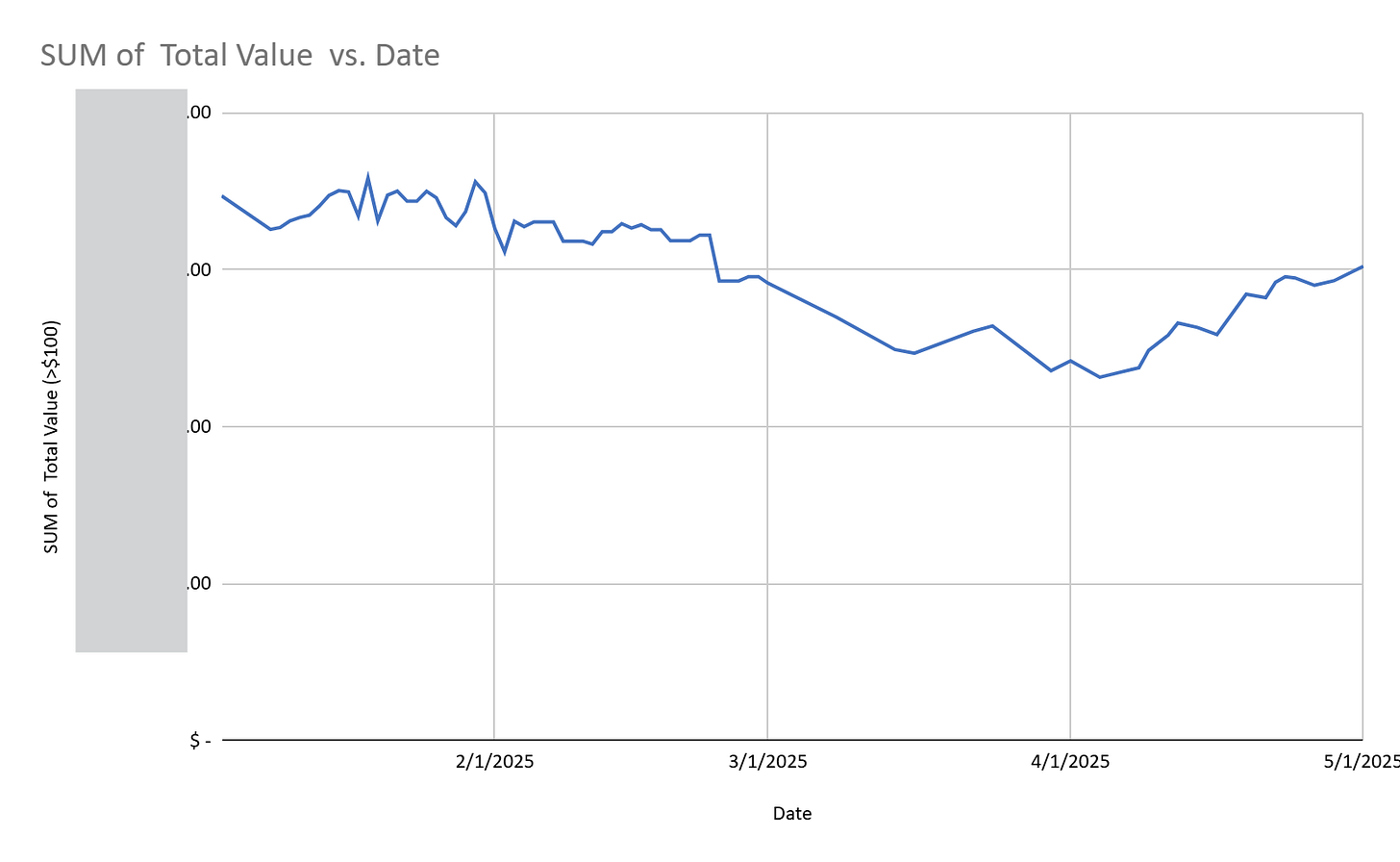

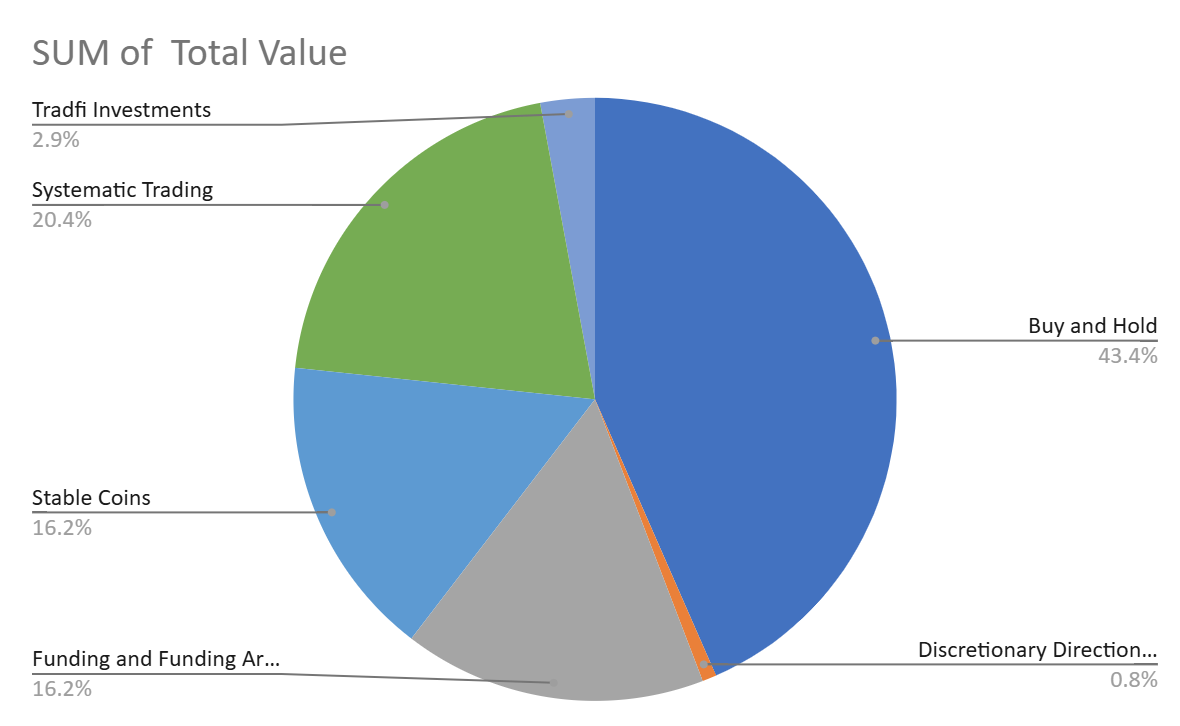

As of 2025, I began keeping tabs on everything that I hold, and where cash is allocated to. Every day or so, I sit down and put everything into a sheet, and figure out the variations of PnL over time.

This is an extremely important exercise. Because it not only keeps your business finances organized, but also forces you to know if your resources are being well managed.

We all know that just throwing losses and bad trading under a rug, won’t solve the problem!!

Every day, I can see where my money is allocated to, and what strategies are bringing me the most yield. If you’re a regular reader of this newsletter, you know that I run a bunch of different things in crypto, and this things can get really tricky when you have dozens of wallets for different purposes.

Now that we got the boring part out of the way, let’s get into the question at hand and find out how do we know we are ready to trade for a living, given our current situation.

There’s a few important factors that go into determining if one can/should trade for a living:

Trading capital

Living costs

Confidence around edge

Risk

Taxes

Trading isn’t a business where you can just go and offer a service or a product that requires little to no investment on your part.

In order to make money trading, assuming you have an edge, you need to have capital down.

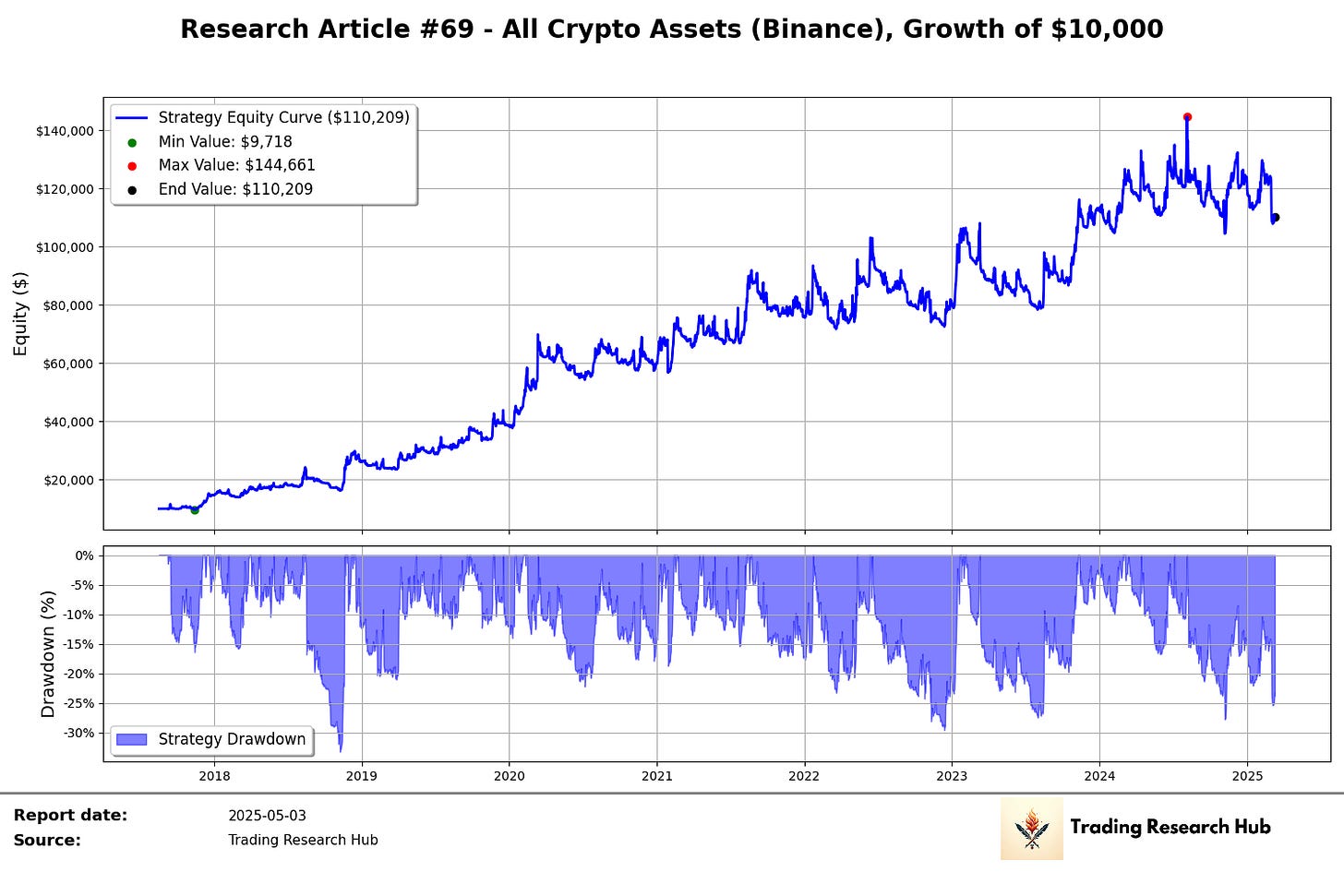

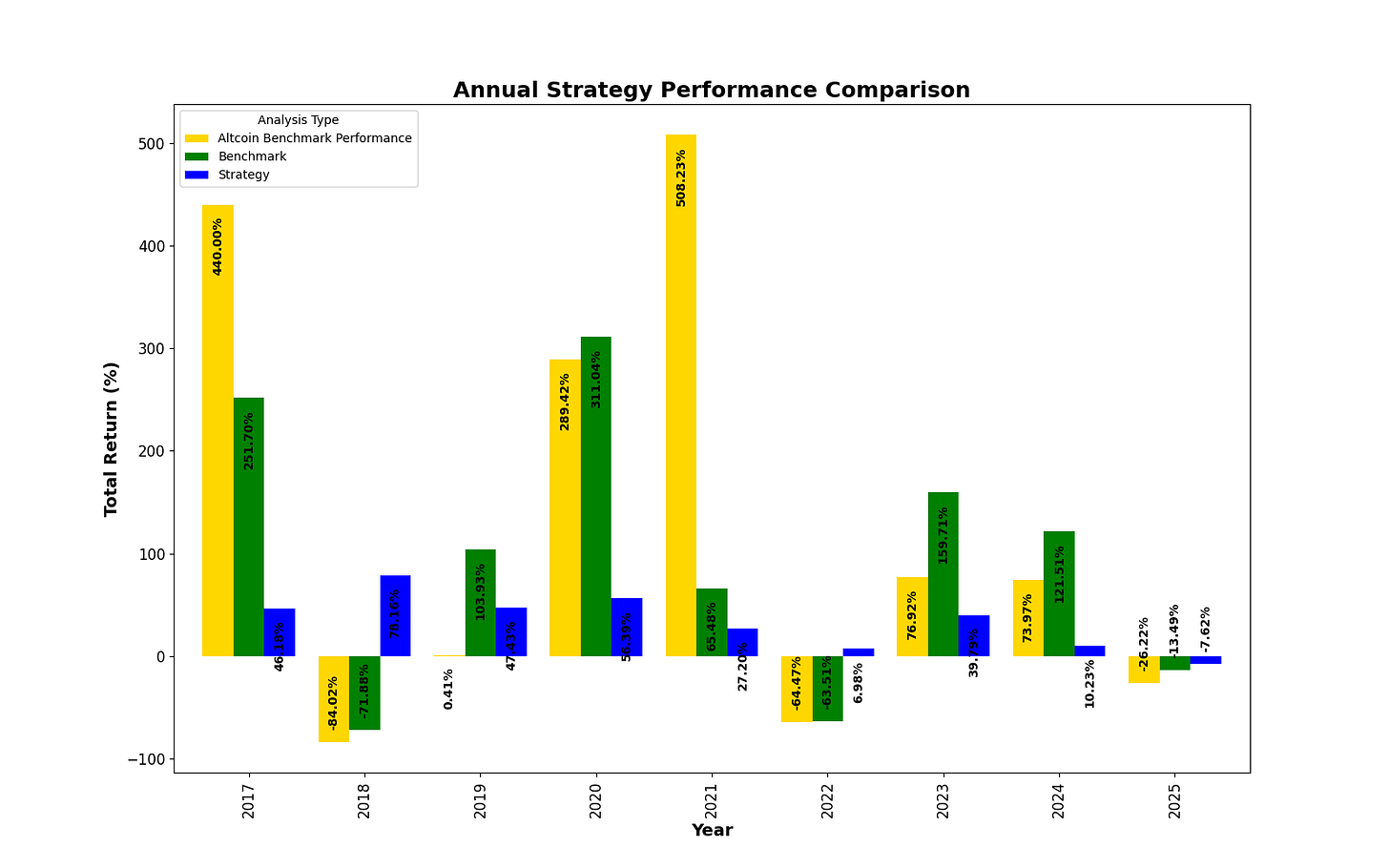

Let’s use a system we’ve developed here at Trading Research Hub. I’ve been working on an improved version of Research Article #62 and I’ll use that improved version as a model for today’s article.

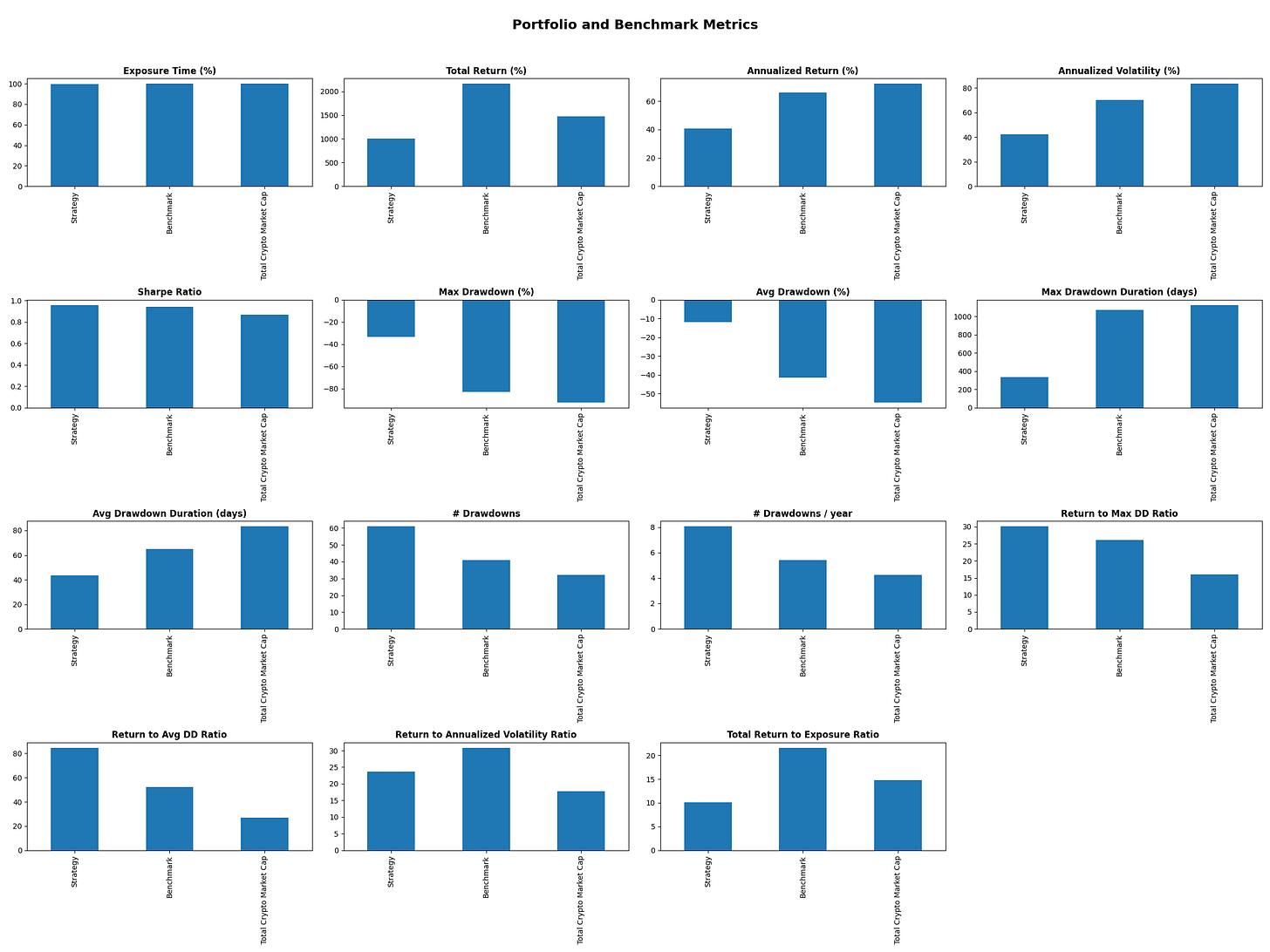

Here’s how the improved model’s performance is looking so far. Few things to fix, but that’s for another article.

With 30% maximum drawdown, an impressive 1000%+ compounded return, and more importantly, significantly higher risk adjusted returns than the benchmarks, it is becoming a nice model indeed.

Now what does it mean in practical terms? What does it mean in terms of bills we have to pay? Is this business model viable for us?

This analysis can be applied to any model you want to run, and the answer will be dependent on the variables we will outline below.

Let’s start by defining our trading capital.

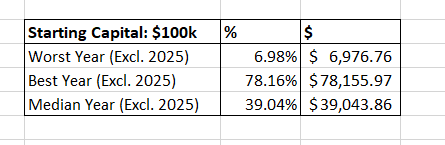

Starting Capital: $100,000

Now let’s take a look at the average uncompounded yearly return. Basically assuming that we start with the same amount of capital each year, how much we’d expect to make with this strategy.

The strategy, on hypothetical backtested performance, has an yearly average return of ~39%, being the lowest year 7%, and the highest 78%.

This means that on a really good year our trading business made $78,000 and on a low year we made $7,000.

This considering that we never compound, and revert back to our initial starting capital each year.

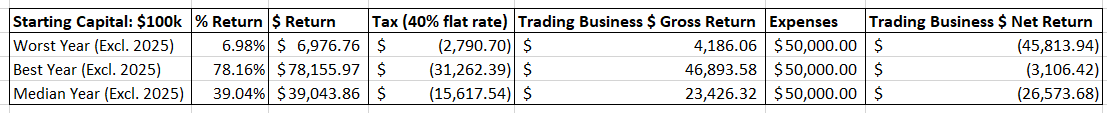

Now let’s consider our living expenses and taxes we must pay. Oh yes, if we’re doing this as a business, we start owing taxes!

Starting Capital: $100,000

Living Expenses: $50,000.

Effective Tax Rate: 40%

I am going to assume that we are retail traders starting out, and that ALL OF OUR expenses aren’t tax deductible from our trading income, for worst case scenario modeling.

After the taxes are paid, even on the best year for this model, we’d be left out with very little left to pay expenses and close the year negative.

This means that we can’t trade for a living , given our current living situation and trading performance.

Now, we could consider increasing the risk that our portfolio can take, but that comes with its obvious caveats. I don’t advocate for it, but I understand that to build capital we need to be willing to take higher risks and volatility.

Been there done that…

The more straightforward solution would be to increase capital by a significant margin, so that even in our worst year, we can still pay bills, and not be negative.

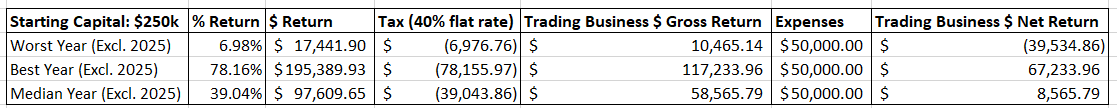

If we increase our starting capital to $250,000, given our expected returns from historical performance, we can expect on average to both pay expenses, and have around $8,000 left, as net profit.

Now we can play with these variables right? Here’s a few options:

Increase the volatility of our models (increase returns, but also risk)

Decrease expenses

Get a more efficient tax structure

Compound the returns into the next years

Add more strategies and markets for higher risk adjusted returns

So how can we translate knowing if we can trade full-time or not into a simple formula?

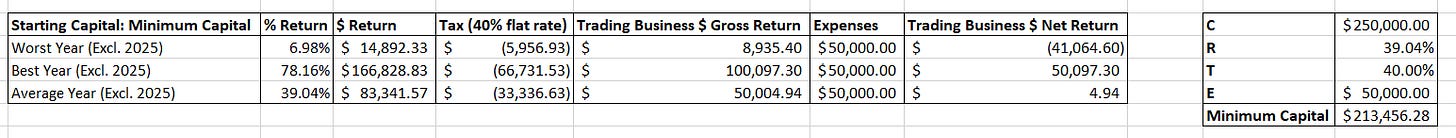

C = starting capital

R = average (pre‐tax) return rate (e.g. 0.3904 for 39.04%)

T = effective tax rate (e.g. 0.40 for 40%)

E = fixed annual expenses (in dollars)

Given our business model, we’d need a minimum of $213,456 in capital to breakeven on an average year.

Again, I want to reference, that this is an average and that there will be years where we lose money and make money.

My own personal cash management strategy, is to keep 2-5 years of paid expenses on the side, on lower yield, but safer sources of returns, so that even on bad years we can still pay bills and continue to push forward without having to deduct from our trading capital.

We also must consider that markets change and our strategies with it. We have limited datasets and the future is always uncertain. Like I say all the time, uncertainty is what we get paid for, but never use the past as the absolute reference for the future, the markets are always changing, and competition will grow.

Like in any other business, keep good cash reserves to withstand even the worst years and survive.

Now we have a quantifiable way of calculating if our trading business is sustainable, or even worth it, given the capital we have at our disposal.

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

pretty insightful thanks