Stop Wasting Time on Plans, Start Doing the Job

How I almost never became a trader...

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

It was Q1-2021 when I was ready to quit trading for good.

The prior year my performance was amazing, every month I was making decent money and I thought I had cracked it. I even got chosen for an interview at a prop shop I always dreamed of being hired for (story for another day).

Late 2020 arrives, the market environment shifts, and I give back a significant chunk…

The worst of all… I didn’t even know why!

It’s crazy to think about it because had I quit, I would have never turned my trading around and seen a profit for all of those years I had spent up until that point trying to make it into the trading industry.

I would have never grown this newsletter to over 7,000 subscribers or my twitter account to over 45,000 followers.

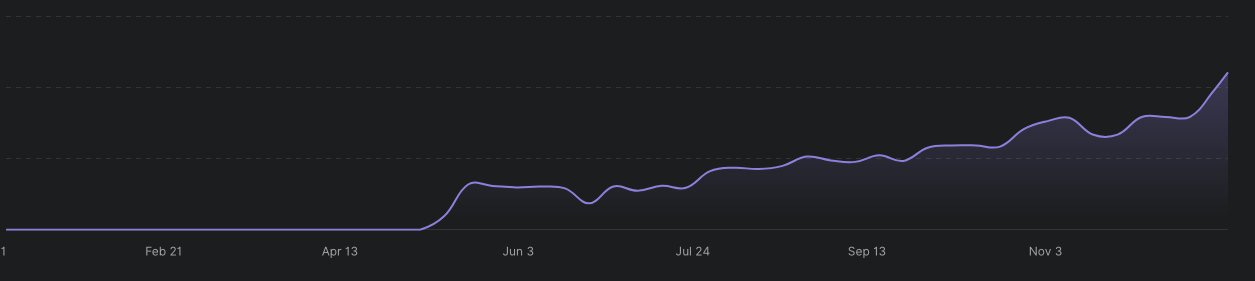

I would also not be launching this new portfolio of strategies, that consist of the best strategies we’ve researched here so far at Trading Research Hub. All of the infrastructure to handle these strategies also custom built by me.

All of this would never have happened if I took that single decision, and with it, literally thrown down the drain €20,000 and thousands of hours I had invested in this business at the time.

It all came down to a single decision, that changed the course of my career, that would have otherwise made me end up somewhere else. That decision, taught me a lesson that I still apply to everything I do to this day. I don’t have many rules when it comes to business or trading, but that rule is what drives everything that I do.

It was mid-2021 when I began being interested about trading again after a few months break. At this point, I wasn’t even opening up charts as I was pretty upset about my failure.

However, everyone was talking about crypto, it was all over the news, I’d even watch a MMA fight and there it was, crypto promo’s all over the place.

It was pretty hard to ignore.

So I thought that with all the accumulated knowledge and data that I had collected, that it would be smooth sailing for me to start an account and start trading those markets.

Even though I was conceptually wrong, it was a good decision.

I was trading intra-day breakouts in equities the prior year. It was very simple and naive system where I’d buy/short any 10-minute breakout and exit at a take profit or stop loss.

Looking back, I was only making money because the market was super lenient due to the massive inflows of retail during a period where everyone was at home. It’s one of those periods in the market where it was pretty hard to lose money even if you tried. So any returns I got from that period, I don’t count it as my own skill as a trader, but as a major lift from the market environment.

In any case, it taught me a lesson that trading momentum might be a good business to do in markets. After all, I was making real cash in my accounts!

So I brought the same idea and I applied it to crypto.

I had no backtest, no idea about these markets, no risk management, but I went in and started trading it. I started making money right off the bat.

With no experience, this was actually a good feat.

The strategy was pretty simple:

Long any daily breakout

Use a simple trailing stop loss on the 4-hour chart

Allocate 2% risk per position

The problem was that sometimes I was holding 50 positions at a time, with no regards for how much leverage I had. This made my PnL swings quite wild.

There were days I could be up/down multiples of my monthly salary at the time, which wasn’t a lot to be fair. But it was a lot to me.

However, despite being a dumb and risky way to trade, I was getting information about what worked in this crazy market, trade by trade.

After a while, I wanted to be a bit more serious, so I had to be smarter. I finally learned to code, built my own custom backtesting infrastructure, started connecting with smarter traders than I…

Each day I was becoming a bit less naive.

Late into the year I was doing really well. Once again, I thought I had cracked the game of trading. I was already making plans for what I would do with all this new money I was making, if I just kept at it for a few more months.

Well, as any trader soon comes to realize, the amazing times tend to not last, and actually be good signals that something is about to burst.

Remember what I said about crypto being hard to ignore back then?

Well… we had it coming.

Even my barber was asking me about crypto. Not that there’s anything wrong about a barber being interested in finance, but it’s usually not a good sign when people that are generally not interested in finance, suddenly start asking you how to make money trading right?

2022 ended up being a brutal year.

But I had learned my lessons and was able to survive it and actually thrive.

All due to the single most important decision that I took:

Do the job.

Simple and short, but it is the lesson that I use to this day for almost anything that I do. It’s probably the most powerful thing I’ve ever discovered because that’s how we learn.

“The game taught me the game” - Jesse Livermore

I am a planner. I like to make smart decisions about everything that I do. Be it:

Building new systems

Finance

Fitness

Buying a house or a car

New business opportunities

Writing

However, I never allow the illusion of perfection to get in the way of finding those answers in the trenches of the activity that I am about to do.

Had I not gone into the market that day, and deployed a naive system, I would not have had the amazing opportunities I’ve had to date, and would be doing something else entirely.

This business, and honestly most businesses, are filled with talkers and teachers, and not many people actually in the trenches, practicing what they preach. This means that they have almost nothing to teach you. You can’t learn this game from the sidelines, I promess you that.

I have over 80% of my net worth in my trading/investing portfolios. Many people will say I am irresponsible for this, but I see it as someone that lives by what he says, or fails trying. My ship goes down if I don’t perform, and that’s how I view life.

To go into the markets and get answers with real cash takes courage and you will learn more than you ever thought possible. It will force you to learn or you’ll continue to lose that hard earned money. There’s no other way around it other than improving. And most are afraid of it.

So every time I have questions about something I want to do, here’s my framework:

Have an idea.

Make a basic model of its implementation.

Go into the market and find the answers.

If you want to find out the answers to a question, always remember that you’re one step away from finding them, and it ain’t in your backtests, it’s where you’re most avoiding going.

Hope you’ve enjoyed today’s short post 😊

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.