Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

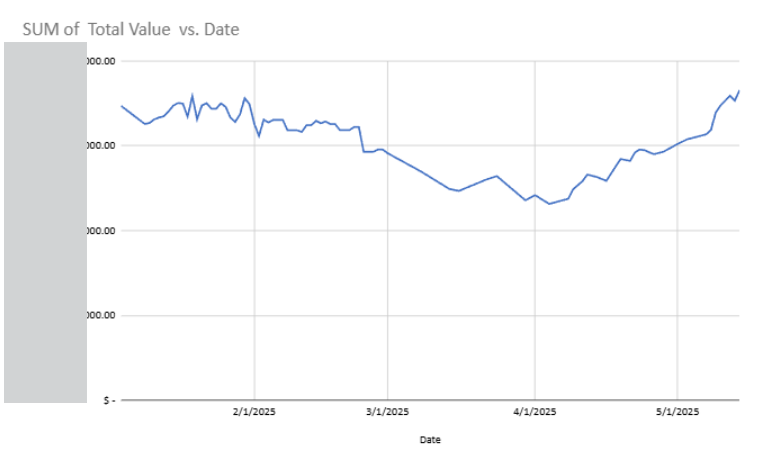

This week, my trading portfolio has hit all time highs, despite the general crypto market still being down -40% off the highs.

As you’ll see below, this is not an ordinary all time highs for me, and I am quite satisfied with how I’ve traded this market so far.

With a systematic approach, with robust trading strategies, we can indeed outperform the market. This is why I publish these articles and the strategy articles at Trading Research Hub.

For the most part, this is the product of sticking to a systematic approach, and having confidence in the work we do here.

This past year was not an easy market to trade through. There were no sustained trends, just chop and some strength every so often. I have been in crypto since late 2021, and this has definitely been one of the toughest markets I’ve traded through.

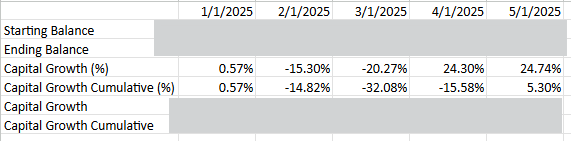

The kind of volatility I allow in my portfolios is not for people that can’t handle heavy swings and want to manage risk “by the book”. By March this year, I was down -32% off the highs.

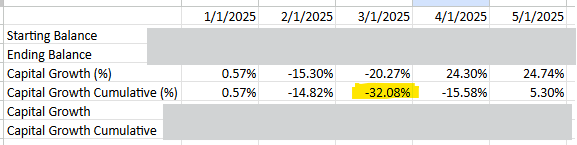

As I alluded at the top, this drawdown was personally even more significant, because back in November-24, I received an airdrop from Hyperliquid.

That airdrop at its peak, quadrupled my net worth, and I added most of it back to my portfolio, right at the market peak in January.

This meant that I was down -32% NOT from my previous net worth highs, but from close to 4x the net worth I ever had.

But this is why I am here, I walk the walk. I won’t say it was easy to continue to allocate through the drawdown, but I feel like I sped up so much of my learning curve, just out of sheer need to protect what I had.

So today, being at all time highs, is a massive achievement.

We’re also getting closer to my goal for this year of having 7 figures AUM in my trading portfolio, which is something that I’ve been aiming for since I’ve started trading with a few thousand dollars.

In today’s article, I will outline step by step what have been the major contributors for this achievement, the strategies, and what I intend doing going forward.

This article will be very much practical as it will be the specifics of what I’ve done, and I want to have this documented to go back in the future.

No fluff, just straight to the point.

Let’s get into it.

Index

Introduction

Fixing Bad Habits

Taking Tail Risk

New Automated Model

Trade Like a Business

Conclusion

Fixing Bad Habits

As we’ve entered in 2025, I carried with me bad habits that were born out of a very good first half of 2024.

I notice this tendency in myself, that when I am winning, and nothing seems to stop me from winning, I start making decisions that are not optimal.

It’s unconscious, but I start relaxing my rules and lay off my discipline. I start taking trades that I wouldn’t otherwise. Since everything is working, and I am not taking significant hits from these lapses in discipline, I only notice them when I’ve already had a significant cut.

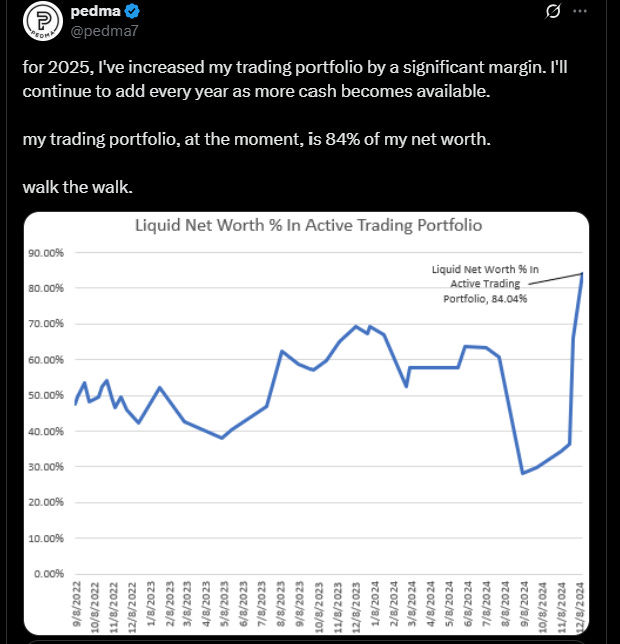

As my equity curve got lower into late-2024, I decided to look into my trades, one by one, and write some sort of commentary about what I saw on the trade. I am not a discretionary trader, but I do allow for some discretion within a valid signal that I take.

What I noticed shocked me and I advise anyone to do this exercise.

I took all the comments I wrote on my trades and fed it to ChatGPT to find patterns in my comments. As I suspected, I was taking a lot of trades that were considered invalid per any trend-follower or momentum trader.

Almost -30% of PnL came just from entering positions too early before a valid strong breakout, and on weak downtrends.

As I have mentioned in this newsletter, even though I am a systematic trader, the signals that I choose have still somewhat of a judgement component to them, as long as I have a valid systematic signal of course.

For some context, I trade weekly breakouts, when the breakout occurs, not when the candle closes. I prefer looking at weekly bars because it seems to be a better filter than just adding indicators on top of indicators to gauge strength.

Since I don’t add any filters to the breakouts, I also prefer to take the strongest technical breakouts, on the strongest assets. I don’t necessarily define what “strongest” mean, as that it can have many moving parts that are hard to quantify. Here’s a few examples of where my own intuition comes in:

Relationship to moving averages on higher timeframes

Momentum over the past 30,60,90 days

Dollar volume vs market capitalization

How much “mindshare” does it have on social media

How established is this coin

What are the fundamentals behind it

Narratives in play

I want to emphasize that I am growing increasingly aware that this is an inefficient way to trade and I don’t really know yet how much idiosyncratic returns (aka alpha) I add by allowing my own discretion.

However, I still have to find a system that beats it.

This means that my intuition, idiosyncratic analysis of signals, or whatever you wanna call it, still provides me with better information than a simple vanilla signal. So I keep it, until I find something that outperforms it.

At the end of the day, as long as I get my exposures right, take the top trades of this sector, I should perform equally to any other trend-follower, as I’ve done. I’ve managed to beat most crypto trend-following programs, but that could just have been luck.

We’re closing in on 3 years of live performance in the market, and that is not something I take lightly.

Let’s look at a practical example of a trade I took. In the week of the 21st of April, SUI broke out of that multi-week highs, and I took a position as per my system dictates.

The thing with these kinds of systematic signals, with no filters, is that they can sometimes be highly subjective. A breakout on its own, can happen at many times that are not necessarily as strong as other breakouts.

Take the example of HIFI back in the summer of 2024. There were a bunch of breakouts, that were just fakeouts, but that were considered a breakout if we don’t do any filtering.

And this is where my own judgement has come in handy, despite having a signal for that particular asset.

Back in 2023, I was trading this model on anything that had a pulse at binance. This is because binance was listing higher “quality” coins, and I could get away with having looser rules around which assets to trade and which we shouldn’t.

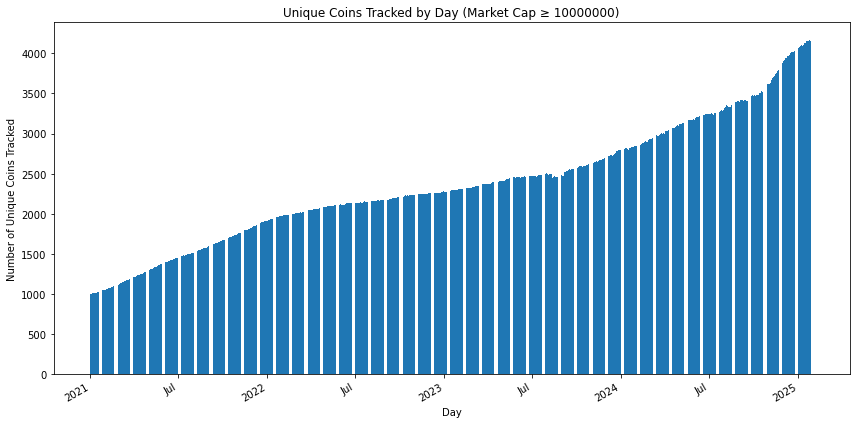

Fast forward to 2025, we have over 2x the number of coins above a 10M market cap volume as per coingecko’s data. And much more than that if we factor in all the coins regardless of market cap.

And binance lately has been listing everything with a pulse, regardless of “value” of the asset.

This meant that my signals, required an upgrade. I can no longer be taking every signal, regardless of strength and characteristics. I had to be smarter about it because I was taking way too many cuts on positions that didn’t “look the best” even for myself.

This became more apparent when I missed the massive trades in 2024 of XRP, XLM and others. Not because I didn’t see them, or missed them, but because I didn’t have enough risk to put on the table as I was completely allocated to other subpar trades.

I am not the best trader out there, but one thing I am good at is on catching the important trades. And this time I had missed them just because of the fact that I had too much exposure on and I couldn’t add more risk, per my risk management rules.

So I decided to dig deep into the problems.

I started by isolating the core principles into a few things I knew could be the problem. A few friends had mentioned that the size of the market cap of these coins did have an impact on trend features. And that makes sense right? Crypto is filled with pump and dump schemes and the lowest it takes to move a coin, the more likely it is that bad actors have an incentive to manipulate its price.

So for the following months we investigated everything about the coins market caps, the coins dollar volume, anything that had to do with size or pump and dump characteristics.

We figured out, that I was losing more money in lower cap assets , and that it was not worth it to trade most things beneath the $100M market cap mark. This rule isn’t strict, if there is an interesting project that all of social media is talking about, that has good fundamentals, a good team, and I get a signal during a very strong market, I’d take it. I just mean that now I have that floor rule that I don’t even care for anything below that.

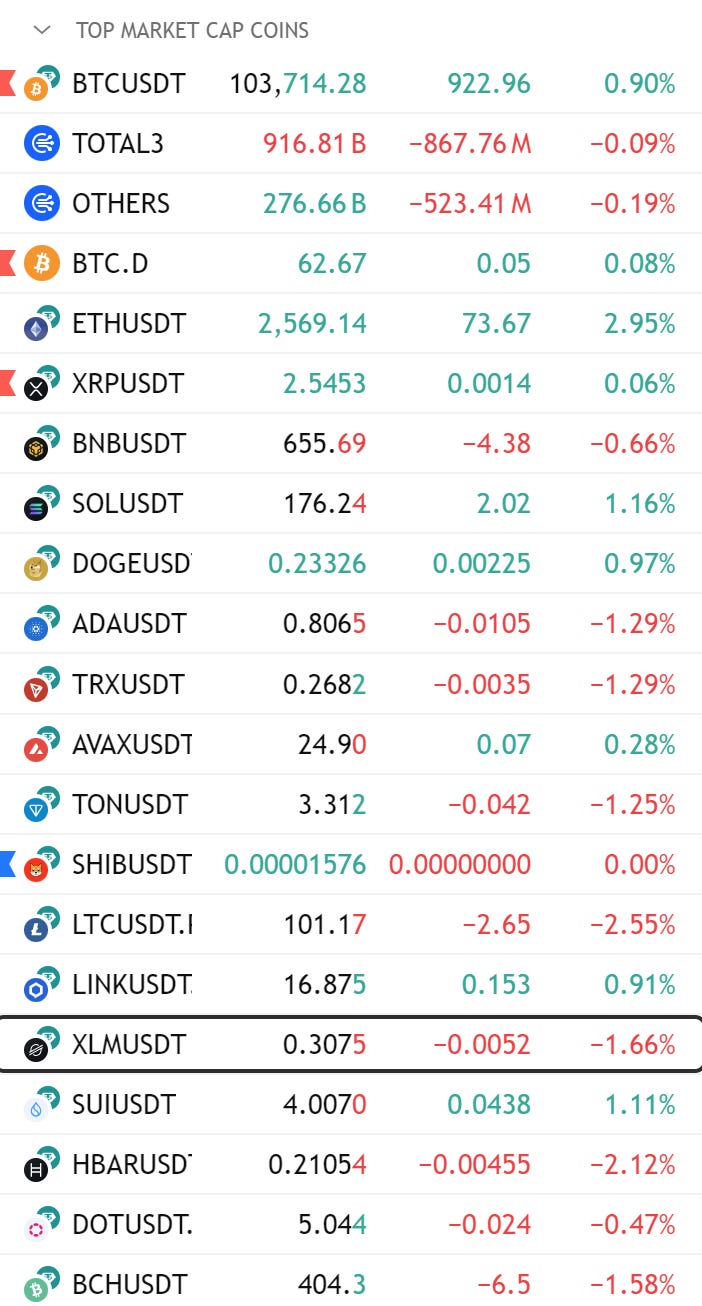

I also now keep a list of all the top market cap coins in crypto right now, and they get priority over anything else. I keep very very close attention to these, as they are the assets that display the strongest trend properties, historically.

My focus has been on the major winners and that has paid off.

With some notable trades such as Bitcoin where I initially bought at $88k , added more at $94k and it currently now sits at $104k. (for reference, the sell order you see on the chart was a position adjustment following a mistake of mine, I still carry the bulk of the position.)

FARTCOIN where I bought it at around 0.65 and as of this day sits at $1.42.

LAYER where I rode it from the 1’s to the 2’s.

SUI having bought it at 2.88 and as of today sits at over $4.

ALCH that I bought at around $0.10 and sold it over $0.20.

All of these trades took priority over subpar ones.

That single adjustment, plus fixing the trades where the trend was weak, saved me a lot of returns for the past few months. I can’t quantify it, but trust me when I say it is significant.

It’s always good to go back and analyze if you’re performing and your peak capacity.

Don’t allow good times to lower your guard.

Treat your trading as a business, log reports every day/week/month, and be on top of your own game.

Taking Tail Risk

What is the hardest position to take right now?

What if everyone’s wrong and are mispricing the reality of current events?

Can I be there to take advantage of their wrong, emotional positioning?

Most of my trading performance up until now has come from traditional trend models. However for the past year I’ve been taking on some trades, at the extremes of volatility, that I find quite interesting.

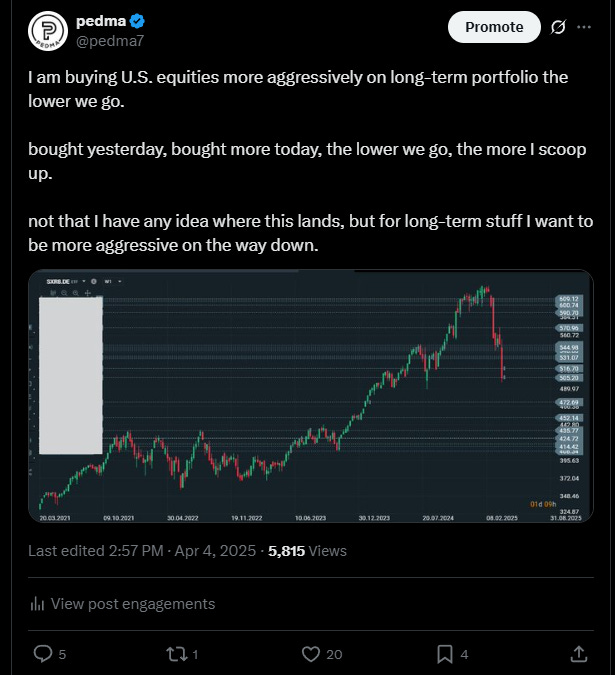

Let’s start with the S&P500. When Trump announced the new tariffs, with that iconic board, the market went into chaos. Everyone was selling and panicking, SPY was down >20% from the highs, and every news media outlet was talking about a recession.

I started buying everything I could.

This is not because I am smarter at gauging macroeconomics, absolutely not!

The thesis was simple, and I was willing to take on risk, and add lower. I was liquidity at times where markets didn’t have liquidity for the amount of selling, and I was willing to take on that tail risk, by providing it.

I do think I had a strong thesis for why the market was pricing it wrong, but I don’t like making up stories about what could be the reason for market behavior. It probably is a mix of randomness, luck, and a bit of my own story.

This trade even though great, was not the largest contributor to PnL for this year.

There is one that was even harder… Hyperliquid.

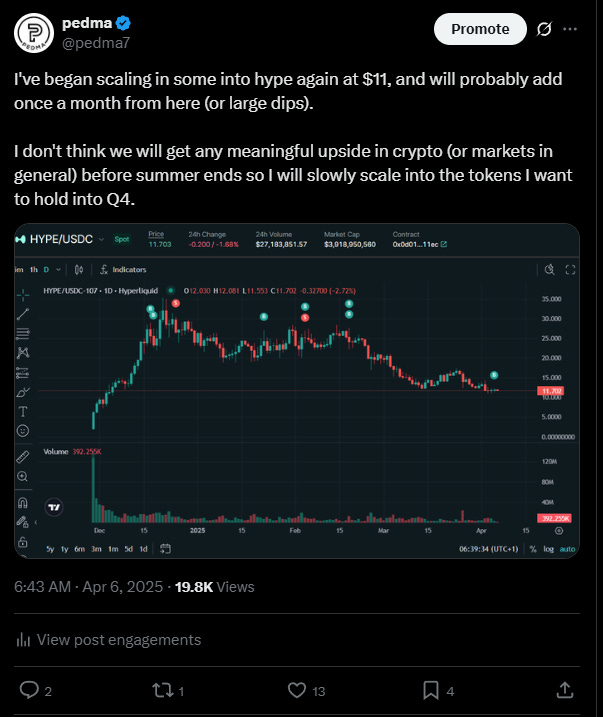

As I mentioned earlier, I received an airdrop from them in November. I rode it the entire way up until the 26’s, where I sold 2/3’s of my stake, and added it to my trading portfolio.

But over the following months, price would fall along with the market.

I still had a decent chunk of allocation to them, and it was quite painful to let it go down 70% from the peak. However my thesis was intact, and there were no significant changes to the protocol. So I bought back as low as $10, and today, it sits at over $26.

This was a major contributor to PnL of this year.

Here’s my buy orders on my portfolio as of today.

This trade was particularly hard because there were some concerns that were coming up at that time with the protocol, and also the market was collapsing. As you know in crypto, despite how strong a thesis for a project is, it still can take massive drawdowns. Hype was no different, and it retraced over 70% from the top.

My thesis was intact though and I decided to buy at the extremes again. Volatility was high, price was below single digits for the first time since December, and I decided to start scooping up as much as I could.

That was a good play that paid off.

It was not all perfect and just catching bottoms of the market. I did have one big mistake that I am quite ashamed of.

Do you remember what was the most “hated” coin of this cycle? Everyone’s making fun of it, saying it will die, it had problems with their vision, etc?

If you said ETH, you are right!

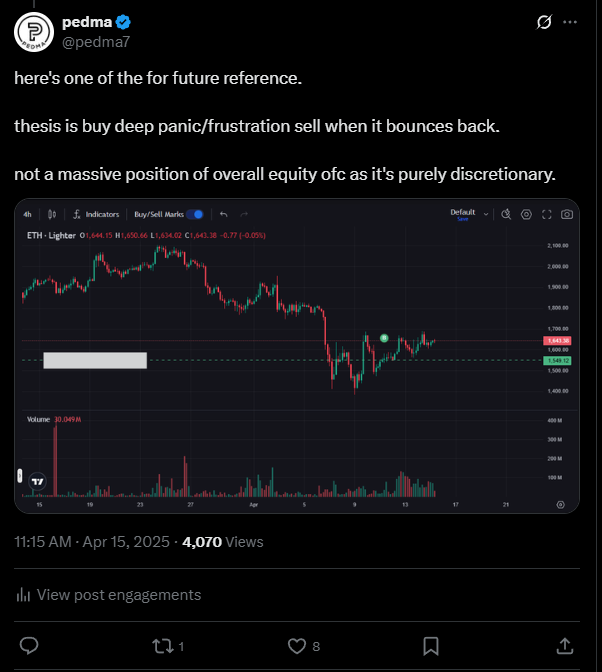

I longed ETH on leverage at around $1.5k expecting it to bounce off the lows given that EVERYONE, and I truly mean everyone, was bearish on it, when it had already collapsed almost 70% from the highs.

As of today, ETH stands at $2.7k, a ~70% increase from my initial entry.

But after a few days, I sold my initial stake, and let a very beautiful trade pass by.

Lesson in there. If you’re going to put on these kind of trades, which are already at extremes, make sure that you stick with them, unless you’re invalidated. Also I put this trade on leverage, which I recognize had me more “uneasy” then normal. But still I could’ve managed it better and allowed for more room for error.

In these tail risk plays, I need to allow room for it to wiggle, because they are highly volatile.

These trades were a decent contributor for the PnL of this year, and I will be doing them again when there’s a clear opportunity for it. They are dangerous, volatile and it takes stomach to manage them. I don’t recommend unexperienced traders to try this at home.

But boy can they pay when you’re willing to take that risk and you happen to be right.

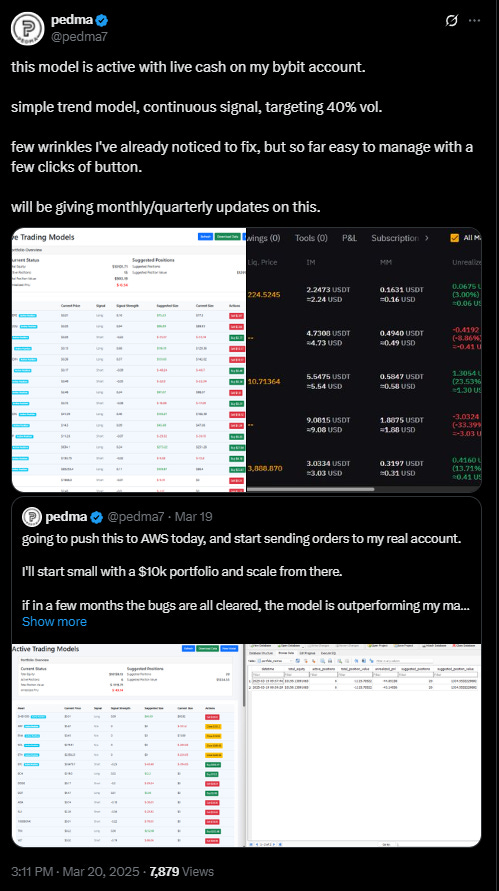

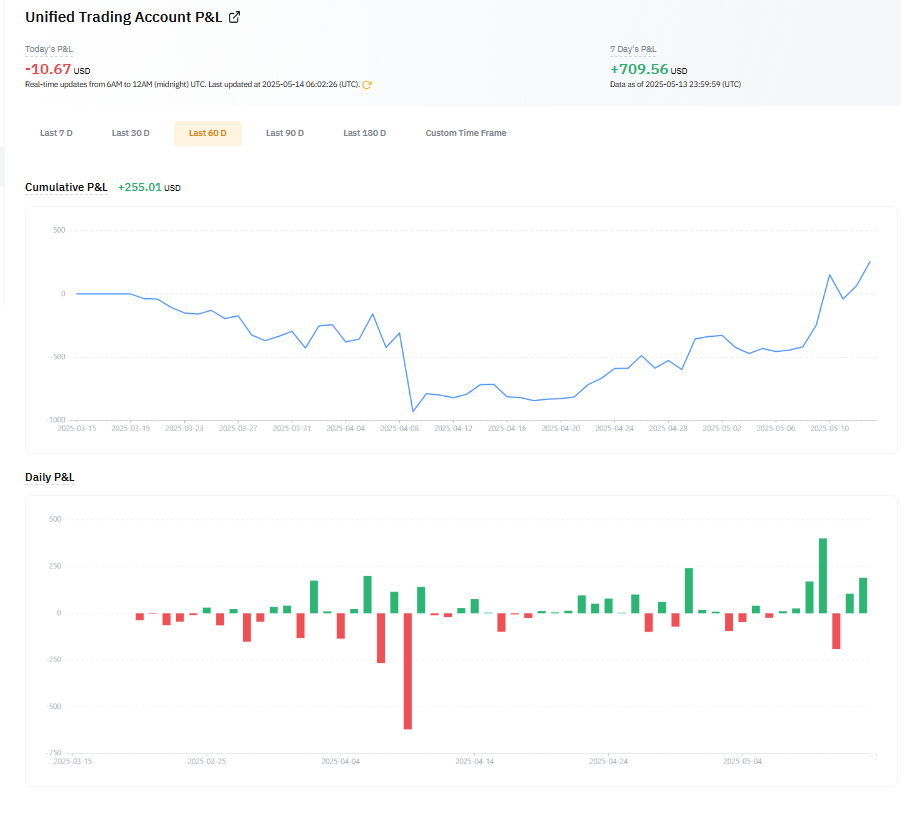

New Automated Model

On March 20th, I launched a more complex variation of a trend model. This model is more professional grade, using methods that modern CTA’s are using. It is volatility targeted, and adjusts its exposure based on a continuous forecast of strength.

I talked about the system here in this research article:

It’s more complex to implement, as there’s more moving parts, and you need to have it regularly rebalance as part of your forecast. But it’s definitely an interesting addition to the portfolio, as in the future, I might want to run my exposures at lower volatility than my main system.

I see this as an experiment that will take months/year to pan out, and when I am ready to allocate, I’ll already have a decent track record to back it.

I am still running it at $10k initial test size, just to figure out the bugs and see if its doing what I intended it to do.

Timing luck played a role in this case. We deployed this model right at the bottom of the market. This meant that the model got maximum allocation short at an inflection point, and when it turned, we were caught on the wrong side of the move as you can see from that drawdown in April.

But we’re now back at all time highs again.

This goes to show that during underperformances, we can’t assume that it is the fault of the model right away, but there could be other variables at play. When you have something robust, that you think can work long-term, you have trust it and let it ride.

If it was a strategy that was data mined, I couldn’t stick with it. I’d probably have assumed that I did some mistake in my backtests and that whatever I had found was no longer there or decaying.

Make sure that your strategies are robust if you’re going to allocate long-term.

Trade Like a Business

I’ve always been very careful in tracking my trading data.

But recently as I’ve been doing more and more different types of trades, I’ve noticed that I had capital for all sorts of reasons scattered everywhere.

This makes it extremely hard to know how much money really are these opportunities yielding, and if you’re not measuring, you’re not improving.

So I’ve made significant changes to how I track all of my wallets and their purposes.

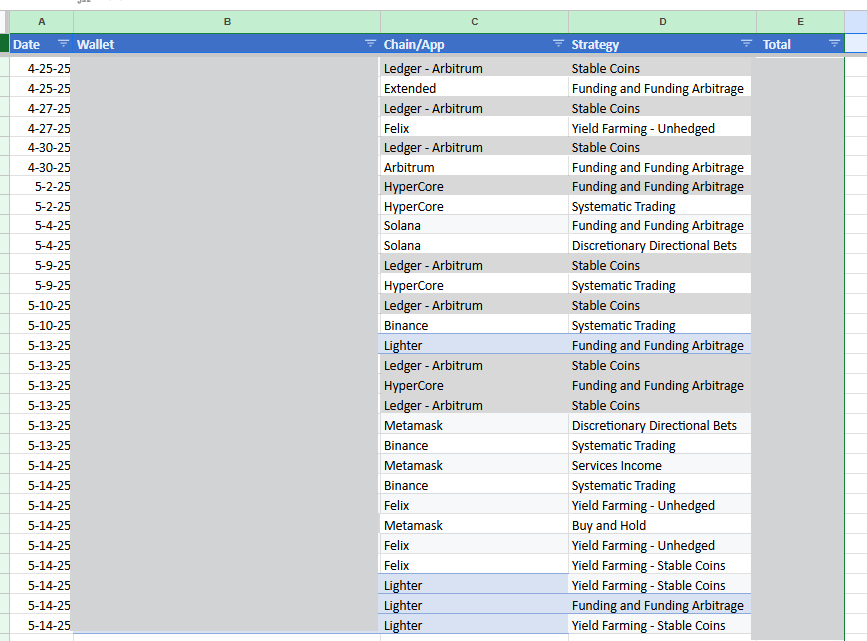

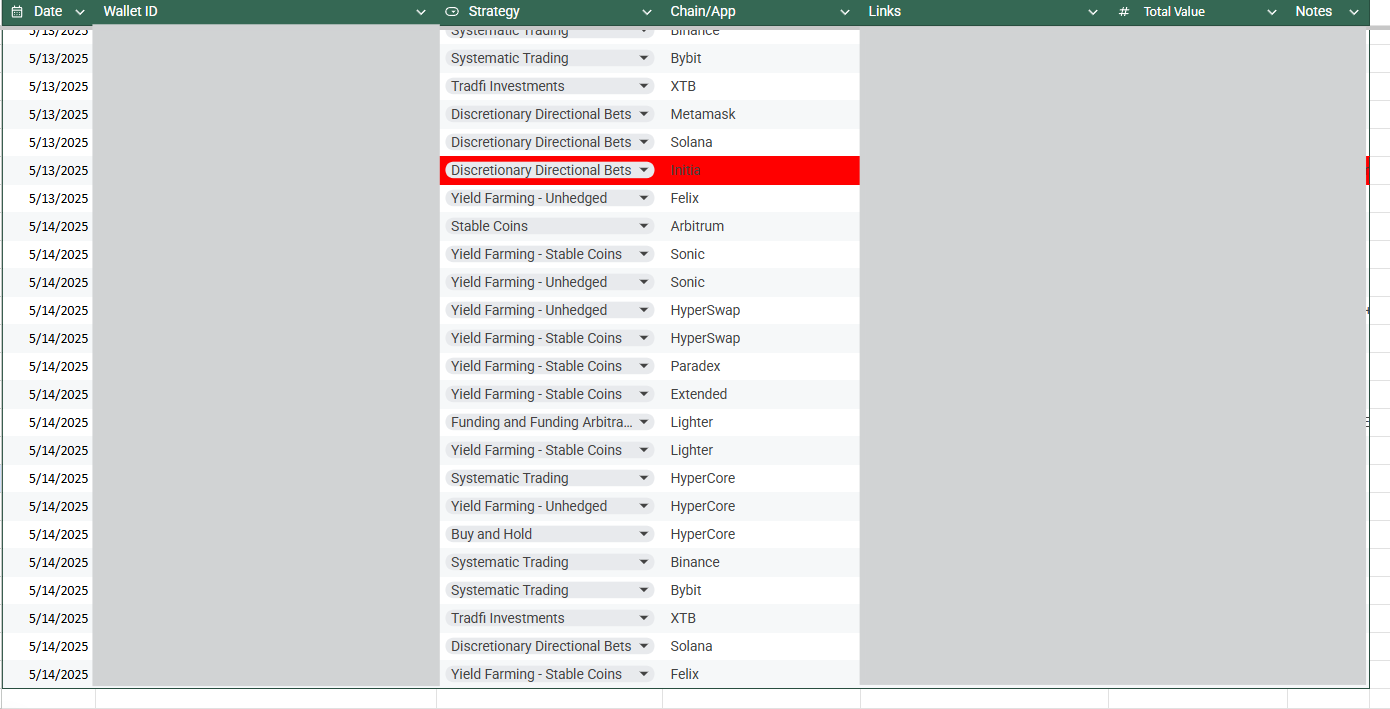

For example, every capital move, from one wallet to another, must have a purpose, and there’s wallets specifically for that purpose. Here’s a simple sheet I use to track all of the debits/credits of each wallet.

This way, I can deduct from the balances those deposits and withdrawals, and very easily get to the return per strategy. Also every day, on a different sheet, I track the balances per wallet, so that I can get an accurate track of all the funds I have spread across the different wallets that I hold.

All of this work, allows me to accurately track the revenue of my trading business.

I think that is highly beneficial that you analyze your own allocations as a business and not like a hobby. We need to perform at peak capacity or eventually we will pay the price.

With this, I was able to find out that some types of strategies I was doing were not yielding sufficient returns for my effort, and I stopped doing them. That not only saves me time but also money, because I can be focused on other higher ROI activities.

Be sure to always track where your attention is going, and if it’s worth your time.

Conclusion

We’ve survived some of the worst market environments that I’ve seen.

Each year that passes, I gain more confidence that what I am doing, has some sort of positive expectancy going forward.

As long as I keep managing my risks, keep my discipline through both bad and good times, I should be able to continue growing the business, and becoming a better trader/investor.

My purpose is to document all of that in this newsletter and on social media. There’s not many traders with a valid track record with documented logs for extended periods of time. I want to have that.

I hope you’ve enjoyed reading this.

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.