Drawdowns Aren't Dangerous— Winning Is

How winning in trading set me back more than a drawdown.

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Most traders are afraid of that nasty drawdown, that could take them out of the game.

But what about the winning periods? Can they be as bad as a drawdown?

I’ve talked about this in the past, and it’s a flaw that I notice in myself as a trader. I don’t know about you, but I have this tendency that when I am going through really good winning streaks, I tend to take “my guard down”, and not be as methodical about my work as I once was.

This pattern, has led me to more losses, than I probably can account for.

It’s such a sneaky risk because it’s not as clear as losing money. It sips through your work, and you won’t even notice it until it’s too late, and you’ve already paid the price for it.

I’ve experienced it, and it can be worse than a drawdown.

How can it be worse?

When I am in drawdown, I constantly dig myself into my work, create robust processes, continue to improve my understanding of markets, upgrade my infrastructure, and keep my work pretty neat in general.

I think I do all of this unconsciously in an attempt to get distracted from the market. But this is good because it forces me to be on top of my game. Mistakes are harder to get through when I am focused in my work. Even if I get into a deeper drawdown, I am pretty confident that I am dealing with it appropriately.

However, while in winning streaks, I let my “rules” get loose, and mistakes, errors, start slipping through the cracks.

This is really dangerous in the line of business we’re in.

For example in the summer of 2020. It was the first time I began making money trading. It wasn’t much, but it was a win after a few years of consistent losing.

I spent that year, just mindlessly trading what I had, and not thinking on where I could be wrong or trying to improve.

The market eventually went cold, and my edge, or what I thought was edge, also died. I began losing money every month, rather than making. The worst of all was not knowing why I was losing.

I didn’t have the knowledge, or backup plans, to understand what was happening and fix it.

I led myself into a position of complete exposure to the unknown, like a broken ship sailing where the tide takes it.

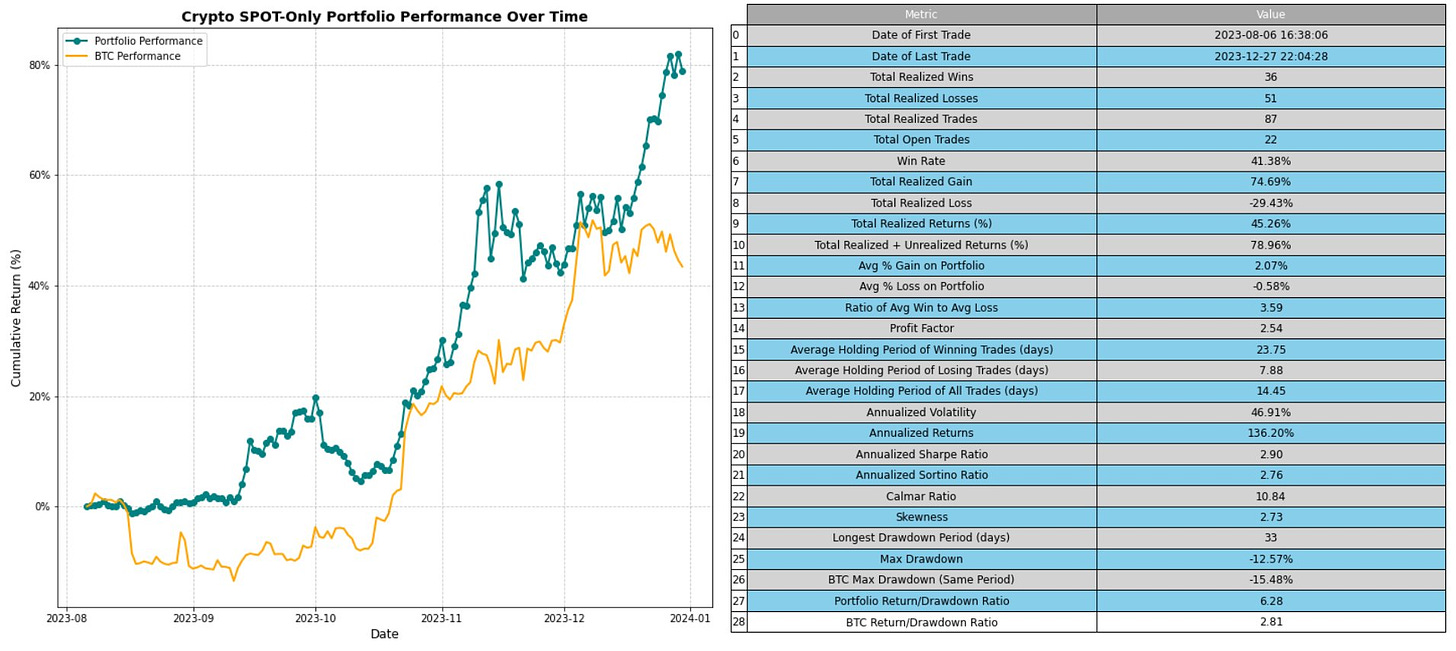

It was not the last time this would happen to me. In late 2023, the crypto market starts exploding once again, and I began making money almost every month.

Life was good and I start relaxing off my rules, stop learning as much as I should, and just lay back.

Similar to 2020, the market turns, and I get into a drawdown that forces me to question my methods once again.

Drawdowns are fine, don’t take me wrong, they are expected, it’s just part of the business we’re in. But this trading system, was still a manual system, although completely systematic. Some of the rules could be bent , if you’re not careful enough.

So I dug into each trade individually, and found out that a major contributor for the drawdown, was me taking signals that were not optimal because I had failed to define what optimal meant.

What I was so proud about, of having a very simple system that worked, was actually me being naive and lazy about it. That allowed randomness to sip in during periods that required caution, and after all the math was done, it was quite a costly mistake.

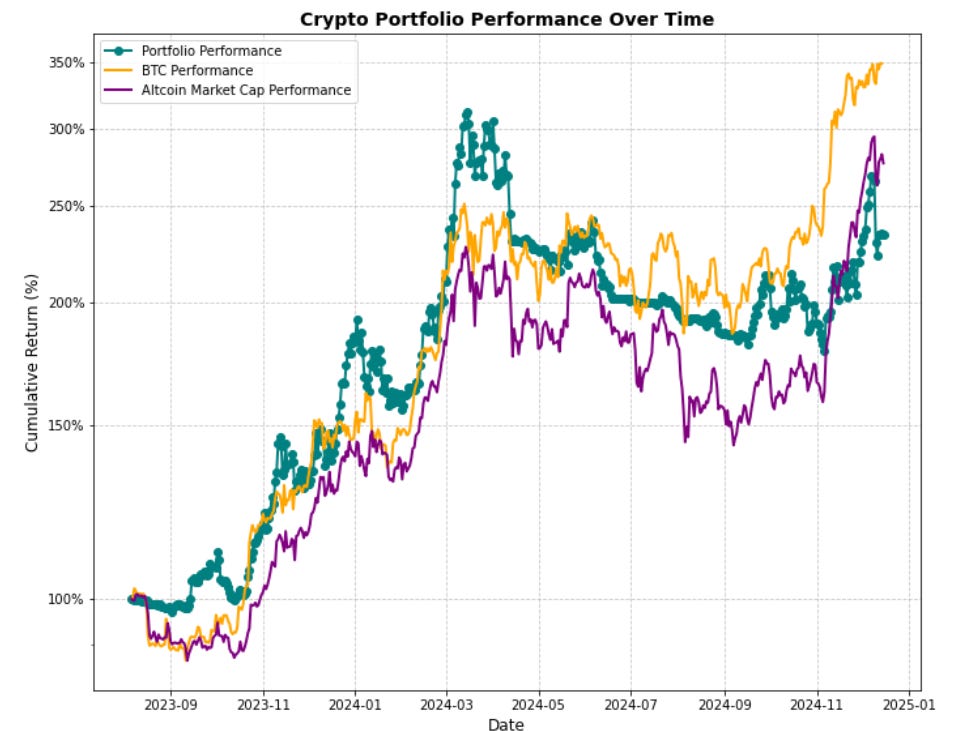

The pattern repeated once again in late 2024 when I got an airdrop from Hyperliquid.

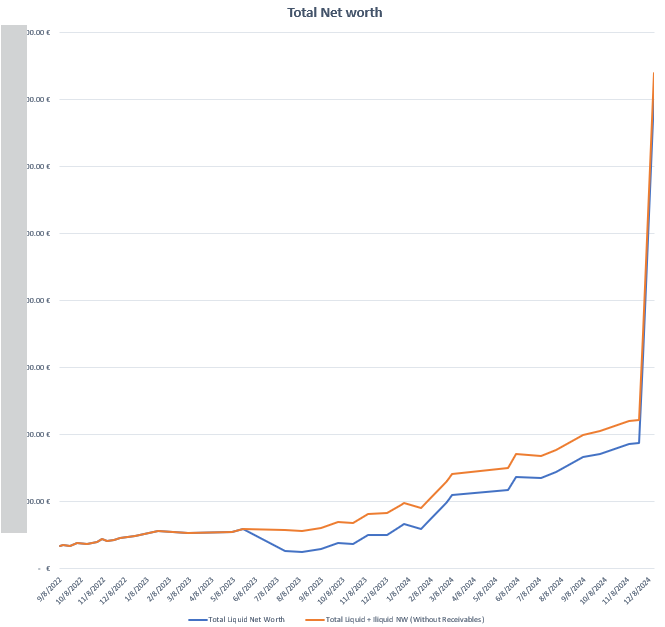

I let it run, and at the top of it, I had 4x my net worth in the span of a few weeks.

I am not rich obviously, but I can afford the luxury of not having to work for a very long time and wouldn’t affect me.

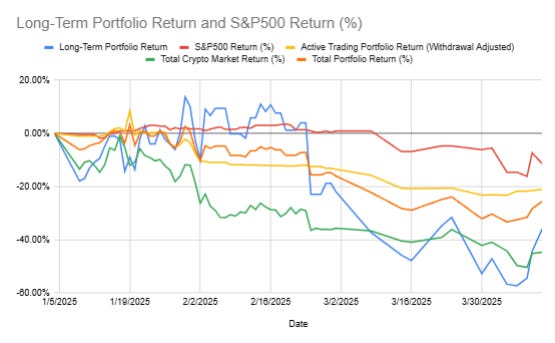

I allowed that to get into my mind. Our newsletter start suffering from less content, I started doing less research, I began “half-assing” projects I wanted to build, and once again, I went into a new drawdown in Q1-2025.

I want to reference again, that the drawdowns are not necessarily caused by myself getting undisciplined, but they are mostly market related. My point is that I start getting really focused when I enter losing periods, and relax my rules during good ones, which is highly inefficient and costly long-term.

During this time of the drawdown, we got deep into content here on the newsletter, published a bunch of articles, and continued working on getting better as traders. Up until Q2-2025 where the pattern repeats.

I start winning again, now I am even higher than the peak of the hyperliquid airdrop.

I relax my rules, don’t put as much work in as I should, and I am not as aware of my potential flaws as I should be.

My goal, is not to accumulate as much subscribers to this newsletter as possible. I’d rather have 1 reader that really enjoys what I write, and take value from it, rather than 100 that don’t read my emails, or that are not valuable to them.

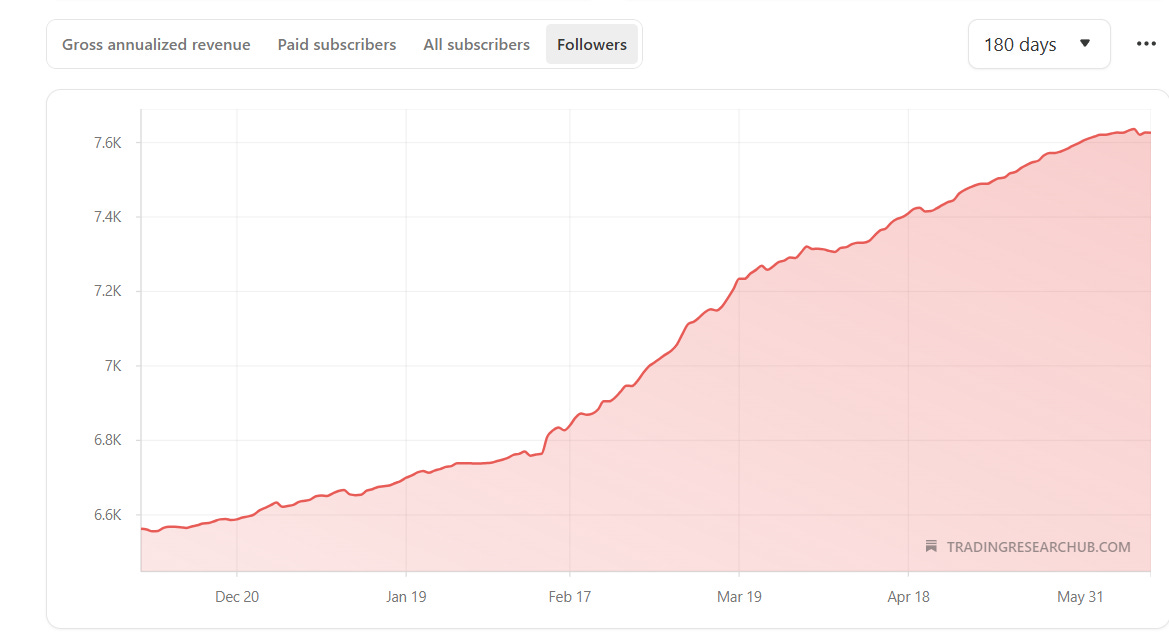

But readers are a good metric to gauge the interest in what you’re writing. You can see on the chart below our subscriber trend on Substack.

The growth was really slow heading into 2025, gets really steep in Q1-2025 (my drawdown), and then slows down again in the remaining of the year so far.

This is a pattern I want to break. I don’t like just working and thinking about my models when I am going through drawdowns. It’s important to always keep vigilant and be on top of our game.

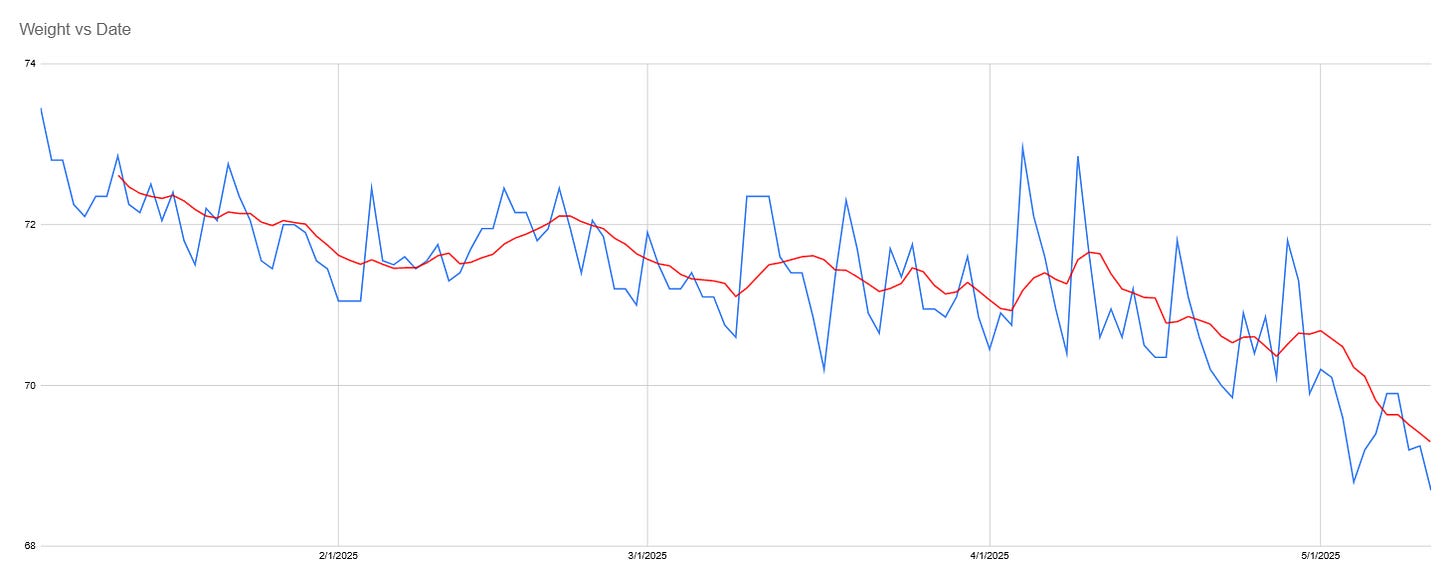

Last year, I started cutting weight. I was not too fat, but I had some additional fat weight, that I wanted to drop, to get a bit more healthy.

This is just from 2025, but when I started in 2024, I was about 76kg , and when I finished the cut, I was about 68kg. I got to a weight I had never been back at since probably high school. Did a bunch of mistakes, that slowed down this process a lot, but I learned over time to deal with them.

Why do I bring this up?

Because the defining thing that allowed me to succeed in losing weight, was tracking.

Tracking everything that I was doing, having a solid plan, and adjusting as we go.

That which you don’t track, you don’t improve.

The problem is that our work is very subjective. Is not like I can track how many calories I’ve eaten today, as equal as how many new trading ideas I’ve explored today. An idea can be a 15-minute test, and another can be a 12-hour test, or even longer.

So the question is, what would be the ideal measurement of your performance as an individual trader?

To me, this is a daily process, and I define making progress like this:

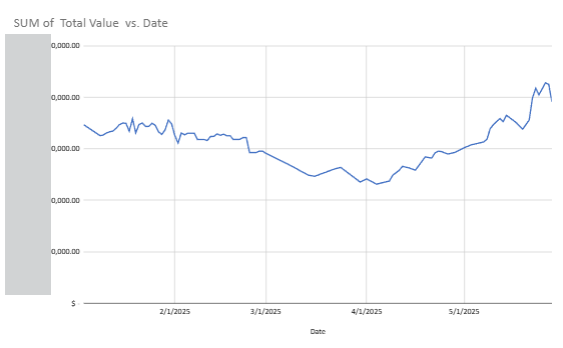

Keep a regular and accurate log of my trading, by strategy, not just global cash in the portfolio.

This will help identify portions of my portfolio where I am losing/making money.

Measure the performance of my trading strategies against benchmarks:

Market returns.

Similar strategy’s returns.

Keep a regular log of overall portfolio equity.

Write a research article at least once a week

Write an update/simpler article a week.

Work at least 4h-6h a day in a blocked fully-focused environment.

This is how a successful week would look like for me as a trader. Keeping all of my business activities accurately measured and on track with what I expect it to be.

If for example my trading performance were to deviate from benchmarks too much, I would then be alerted to that fact, and try to understand if that’s normal variance, or if my models are not being as efficient as they once were.

Now talk is done, all I have to do is track it, and make sure I keep up with that schedule regardless of how good/bad I am doing.

This is my job, I am a professional, and I need to get reminded of that. So should you, if you read this far.

I hope you’ve enjoyed this honest and more raw analysis of my own performance. We’re all in this journey of trying to get a bit better each day in our trading and I think that self-reflection is a really important step in that.

Have an amazing weekend!

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

I find myself doing the exact same, working more during the drawdown. I think I do it because psychologically it makes me think that “ok, I am understanding what happened. It makes sense I’m in drawdown”, even if I as usual I make no changes.

My system is fully automated, so very easy to just leave it for long periods.

I found automating my metrics, in particular tracking against benchmarks (BTC/top x coins), so first thing I do each morning is look at that benchmark tracking, then at the trades (if any), to understand whether I “should“ have made money or not. Also gives me a routine to do in both good and bad times.

I have a regime filter, so watching the indexes go down, whilst my bot doesn’t lose money is as pleasurable as watching it make money in good times.

The only upside I see to leaving it to work is that it keeps you from interfering. I believe in the core ideas of my system so I try not to interfere often. IMO you have to let the system run for a while to get some understanding of how it behaves/will behave. I research all the time (sometime more than other times), but I typically let it go for a few cycles of run ups/drawdowns, then apply any new changes. So like a 2 or 3 month change process.