Why do Crypto Tourists Lose Money?

The Ugly Truth About Most "Traders"

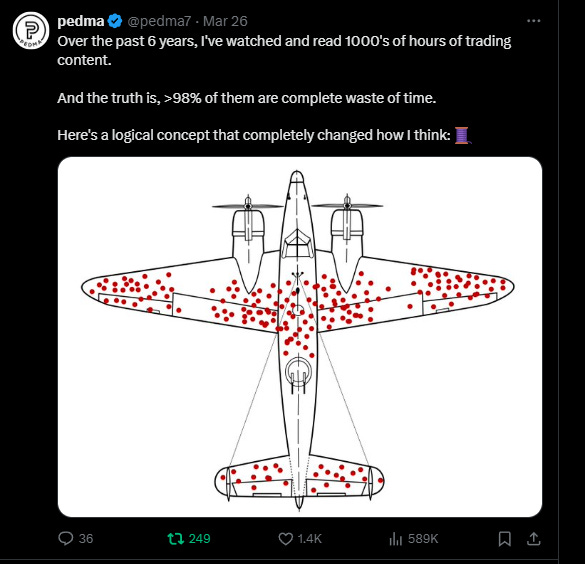

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Everyone is looking to get exposure to crypto once again.

We can see an uptick in search, interest from friends/family, on social media, etc.

… and for good reasons:

Incoming U.S. administration which seems to be highly receptive towards crypto.

Speculation around easing of regulation.

Bitcoin hit an all time high of $93,000.

When crypto is strong, it really can be the land of opportunity, for those that are exposed to it and that know how to navigate it.

I’ve been trading crypto since 2021 and have seen a lot of themes and narratives come and go.

But there’s one theme that never changes:

… the public seeks to enter the sector when it’s hot, leave when it’s slow, and repeat.

But this makes them tourists, and as so, they are always late to the next cycle.

How can you make sure you’re never late?

That’s what we’ll cover today, but first, let’s review some of my open trades so that you know I ain’t a tourist.

As you know, I don’t like to talk only theory, I practice everything that I preach…

Currently 116% of my capital is exposed, spread across 22 open positions.

(I have other positions that are not for the “main” portfolio, but that are scattered across wallets.)

I was trading spot-only up until earlier this year, but following the EU regulation around USDT, I had to switch over to futures.

(… now I am paying funding fees on a daily basis, which is all for my safety!!! 🙃)

And they can get quite costly!

Funding fees is something we will dive deeper in a future Research Article as they have become an important part of my trading.

Here’s some of my best open trades:

Bitcoin:

Entered this position at 66,509.10 and now it’s at 91,662.08.

Total return: 37.82%

BONK

Entered this position at 0.026 and price is currently at 0.0556.

Total return: 113.85%

SUI

Entered this position at 1.12 and price is currently at 3.78.

Total return: 237.50%

PEPE

Entered this position at 0.0119 and price is currently at 0.0203.

Total return: 70.59%

All the others have great potential, but are still developing.

The point I want to make is that, I’ve been taking risk far before this increase in price and exposure in the media.

By having made that bet, and allocating all of my time and capital, I am being rewarded for it.

That is the entire concept of profitable trading.

You want to be rewarded for taking risk. If people are only coming into this space when it’s “safe” or “everyone is doing it” what really is the risk there?

We are not paid to be comfortable but to take risks. The best trades come from betting despite massive uncertainty.

Here’s practical proof of that when I bought Bitcoin, in late 2022/early 2023 at around $17k.

… when everyone thought the space was dead and that regulation was going to send it to insignificance, I continued to bet and build in this space.

Not because I have a blind belief about it, but because I seek risk where most reward is.

I ain’t no tourist…

Reality Check

I always try to be as real as possible with all of you reading.

Is it all rainbows and sunshine over here?

Obviously not.

It might seem like it, when every cycle we hear a story of some kid who turned a few hundred or thousand dollars into multi-millions dollar fortunes.

Feeling like that is absolutely normal and what probably initially drew you towards crypto!

But the reality is that often these type of returns are achieved 2 ways:

Massive amounts of leverage

Lottery type luck with some weird coin.

In the above article’s story, the trader was paying attention and happened to catch a massive lottery ticket type trade.

Never forget that for each of those that get lucky, there’s thousands that lose all of their capital.

We have the tendency of focusing on the ones that win due to our inherent bias towards the survivors!

Also the people that destroy their portfolios rarely showcase their losses, and more often than not, hide them from public view.

One of the interesting things about Decentralized Exchanges Protocols, is that they have public statistics of trader’s PNL on their platform.

Take the example of HyperLiquid’s:

Most traders lose money and that’s an undeniable fact.

So even though these stories are interesting, the reality is much different for those actually trying to make this a sustainable business.

Since March this year, everyone trading trend in crypto (including myself) has actually been in a drawdown!

Search any trend trader that shares his results, and compare their performances.

It has been a painful 7 months of losing money.

There’s no escaping these periods.

When there are no trends, either up or down, we get chopped a lot.

But that’s what we get paid for.

We as traders are paid to harvest risk premium, and to manage risk in between bad periods.

As we harvest this risk premium, we must always consider the risk and volatility of the sector we’re in.

Crypto is quite volatile.

Everyone gets attracted by the returns, but get scared by the volatility that they find.

So they leave.

But this is not inherently unique to crypto. Happens everywhere and that’s why most traders lose money. They can’t stand temporary capital loss, which is absolutely necessary for any trading business.

A good trader quickly finds out that losses is where the success is to be found. It’s the pain that most people can’t take, and it’s that pain where the opportunity lies for the trader willing to take it.

How to Extract the Maximum from Opportunities?

As we have seen in Research Article #52, too much size can actually hurt your performance in the long-term.

How many stories have you heard of people that made large amounts of money, during great markets, only to lose it all or large portions of it after?

I have documented a few of these stories:

All of these individuals made extraordinary returns at some time in their career.

But all of them went through extreme drawdowns that most people can’t bare.

Warren Buffet said:

Rule No 1: never lose money. Rule No 2: never forget rule No 1.

Obviously he wasn’t saying that you can’t lose money, that’s impossible, but you must minimize it as much as possible.

Compounding effect really is one of the wonders of finance.

In order to recover from a 50% drawdown, you must make 100% to breakeven.

Imagine you start with $10,000 in your trading account.

50% Drawdown:

After a 50% loss, your account balance would be: 10,000 × (1−0.50) = 5,000

Required Return to Breakeven:

To recover back to $10,000 from $5,000, you need a 100% return on the remaining $5,000: 5,000 × (1+1.00) = 10,000

Making 100% in the markets is no trivial task and that’s why it’s so important to not let your greed take over and bet responsibly.

How do I trade?

For those reading this for the first time or are not aware with what I do (I have an entire section on my track record).

I am a systematic trader.

This means that every decision I take is robotic, and there’s no discretionary decisions being made.

The type of models that I specialize on are trend models, but applied only to the crypto sector.

That’s mostly what I write about in our research articles.

Now let’s get practical, how exactly do I trade?

Some parts of it are proprietary and I have no intention to share, but I can guarantee you that they are not the sole reason of why I make money.

My models mimic most trend models, but hopefully just a bit better.

Let’s look at Solana’s example.

I entered this position at $194.18, in early November.

Trend is all about the assumption that price expansions tend to persist in a certain direction.

So we take a bet on breakouts, volatility expansions, etc.

… and that’s what I did:

Here’s a few rules that I want to see:

Broke a multi-week price point that wasn’t able to break before.

Massive uptrend with decent amount of volume and attention.

Highest relative performer to others (ranking).

Seems simple ain’t it?

But that’s the truth to it. My models ain’t fancy. I am “just” harvesting the returns of the space, and managing my risk.

Most people can’t take the risk that I bare. My edge is my patience to hold through the volatility in the expectation of getting paid for that exposure.

Solana has been a decent return generator for my portfolio since 2023:

If you follow the ideas I share here, you might be wondering:

“Ok Pedma, you have a simple model, but what about risk management that you talk about so much?”

ahhh… That’s a good question!

This is one of my earliest models.

So it’s a very basic, old-school type trend model.

There’s more efficient ways to look at risk as we’ve been discussing in our research articles.

However here are the risk management rules for this model:

I only allocate 1% of risk per trade.

Based on the distance from my entry price to my stop loss.

I have a stop-loss

I have a trail stop

The game is how you monitor and find these opportunities.

This is where being a tourist becomes a bad deal.

Every day I am checking my scanners to find new opportunities that match my rules.

Regardless of bull or bear market, I am taking exposure.

That’s why you see me catch trends so early.

It’s not that I am a “sniper , it’s that I am taking constant exposure despite what people feel about it.

And so, when the market turns, I am there.

Now, what are the results so far?

Current P&L

First we need to find out the context of what drives our returns.

I am trading altcoin trend, which obviously means that a lot of the returns will be driven from the altcoin market.

I also trade BTC, but it’s in proportion to the entire holdings.

Altcoins have been massively underperforming BTC’s growth.

This makes it hard to trade altcoins and compare it to BTC, because BTC dominates.

Despite that, I’ve been beating BTC for the major part of last year, but this year BTC is leading the way.

The blue/greenish line is my portfolio performance.

You can compare my performance to other trend traders in the space, and you’ll find that my models are doing fairly well.

Now will this continue?

That’s a question for future me to answer, but you can be sure it will be found in these articles.

So, how not to be a tourist of any kind and make trading a real business?

Stay Consistent: Real traders commit through market cycles. Consistency beats hopping in and out when the buzz is loudest.

Take Risks Thoughtfully: True returns come from managing calculated risks, not avoiding them. Comfort rarely leads to profits.

Embrace Volatility: Understand that losses and volatility are part of the game. Learn to endure them, and you'll find opportunities where others quit.

Develop and Trust Your Process: A systematic approach—following clear rules and risk management strategies—will keep emotions in check and improve long-term results.

Focus on Long-Term Compounding: Avoid the temptation of high-leverage "lottery tickets." Protect your capital and let compounding work its magic.

I am building many more models to deploy and all that journey will be shared here for everyone to see.

I hope you join along!

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

Impressed with your pnl. Most wont even post and i wont follow anyone who doesnt these days, haha.