Knowing How to Find Edge Is Better Than 100's of Trading Strategies…

Beyond Algorithms: How Understanding Market Behavior Creates Trading Opportunities

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Trading strategies are great, and we need them to trade the markets profitably.

But in my experience, trading well and profitably, is not so much about the strategy itself, the data engineering, or even the complexity of the model, but rather about how you think and find your edge.

Many aspiring traders focus too much on the rules and parameters of a model, when in fact, 80% of the work (I totally made up that number), is in the research process and knowing what kind of effects you’re exploiting.

Why is this inefficiency being caused?

Why aren’t the big and more informed traders taking all the returns from it?

How am I going to trade it?

Those are the important questions, and in that order.

Nothing in markets will be precise. Signals are extremely noisy, and the best we can get is rough estimates of what we should expect.

That makes trading the markets highly uncertain, and expecting otherwise is just deluding ourselves.

Trading is like having a store and every client being able to pay what they want. Some will pay you higher than what you expected, others much lower, and maybe you breakeven or make money at the end of the month.

This is what makes this business so hard.

But there’s hope for the “little guy”.

There’s only a few games I can compete as, not being the best or most capitalized player in this game.

My main advantage is trading in a place where “known” effects like momentum and trend are much more pronounced, since there’s not as many people piling into these effects, making them less crowded and with more “juice to squeeze”.

I regularly share trading strategy ideas for our subscribers here: https://tradingresearchub.com/t/research

Above is my trading performance running a long-only trend model in crypto, for the past 2 years. These are live returns after fees and funding.

But you can be asking yourself:

“But Pedma, I don’t want to be trading the crypto markets or other lower capacity markets like yourself, how does this apply?”

In that case I’d be doing things like risk premia harvesting , or the extraction of known effects, like the examples we’ve talked above. The only difference is that their risk adjusted returns will be smaller, as they are well known and quite crowded.

Whereas I can get a sharpe north of 1 in crypto, you’ll probably be looking at a 0.3-0.5 sharpe in these markets (depending on diversification can be higher).

There’s nothing wrong with that, you just need to know that opportunities are different, given the risk you’re willing to take and manage.

But if you’re going to trade price inefficiencies in well established and highly liquid markets, one thing is for certain, you’re going to have a hard time, because everyone’s competing for those prices.

So how do we go about finding edge? The concepts are the same both for high and low competition markets. The degree of complexity and how good you have to be are the only variables, given the level of skill of the average market participant.

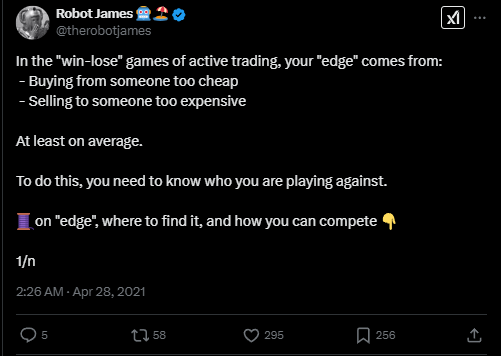

Let’s start by defining the game of edge.

We want to buy things that we consider cheap

We want to sell things that we consider expensive

That’s the whole practicality behind the idea of edge.

But we all know that…

The thing we want is to know how to find those prices that are cheap and expensive so that we can take them.

If you’re a market maker, it’s a pretty simple concept. Someone wants to offload inventory at a level you estimate to be too cheap/expensive, and the market maker naturally is happy to trade at those prices and collect the spread.

The role of the market maker is not to predict price movement (even though there’s some component to it), but rather to provide liquidity to traders willing to cross the spread. The service they provide is clear and useful to a market that wants to trade.

However, if you trade like me, we are probably not going to be building a market making business, so for positional traders, that relationship is less clear.

Take the example of a simple rebalance.

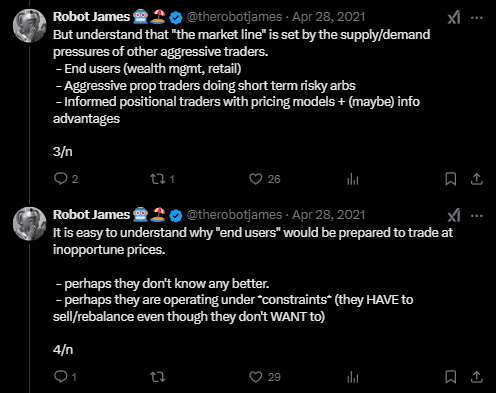

We know that institutional investors, such as pension funds and mutual funds, tend to rebalance their books at the end of a month, quarter and year. If this is true, it should generate sell pressure on the extreme performers and buy pressure on the underperformers, caused by these major players rebalancing their books back to a target allocation.

This is the start of a “thesis” around edge. You know that there’s price impact, and you will position yourself in order to provide the liquidity necessary for the market to operate.

A useful service…

And there are many things that “constrain” these market participants that are not necessarily rational or expected behavior. And these behaviors generate effects that we can capitalize on.

And when we go to less competitive trading environments, these effects become more apparent and “easier” to find. To understand these effects, we need to be aware of the market that we trade and what could cause these price distortions.

Now let’s look at another example — window dressing.

Fund managers sometimes want to make their portfolios look better at the end of a reporting period, like the end of a quarter or year.

To achieve this, they tend to sell stocks that performed bad (the trash) and buy stocks that have become better or popular, so that they can appear more impressive to their clients.

This generates behavioral effects, that we can trade with them, if we:

Buy the unpopular stocks they’re trying to get rid of (often at a discount).

Sell them the popular stocks they want to buy to look good (often at a premium).

And this is a thesis we can start to develop a strategy around.

Another one is getting paid to “fade” short-term supply and demand imbalances that are merely caused by emotional traders.

Take the example of short-term news, that are merely based on hype and not on substance about some quality improvement, or lasting meaningful impact to a business.

By getting exposure in the opposite direction of these distortions, we can potentially capitalize on the eventual re-pricing to the “fair-value” of the asset we’re trading.

There’s a very clear example of this in the micro-cap niche in U.S. equities. For many years companies release over-hyped PR’s or news, often paid by the companies themselves, with the sole purpose of pushing prices higher and generating some cash.

These are some of the tactics they use:

Insider Selling: Once the stock price is artificially inflated, insiders (like company executives) sell their shares at a high price. This is known as a “pump and dump” scheme.

Secondary Offerings: The company issues new shares at the inflated price, raising capital from investors who believe the hype.

Convertible Debt: Some companies issue convertible debt to investors who then convert it into shares at a discount, selling them at the pumped-up price.

Warrants and Options: By issuing warrants or options tied to the stock price, companies can raise funds when these are exercised by investors during the hype cycle.

They can push price higher because these stocks are often thinly traded, and a small increase in buying interest can push them a lot higher.

One type of strategy that could be deployed is to provide liquidity to these price insensitive buyers on the extremes, and capitalizing on the eventual move down.

Obviously there’s risks here.

Every now and then, there’s one of these stocks that go higher and higher, and if you keep shorting it, it will blow your account out.

But once again, the service provided to the market is quite clear:

Providing liquidity for traders to trade at extreme prices

Helping the market re-price assets back to fair-value

You should expect to get paid for such actions, obviously if your model assumptions around pricing are on average correct.

But once again, the competition in that micro-cap market, is extremely low due to the low liquidity that is available for large players to participate in. Maybe you can get a few million $ yearly PNL from it , doing it at full capacity, but that’s not enough for funds managing billions in AUM. Also it’s highly unlikely that they are willing to go over all the constrains (borrows availability, capacity, halts, etc) in order to extract a few million $ in PNL.

But for you and me, that’s a worthwhile value to go for!

In the quest for alpha (inefficiencies), these big firms buy order flow from “retail centric” brokers, in order to get information about their client’s behavior.

Why they do this?

Because they know most of these traders are trading noise.

Meaning that they’re trading with no edge.

And when they make mistakes, that cause market impact, these firms will eat all the edge available, since they do it at maximum capacity to maximize profit.

So they act like a big fishing boat, throwing a big net around inefficiencies in the market, since they know what these traders are buying and selling and positioning themselves against them.

Most traders are uninformed traders because most traders lose money on average.

Obviously sometimes there’s a GME 0.00%↑ like we observed in 2021, that blows a few funds out of the game, that didn’t have their risk game on point.

But sometimes, like we discussed above, these inefficiencies can leak out because it is unattractive for these sophisticated participants to exploit it.

All we have to do is know where to be, when to be, and extract some noisy alpha.

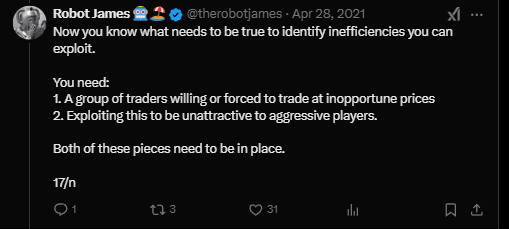

In the end, finding true price inefficiencies is about knowing your market really well.

Where are traders that are willing or forced to trade at bad prices?

Can I exploit it given the competition around me?

If we have these things dialed in, over time we can build a portfolio composed of price inefficiencies, that can be highly lucrative over the long-term.

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

great curation. I'm also a big fan of Kris and James. I've learned a lot from them. it's unbelievable how people trade thinking they have an edge because they're following someone else trading strategy. I've been there years ago trading penny stocks...