Pedma's Portfolio Management Journal - 04/04/2025

An in-depth review of my trading performance

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

One of the most important factors for successful trading and investing is to keep regular journals of our trading activity. I’ve been trading for 7 years now, and I still do it every month, quarter and year. I never miss one!

We need to regularly think about what went wrong, what went right, and improvements to make. Even though we operate a business that is built on capital growth, not on providing goods and services, we still must carefully think about our performance.

We shouldn’t just throw it under a rug when we are losing money or look at it every day when the market is in our favor. We must keep a regular schedule of performance evaluation, of our trading business.

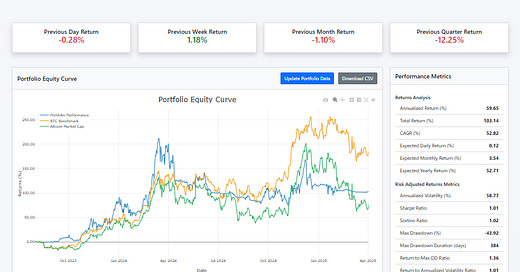

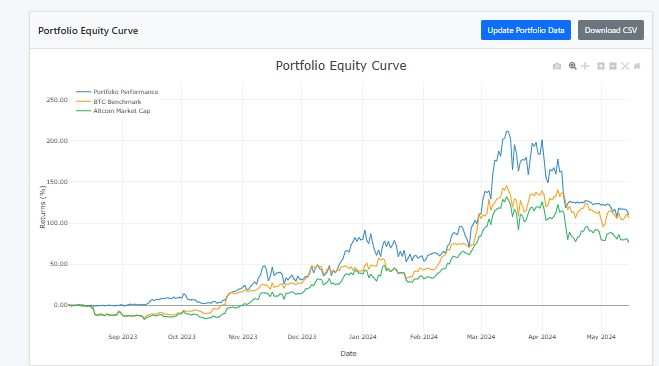

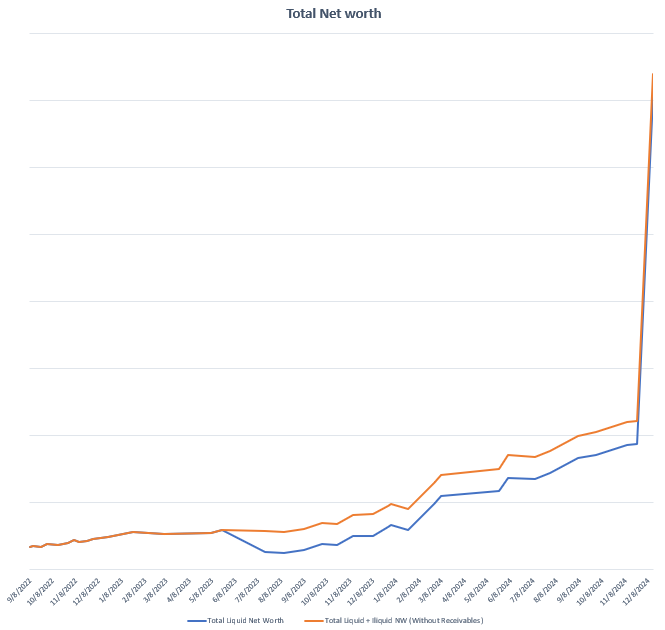

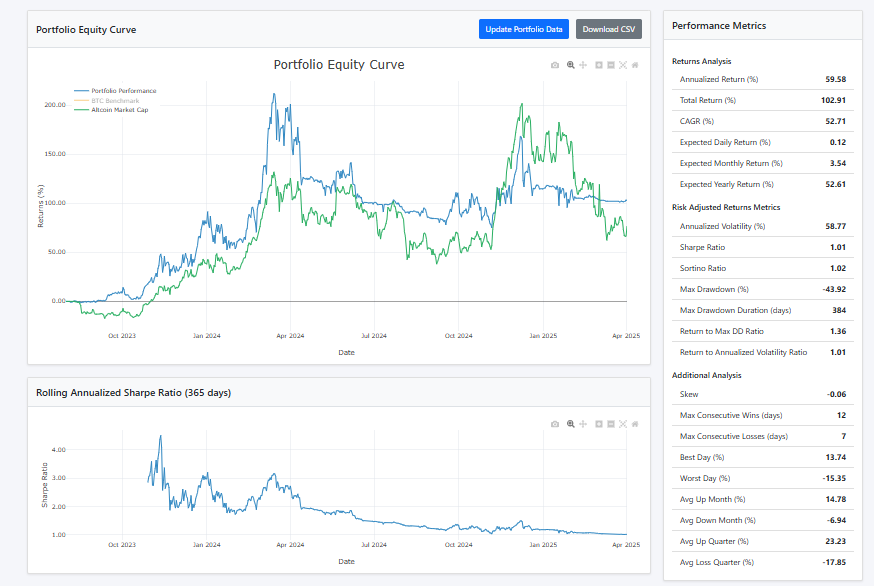

Despite being up 103%, net of fees, in the last 2 years, I’ve been in a drawdown now for 384 days, more than 1 year (blue line below)!

A lot of traders would look at my last year and think I must be doing something wrong. There has definitely been costly mistakes that I will outline below in depth, but negative performance doesn’t necessarily mean that you’re doing something wrong, as we will see below.

Despite this, my CAGR stands at 53% and my sharpe at 1.01 for the past 2 years.

In this article, we’ll go through a few points:

What role has the market played in my performance?

What mistakes have I done and how am I fixing them?

What can I do better going forward?

I will start with a brief reflection on 2024, and after that we move forward to market analysis and my own performance analysis.

I hope you enjoy this!

Index

2024 - Overall Reflection

Market Analysis

Performance Evaluation

Missed Trades

New Portfolio of Strategies

2024 - Overall Reflection

I was having an amazing time from 2023 to 2024. I was making money every month, portfolio was growing at a massive rate, life was good.

But it’s in the good times that I notice myself getting distracted. I get complacent when things are going my way. Don’t get me wrong, I wasn’t on a beach doing nothing, I was here all day doing research and looking at markets.

But I was distracted by a lot of things that were not directly impactful to my trading. That distraction allowed some inefficiencies to slip away, that ended up costing me a lot of money. We are going to analyze them in today’s article, and I will explain how I’ve fixed it going forward.

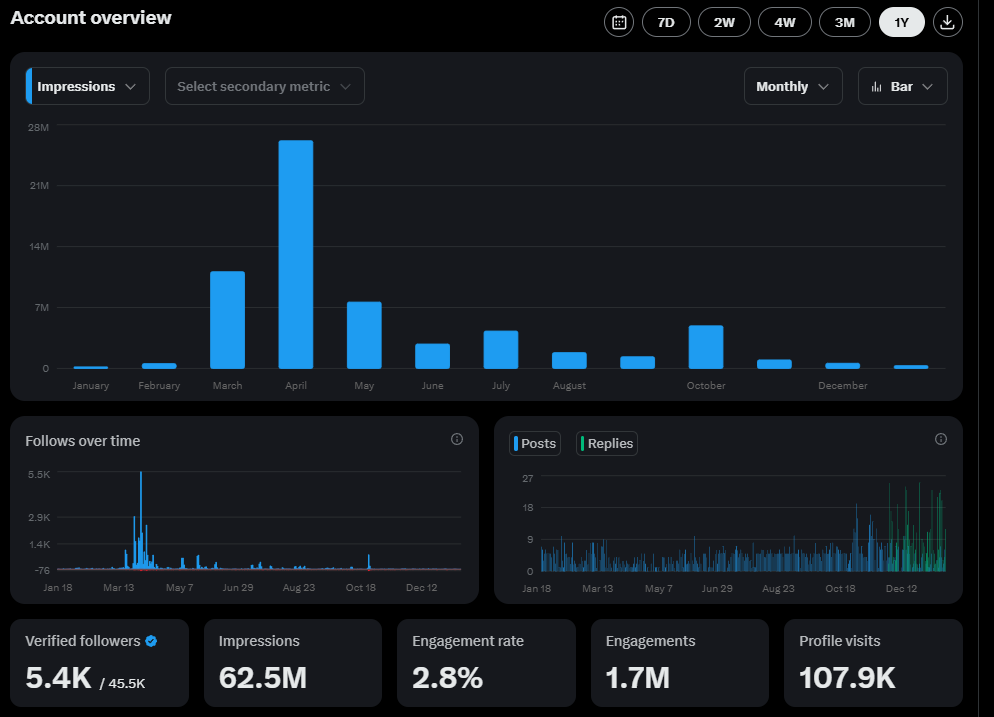

Making Content

One of my distractions was my twitter engagement game last year. I learned how to play the game, and got a substantial following in a few months, accumulating over 60 million impressions on a niche topic—systematic trading. And this was over the span of only a few months.

This is great, and nothing wrong with that, but I quickly realized that this was interfering with my own trading and I was not learning anything new or growing in my own trading by focusing so much on content. And that was really stressing me out.

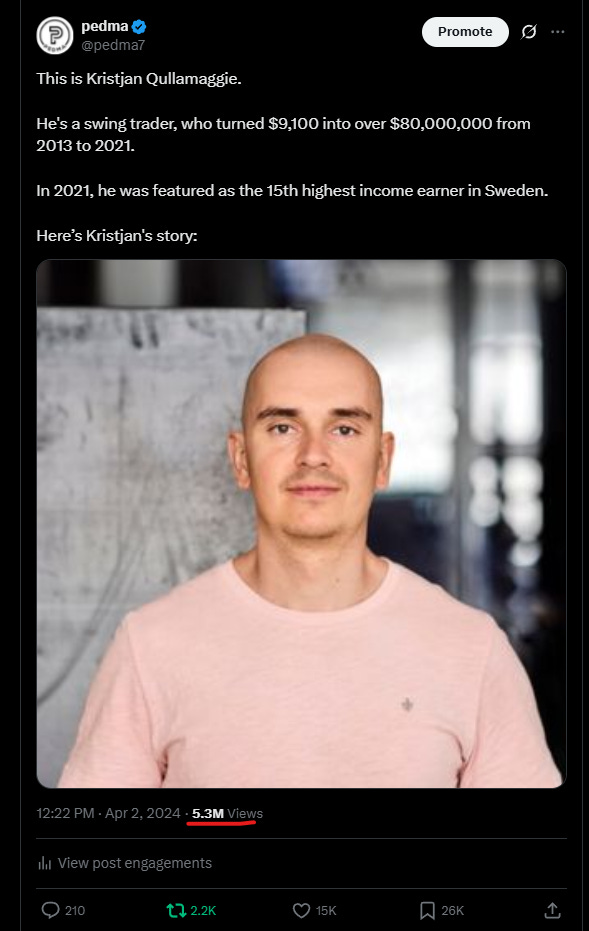

I am a trader at the end of the day, not a marketer. It is fun to see your posts reach 1M, 2M even at times 5 million views, like the one below.

But I had to take a step back from it as I saw my trading suffering. For context, I was spending 4h-6h per twitter thread at the peak of my game, and I was publishing a thread sometimes every 2 days! After 4h-6h of any task, I was exhausted to do anything else that required deep thinking. And that is not in line with my goals.

So I took a break from it, and focused on my trading game, and that is what brought me satisfaction in my work once more. Now I am deeply immersed in research, getting better at my own allocations, making more money as a trader. Will I ever go back to produce highly engaging content? Maybe, it’s a fun game to play, but it has a cost, and that cost I am not willing to pay right now.

I am focused on becoming a master at my craft. That’s my mission. The only content I want to do is on this newsletter, and document my way there. In order to become the trader I want to be, I must be constantly improving, reading, researching and building. And I can’t do that when I am also focused on creating highly engaging content.

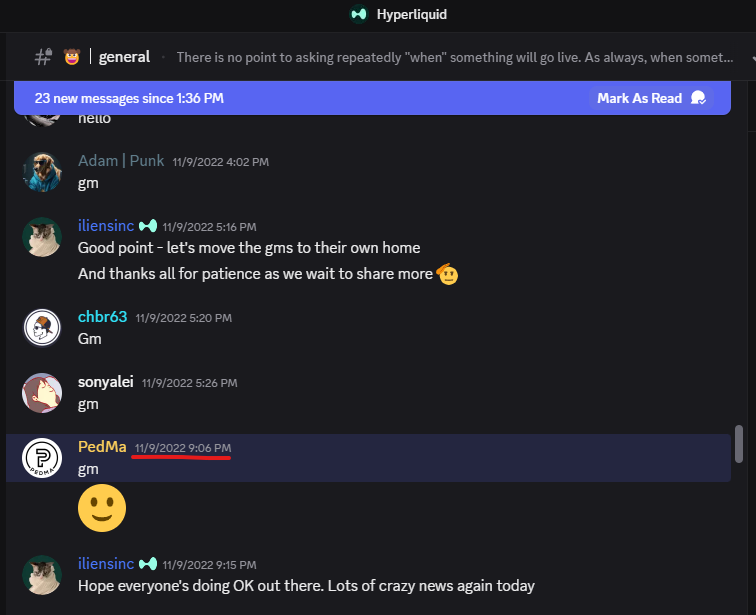

Hyperliquid

Later in 2024, I got lucky with the Hyperliquid launch. It’s my single biggest win by a large margin, and yet at the same time, my largest bag fumble.

I knew about hyperliquid from summer 2022.

I know people from this time that got 8-figure airdrops. I didn’t get that high because I decided not to trade there as I didn’t have much time back then and was focused on other stuff.

The biggest bag fumble of my life, and probably will stay that for a long time.

Yet, despite that miss, I still 4x my net worth from receiving their airdrop and holding it.

Getting the airdrop was not skill, and I do admit that I got extremely lucky. But what happened next I don’t say it’s complete luck, it involved some willingness to take on risk, some skill to hold it (not bragging) and the advice of good friends.

I was actually going to hold the entire stack for the long-term, but my friend, also known as Goshawk Trades on twitter, helped me see that this was too large of a position to hold, given my net worth at the time (thanks Goshawk!). So I sold 2/3’s of my stake at the 26’s level after he knocked some sense into me. It’s funny that even after all of these years, I still got blindsided by my perceived potential of the project.

Don’t get me wrong, it’s an amazing project, and I do see it returning to all time highs in a few years, but the amount I had, was too large to hold, and I do think there’s less risk for that capital to be in my own models. I still hold 1/3 of it for the long-term.

After all said and done, I held the airdrop from $2 to 26$—a 16x return.

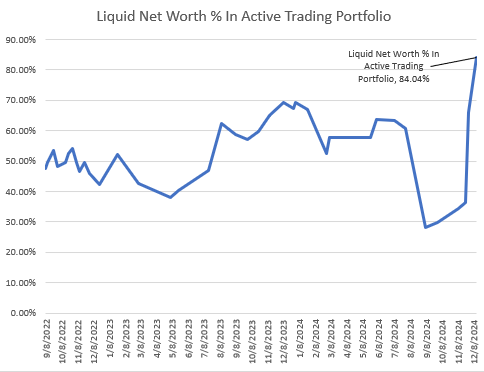

A reasonable person would take that money and put it in the bank or in the S&P500 yielding some return, but myself, I like risk. So I took that cash, and I sticked it into my trading account.

Which meant that around 80% of my net worth is now in my portfolios.

Is this wise? For most people no. But I am 27 years old, my only responsibility is a mortgage and I am willing to bet on myself. I have a proven track record of trading well over long-horizons, and I am not here to play it safe.

But I do realize that I got very lucky with this airdrop and I am now in a position that I can live solely from my own trading, as before it was a bit harder. Will it be a wise decision? Well, I’ll be here in a few years to tell the story and we can find out. But for now, it is the decision I’ve taken, and I haven’t looked back.

Market Analysis

My trading performance has been mainly crypto focused for the past few years. So in order to get a perspective of how I am doing relative to the market I trade, I will do a brief analysis of the crypto market.

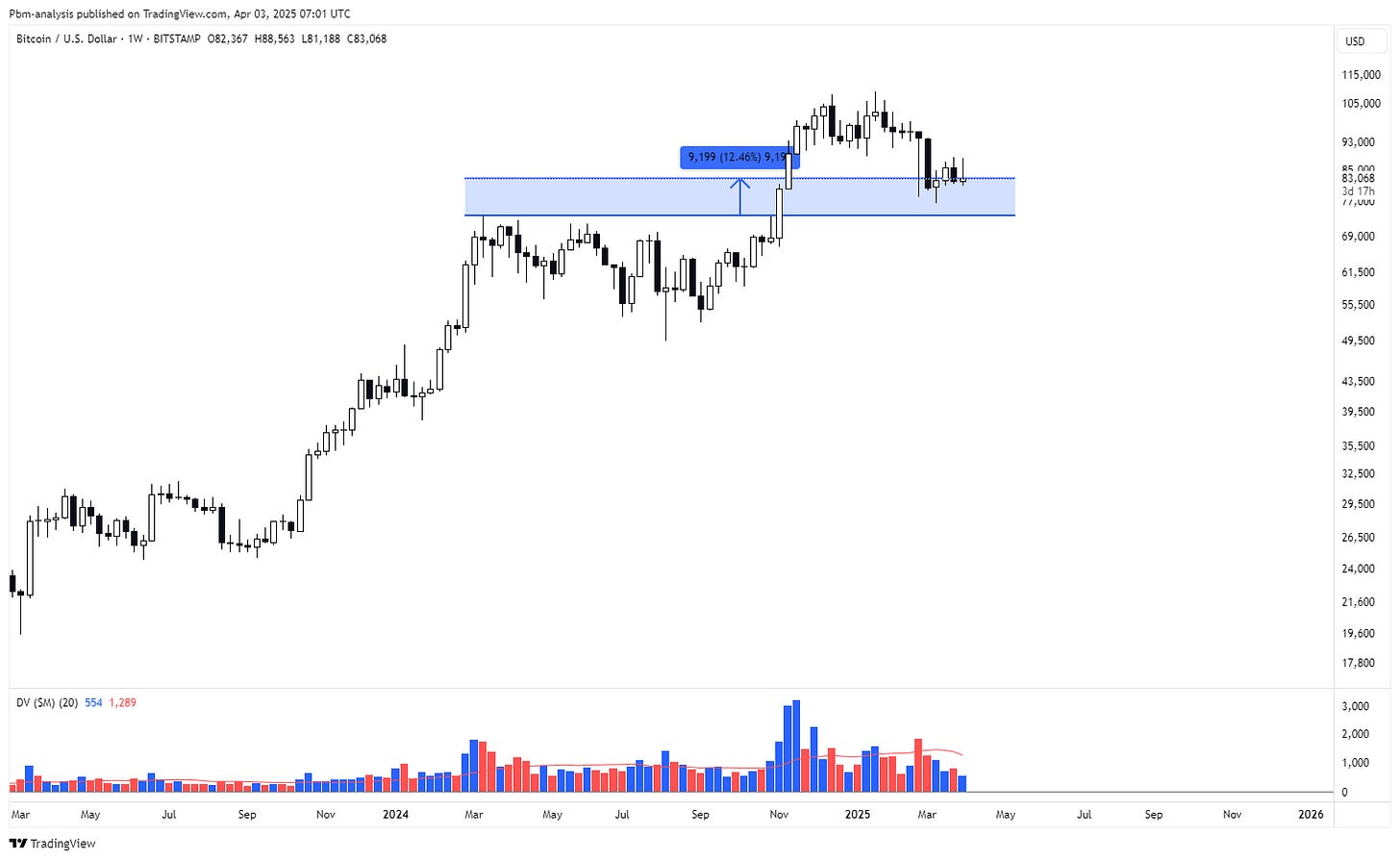

Despite all the things we’ve seen on the news regarding crypto, BTC is only up 12% from the March-2024 tops.

But we don’t only trade BTC. In fact, BTC is a small portion of our trading since we’re trading the crypto market as a whole. If we take the “OTHERS” chart, which is composed of every other altcoin outside the top 10, we can see that it is down 41% from the Q1-2024 tops. Ouch!

Let’s dig a bit further, and check the top market cap coin’s performance for the past year or so.

ETH: -55% from Q1-2024 highs

SOL: -44% from Q1-2024 highs

AVAX: -72% from Q1-2024 highs

LINK: -44% from Q1-2024 highs

Other than going down and chopping around, crypto hasn’t really done much for the past year as we can see. It has been stale in performance, no real bids, just shady action and a lot of memecoin trading that I don’t do size on. This means that a model that heavily relies on momentum will suffer and that is not something we can control.

If we look at the dominance of BTC on the overall crypto market, we can also see it has been on an up-only trajectory, even though BTC itself hasn’t done much as we’ve seen above. This just shows to me that altcoins have no real bid right now, and BTC just by holding its value, is gaining all the market share.

However, some of my lack of performance for the past year is not only the market’s fault, I’ve done some pretty significant mistakes.

Let’s dive into them.

Performance Evaluation

At the end of the day, my performance against that of the crypto market, has been decent and I am happy about it. However, last year I did do a bunch of mistakes I am not happy about, that should not have happened, given everything I know about trading at this date. This cost me a lot of money looking back.

Mistake #1 - Using Random Stop-Losses

I created this system in late 2021. I was a very naive trader back then. I was using things like stop-losses on breakouts. For example, Bitcoin broke out from the Q1-2024 range in late 2024. For this model I bought and calculated my size based on the distance from the breakout level to the lowest low of the weekly bar. Business as usual for a naive trader.

There’s several problems with this.

One being that I assumed that the low of that weekly bar had any relevance whatsoever. I assumed that because other swing traders I took inspiration from, like Kristjan Qullamaggie for example, did it this way. But it inserts a kind of randomness that I dislike. I got stopped out a lot for no reason other than the random noise from the market.

I also got a LOT of size on short consolidations and small size on assets that wicked out more. But how much relevance does a large and short consolidation have to my edge? Probably none. So why am I giving more weight to the positions with small consolidations than those with larger consolidations? It doesn’t make sense at all.

I didn’t change it because I was afraid of touching something that was working for the past 2 years. To be honest, it’s irrational, because I know for a long time that I haven’t been trading efficiently, due to these naive assumptions that I had. But no more, it’s time to fix it!

Fix to Mistake #1 - Volatility Targeting

I touched this matter in-depth on my latest research article.

The basic notion is that going forward, I am going to size my positions given a certain volatility forecast, and my target volatility for the portfolio, which I will keep pretty high at 60%.

This means that positions are sized based on their current volatility, and not on randomly placed stop-losses that are affected by all kinds of randomness from the market.

Also the stop losses are gone and I will no longer be trading with a stop-loss. My positions will be large enough, to make significant returns when the time is right, but small enough that if any individual positions crashes for whatever reason, I am protected.

Mistake #2 - Trading Low Market Cap Coins

We’ve touched on this matter on research article #53.

I outperformed altcoins for a long time. But something changed along the way and I began underperforming them going into Q4-2024. Something had to be wrong.

After digging into my data, I noticed that I gave allocations to a lot of small coins, that I had no business trading trend on. In crypto, the lower the market cap, the lower their trend property.

In simple terms, the smaller the coin, the more noisy they are. This makes sense from a behavioral perspective right? Less market cap, on average, means less liquidity, which means that smaller positions can cause significant distortions in price, that are based on nothing, other than randomness or manipulation.

We don’t want that. We want steady, long-term trends that we can ride. I’ve written about this effect here:

This means that I missed a lot of great trades because my portfolio was fully allocated to suboptimal positions.

Fix to Mistake #2 - Minimum Market Cap Threshold

What I’ve implemented going forward, is to set a minimum cap of $100M market cap to the coins that I trade. I will no longer trade coins below that, and I will also prioritize trades from the largest coins, rather than weaker signals from smaller ones.

This will ensure that I still trade emerging new projects, that are important to our PnL, but also that I am tactically allocated to the ones with most potential and the most established ones. I don’t want to waste capital on lower value opportunities.

As I am writing this, I realize that I don’t like the $100M market cap rule too much. Because let’s say that the crypto space would 10x tomorrow. Then $100M market cap, might be too low once again. We need to set a better rule for this. Something that adapts, that we can measure trend strength on. Maybe deciles, or a fixed number from the current top list by market cap, but that is something for a future research article. For now, let’s stick with the 80/20 solution, and remove the low liquidity coins from our pool. The data is clear on that.

Mistake #3 - Lower Signal Quality

One of the issues with this model is that even though systematic, I am still trading it by hand. I trade it by hand for many reasons but one of them being because I trade right as the asset is breaking out. It would be a pain to automate, and it takes me so little time to trade it, since the timeframe is weekly, that it makes no sense to add that extra layer of complexity to a working model.

The issue becomes, that I can pick and choose signals that I want. Let’s take an example of why this is a problem.

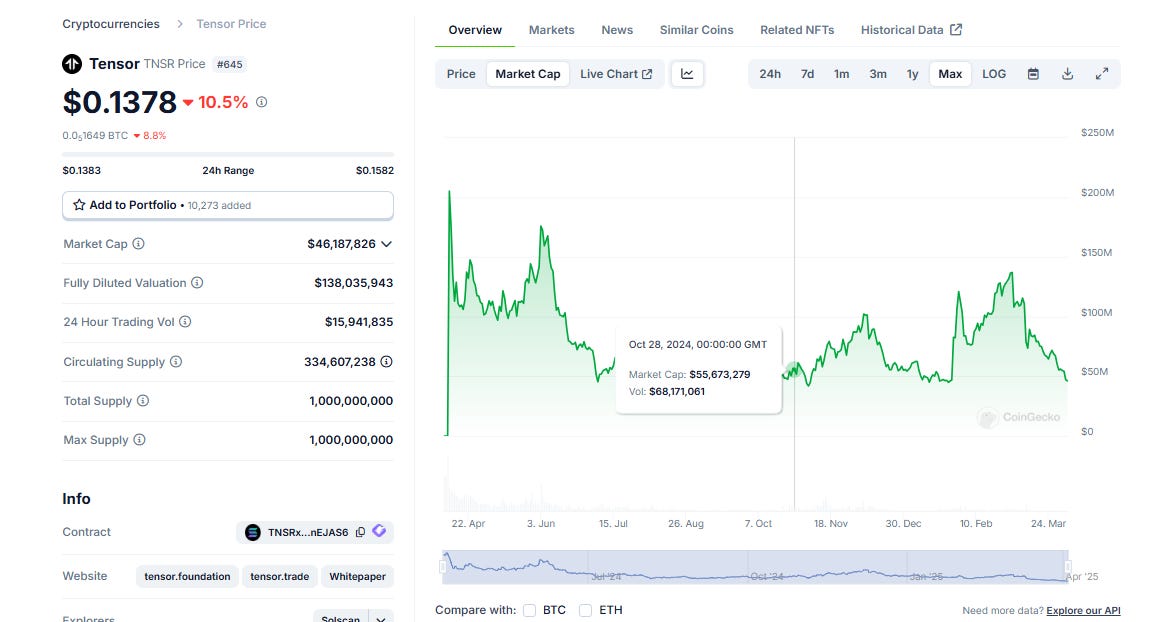

I entered TNSR as it was breaking out of that long consolidation. As you can see price quickly reverted to my stop loss and I ended up taking a decent loss on this.

If I wasn’t using a stop loss, I would have actually ended up with a profit on it, and not get wicked out of the market. As we’ve seen above, that is a very inefficient and expensive way to trade.

Had I sized it to its volatility, my size would have been more than 45% smaller. Which means the loss (even if I got stopped out) was 2x larger than it should’ve been. In other words, I allowed this position to contribute 2x the volatility than other positions. This is unacceptable.

It was a small market cap coin with $50M market cap at the time we traded it. We don’t want to be trading these assets, we want to trade the strongest ones. As we’ve seen above, these assets tend to have lower trend properties that we don’t want to be exposed to.

Missed Trades

If we put all of these factors together, it made me miss some massive winners, because I was fully allocated at the time they were breaking out and I had no more risk to allocate. Here’s a list of my top misses from last year:

XRP - How did I completely missed one if not the top performer of last year? Because I had no more allocation left out! I am ashamed of not trading this one as it is my bread and butter. It cost me heavily.

XLM - Another massive fail. How did I not trade this one? Again, massive cost from taking positions in assets I shouldn’t.

DOGE - Another one I didn’t trade. Why? Because I was fully exposed when it broke out. Another massive fail from me.

HBAR - Another massive winner that I didn’t take part because I was exposed to stuff I shouldn’t be exposed to.

As I am writing this, I realize I am getting more frustrated about my performance than usual. This is good reflection, this is how we grow. I need to do better.

New Portfolio of Strategies

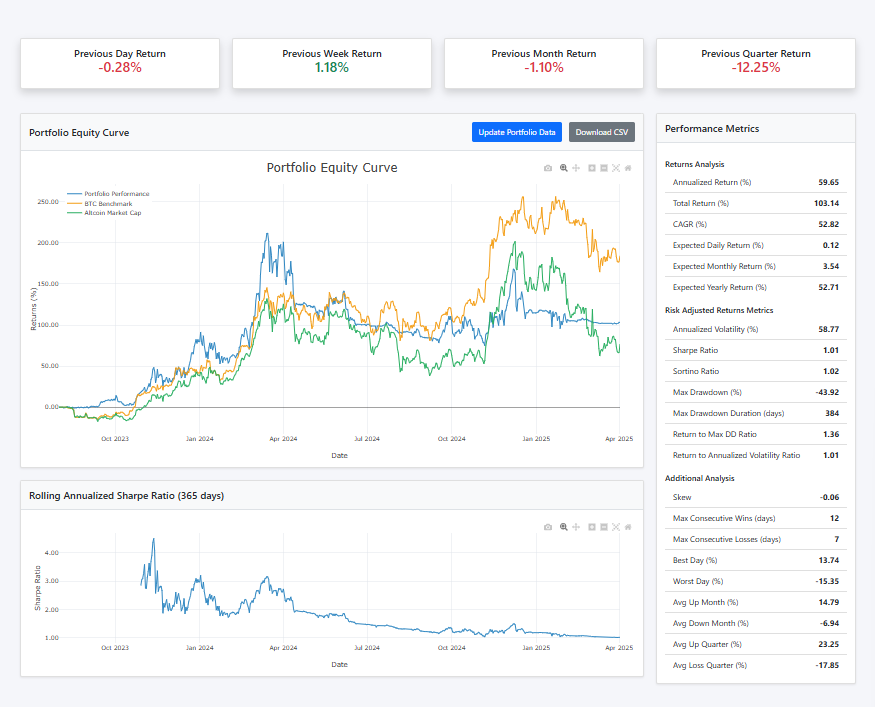

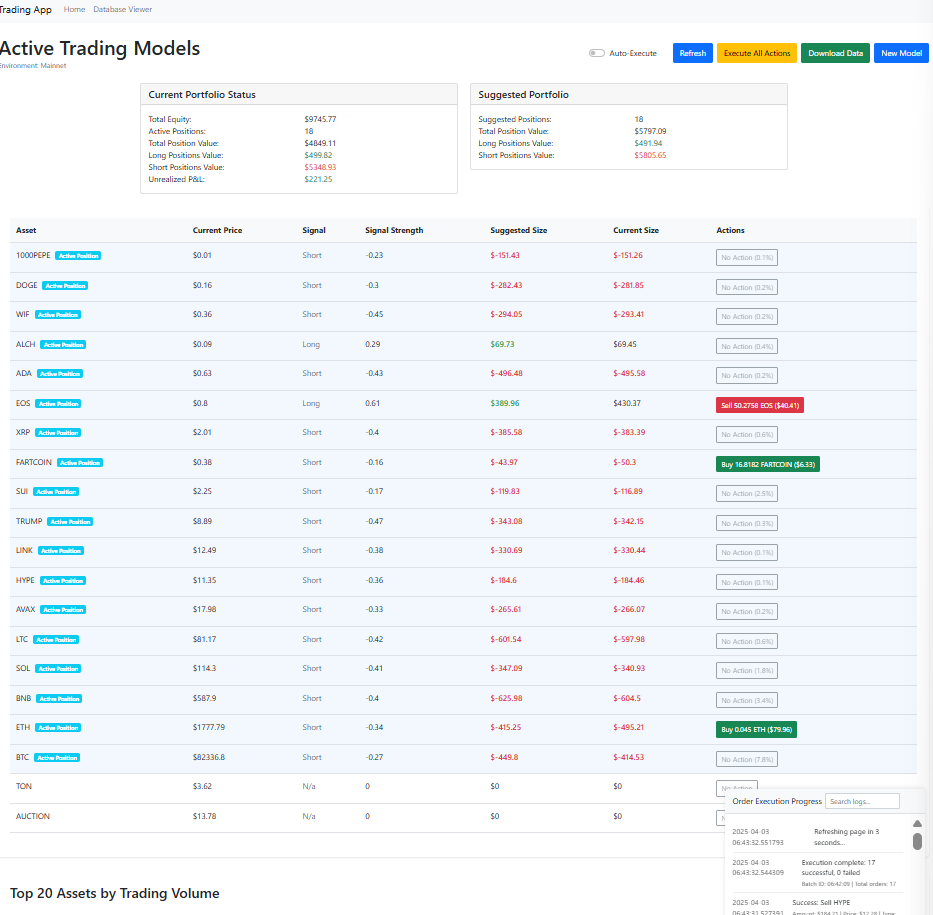

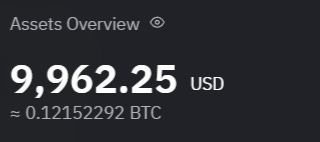

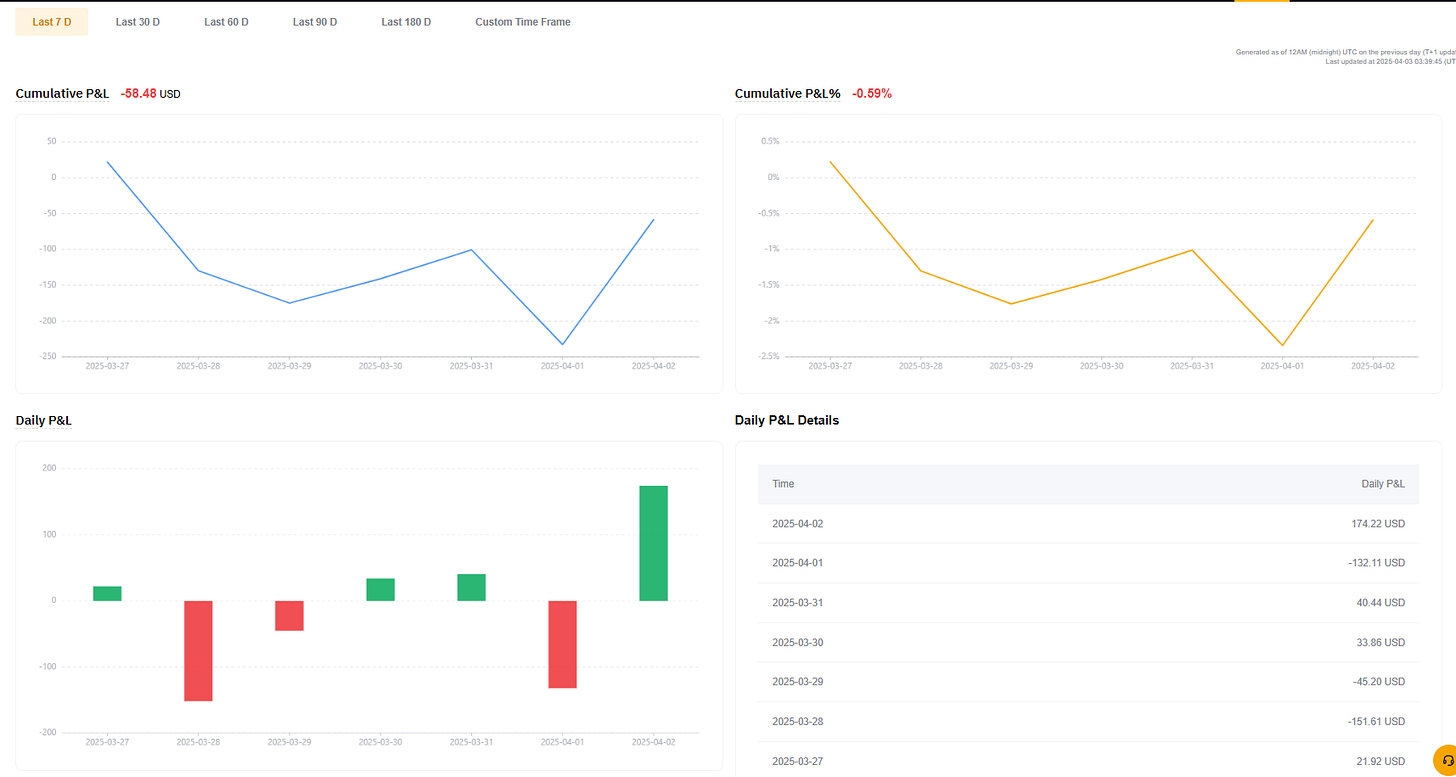

One of the major projects I’ve concluded this year, is the new portfolio of strategies. Right now it’s in beta testing, with only $10,000 allocated to it. The goal is to create a portfolio of signals, that should increase my sharpe, and profitability over the long-term.

Here’s the dashboard I am using right now to manage it:

I’ve only released it about a week ago from this article, but so far, given the current market volatility, it is been doing pretty well. As the market crashes, with all the bugs I’ve had to fix so far, it still holds its value quite nicely.

(I’ve noticed the discrepancy with the dashboard total equity above, but that’s a bug I need to fix. The capital from the exchange is what matters.)

You can also see here the equity curve directly from the exchange. It’s so new that I haven’t had the time yet to build a custom one myself.

If you’re asking what signals are we currently trading here, I have a detailed article on that also:

We will be adding a lot more signals and strategies to this model during this year, and it will all be documented on Trading Research Hub! If you want to get these updates, subscribe and stay tuned!

I realize that this article is getting quite long so I will close it here.

If you reached to the end of this article, it means you are serious about trading, and I truly believe that in order for you to have any chance at this game, you have to regularly do these analysis on your own trading performance.

Be real clear and honest about your shortcomings and celebrate your wins. Improve something every time and keep growing. This game never ends.

I hope you’ve taken value from this review as I have.

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

Fantastic insights. But it’s even better to see that you acknowledge your shortcomings AND address ways to overcome them. A rare find.

Honestly i haven't seen more interesting crypto substack than yours. Really good job