Don’t Just Research Systems. Build Stuff!

Next Steps To Achieve More in Systematic Trading

Hey there, Pedma here! Welcome to this ✨ free edition ✨ of the Trading Research Hub’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

What if I deployed 12 trading strategies in 12 months?

Including public access to the live AUM (assets under management) for that portfolio?

… and made the entire journey public here?

This idea has gripped my full attention ever since I’ve watched the Peter Levels interview with Lex Fridman.

Peter Levels is a self-taught programmer making close to $4M a year with his startups.

His philosophy?

Solve problems for people and move fast.

Other successful entrepreneurs have the same philosophy.

Mark Zuckerberg for example said:

“Move fast and break things.”

Peter’s story is crazy and fascinating at the same time.

He is not one of those geniuses that are born with a natural talent for this stuff.

He’s incredibly smart due to his hard work and relentless approach to building and helping people.

He has failed many times.

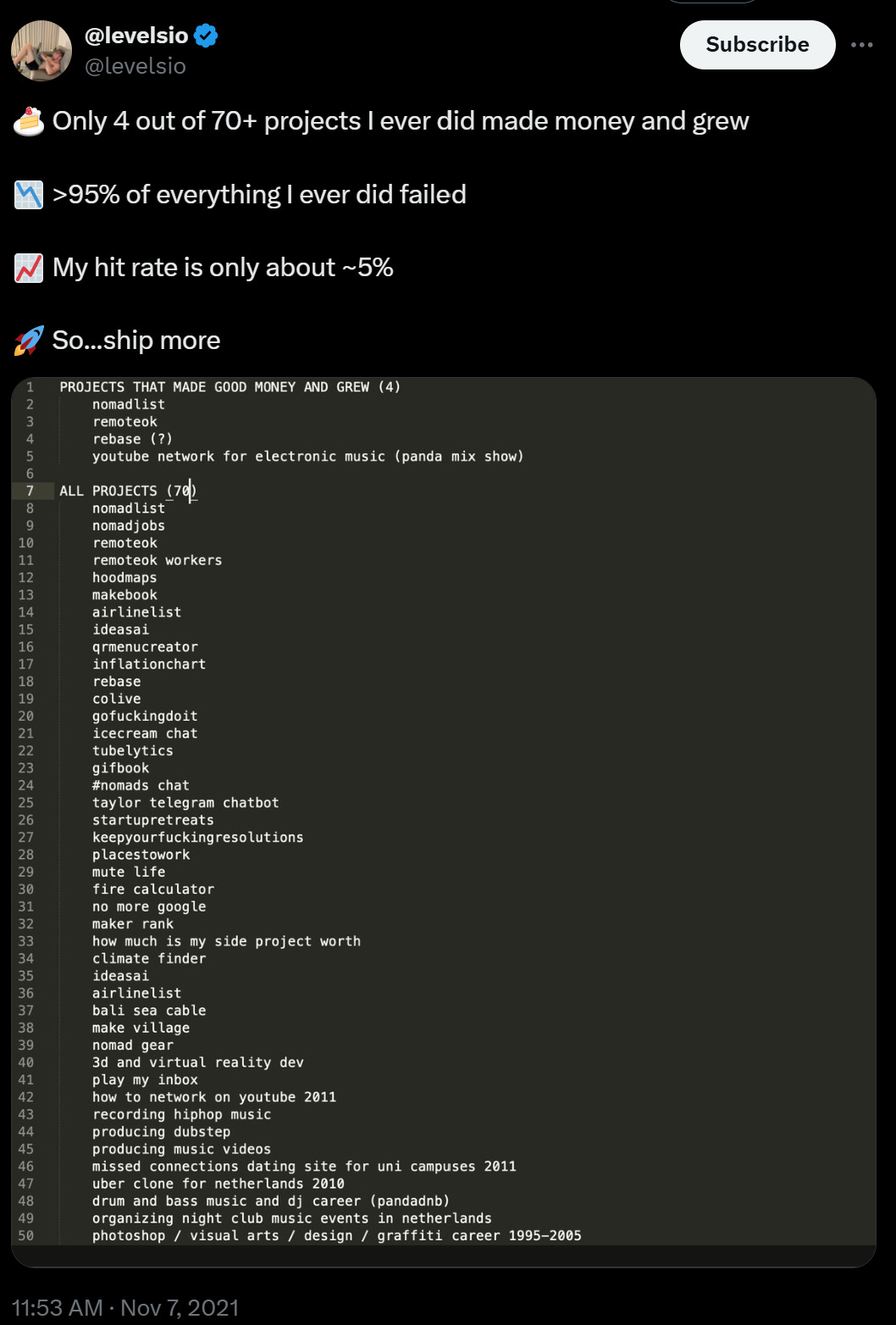

In 2021 he posted that only 4 out of 70+ projects have made money for him.

Over a 95% failure rate!!

I think that many of us that read this newsletter, identify with stories like Peter Levels.

I certainly do!

I have no background in traditional finance, coding, research, etc…

I don’t even have a college degree.

Yet I’ve been able to build a profitable trading business that keeps growing every year.

Now, this post isn’t meant to tell Peter’s story, but to tell you about the path that I am about to go on.

Over the course of the past year, I’ve written 52 research articles with trading ideas and concepts, designed to help you research and build your own trading business.

But I feel like there’s something missing…

The practical side.

Despite having been successfully trading my own trend-model in crypto for the past few years, I want to continue growing my book of strategies.

I don’t want to get complacent and stuck on one trading model forever, even though it’s something that I’ve been successful at.

But to do that, I need to go back to my roots and build fast.

There’s much so much more that I want to do and show you.

Not only will I continue to produce these articles, but they will become much more practical.

I am going to take the Peter Levels method and start iterating much faster when it comes to deploying trading models.

The frequency of the articles may take a hit, for the next 2 weeks, as I am building the infrastructure to support the strategies, but I think it will be worth it.

In my career as a trader, the best times have always been when I am deploying stuff.

(… and what I mean by best, is when I’ve learned the most!!)

When I needed that first strategy to make money, to be able to prove to myself that I could make this crazy idea of being a trader work, and that I wasn’t just wasting my time.

And that is something that I miss doing.

I don’t have that chip in my shoulder anymore because I’ve already proved that I can make it work.

But I can’t become complacent.

I can do much more than just one model in one sector.

I’ve already developed the infrastructure to process and clean the data over the past few weeks, and this week I will be working on the execution algorithm.

You will not only continue to get my careful research, but also you will be able to track the live performance of the strategies that I release here.

They will have real money behind them.

I might work with an audit team in the future to confirm the results each year, but I am not sure on the details yet.

My mission is full transparency in a field where there’s so many that pretend to be something they’re not.

I am very active trading my own main portfolio (especially now that Bitcoin has gone crazy), as that is what generates the bulk of my trading returns.

And that won’t change…

But I will allocate more time now towards this public portfolio.

This will in time not only diversify the risk from my main trading portfolio, but also provide a live track record of automated trading models we build here.

We are practitioners of the game, not armchair theorists.

I am excited for what’s to come, and I hope you join me.

After this is done, I will have one, if not the only newsletter that actually trades its own capital.

That is the way…

For many years I’ve had capital at risk, and now it’s time to take it even further.

Let’s get back to work!

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

You should definitely deploy a bunch of models and share the live performance. It will be cool to see