Your Returns Aren't What You Think...

The importance of understanding the difference between levered beta and true alpha

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

If you’re not a subscriber, here’s what you missed this past month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Have you ever wondered why some traders seem to make money easily during bull markets, only to give it all back (and more) when things turn south?

A famous example that comes to mind is Jesse Livermore.

By most standards, his achievements were very impressive…

After all, at one time he was the richest man in the world…

However, traders like these have a major flaw:

The ability to keep their profits after massive runs.

After their blow ups, they have the tendency to justify it many different ways:

Broke their rules

Psychological issues

Didn’t account for this or that

… and many other excuses

The truth is that their impressive returns were derived from something called leveraged beta, and not true alpha.

So any loss is amplified by the same “amplifier” that generated their returns in the first place.

Let me share a story that illustrates this perfectly.

Back in 2020, during the massive momentum in most markets, I was part of several trading communities. Everyone was a genius. People were posting incredible returns that were quite unreal.

Myself included…

I tell a bit of my story during that time here:

I literally saw people building accounts in a way that still blows my mind to this day.

And I am not easy to impress when it comes to trading performances.

But something interesting happened in 2022...

Most of these "trading geniuses" disappeared.

Their accounts got blown up, but we never hear that part of the story. The same leverage that made them look like experts during the bull market, destroyed them when the trend inevitably reversed.

They were simply playing with levered beta – amplifying their exposure to the market's natural movements – rather than generating true alpha.

What's the difference?

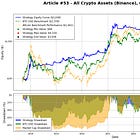

Levered Beta: Think of this as taking the market's natural movements and amplifying them through leverage. When the market goes up 10%, your account might go up 30%. Sounds great, right? The problem is that when the market drops 10%, you lose 30% (approximately). You're just riding the market's waves with bigger swings.

Alpha: This is actual edge that can’t be explained by the market – in a simpler way, the ability to generate returns regardless of market direction. It comes from having a genuine advantage, whether through superior information processing, better risk management, or a systematic edge that works across market conditions.

How can you tell if you're trading with levered beta or alpha?

You can measure the correlation between your strategy’s returns, to the exposure you want to measure against, in this case, normal market returns.

(There’s other forms of beta exposure, but that’s a topic for a future article.)

The key for new traders isn't avoiding beta entirely – that's as close to impossible as it will get.

Instead, it's about:

Understanding your market exposure

Measuring how much of your returns come from beta

Managing that exposure so it doesn't destroy you in drawdowns

I learned this lesson the hard way multiple times now. I thought I was a really good trader, but in reality, I was just riding the massive bull markets with leverage. When the tide eventually turns, I had to completely rethink my approach to risk.

Today, I still have market exposure – that's inevitable in trading. But I understand it better. I measure it. I manage it. And most importantly, I don't let it get out of hand.

For those starting out: Take time to really understand your beta exposure. Track how your returns correlate with market movements. Be honest with yourself about how much of your performance comes from the market versus pure edge.

This understanding won't make you immune to drawdowns, but it will help you build a more resilient trading approach that can survive different market conditions.

Remember: The goal isn't to eliminate market exposure, but to master it. Know your beta, manage your beta, and you'll be better prepared for when market conditions inevitably change.

I hope you’ve enjoyed today’s article! 😊

Ps… Looking to Work With Me?

After testing 100’s of trading strategies and spending 1,000’s of hours studying trading and building my own models, I had a few clients reach out to work with me and the outcomes have been quite good so far!

I’ve helped multiple clients now:

Develop their first systematic model

Help reviewing their current trading processes

Build solid frameworks on trading system development

Stop wasting money and time on bad ideas

Develop better risk management models

And much more…

If you want my custom help on your trading business, or would like to work with me, book a free 15-minute consultation call:

And finally, I’d love your input on how I can make Trading Research Hub even more useful for you!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.