Trading Journal #2 - January 11th, 2022

The past few days Bitcoin has been steadily but slowly increasing and closing green on the day. When the dollar is weakening and equities are strong usually this is a good sign for crypto. Even though that people talk about the crypto market being its own separate market , it is obvious that the overall macro environment has an affect on crypto. If people are feeling uncertainty, like we are now with global inflation, increasing interest rates, making already tight budgets even tighter, they won’t have spare money to buy speculative assets.

And it is a fact that most especially the crypto market needs retail volume inflow to drive prices higher. As long as retail is being squeezed with an increasing cost of living, it will be hard to push the market higher in my view. So we need to pay close attention to these indicators.

Tomorrow we will have the CPI numbers released which will impact the market. In theory it will give the public the assurance that inflation is going down and that more drastic measures from the FED on money policy won’t be necessary. Or the full opposite!

Setting this aside we need to look to the market from a strategic perspective. If you don’t have a strategy in which to trade the market you will not make it as a trader. Basing your trading and investing decisions on mere opinions is the fastest way I know to the broke house.

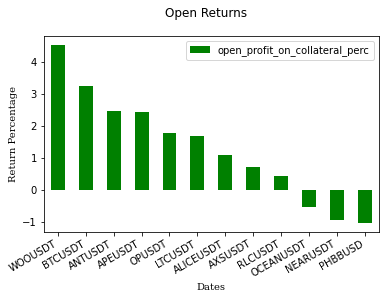

These are the positions that I am currently holding in my trading portfolio. I know exactly how much I am going to lose if they were all stopped out now. I know exactly the maximum drawdown the worst case scenario offers. And that brings me clarity to my decisions. I don’t question my systems and let them guide me forward.

If you don’t know the historical expectancy of your system, you will be left questioning your decisions every day. And when you are in a trade the last thing you want is questioning your decision. When a trade is placed the only reason to leave it is your pre-defined levels. All the work of the WHY you got into that position is done prior to the trading day when you are building your system.

It is definitely a hard environment to trade as there’s not sustained momentum as once was. It is no excuse to allow your portfolio to be destroyed by 80% drawdowns of course. For that you are better off just investing in the S&P500, at least there you’ll rarely experience 80% drawdowns. A traders job is to produce more returns than average buy and holding, but also to reduce drawdowns. If you can’t reduce the drawdowns that the asset which you are trading produces, you are not doing a better job than just buy and hold.

What does a trader need in a trading system?

Entry level

Stop level

Take Profit or Trail level

Position Sizing

Portfolio Exposure Analysis

Your trading is your business and you need to make your business profitable. If your business is not profitable then why do you keep doing the same thing over and over again?