Traders' Tales #1 - 155% Annual Return Trading Stocks: Mark Minervini

Series on systematic and discretionary trading strategies

Hey there, Pedma here! Welcome to this free edition of Pedma’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Introduction

Hey everyone, Pedma here!

I hope that everyone had a fantastic week.

We had some increased volatility last week in crypto land, but nothing that we aren’t used to handle.

Today I am starting a new series called Traders' Tales.

This newsletter is growing and I want provide more value to a broader audience of traders and investors.

In short articles, I will be reviewing tales from traders that have some sort of a track record.

Regardless of their trading style.

I spend a lot of time on trading related content, and I regularly find very interesting traders.

They might not necessarily be systematic, but they’ve achieved some unique results.

The purpose of these articles is to be less intense on the research process.

If you have 1 minute to spare, I’d really appreciate your review on today’s article.

Your opinion is how I guide the content of this newsletter.

I won’t bore you with more details, so let’s get into today’s article!

Index

Introduction

Index

Who is Mark Minervini?

Strategy and Philosophy

Risk Management

Final Thoughts

Sponsor Of Today’s Article

Who is Mark Minervini?

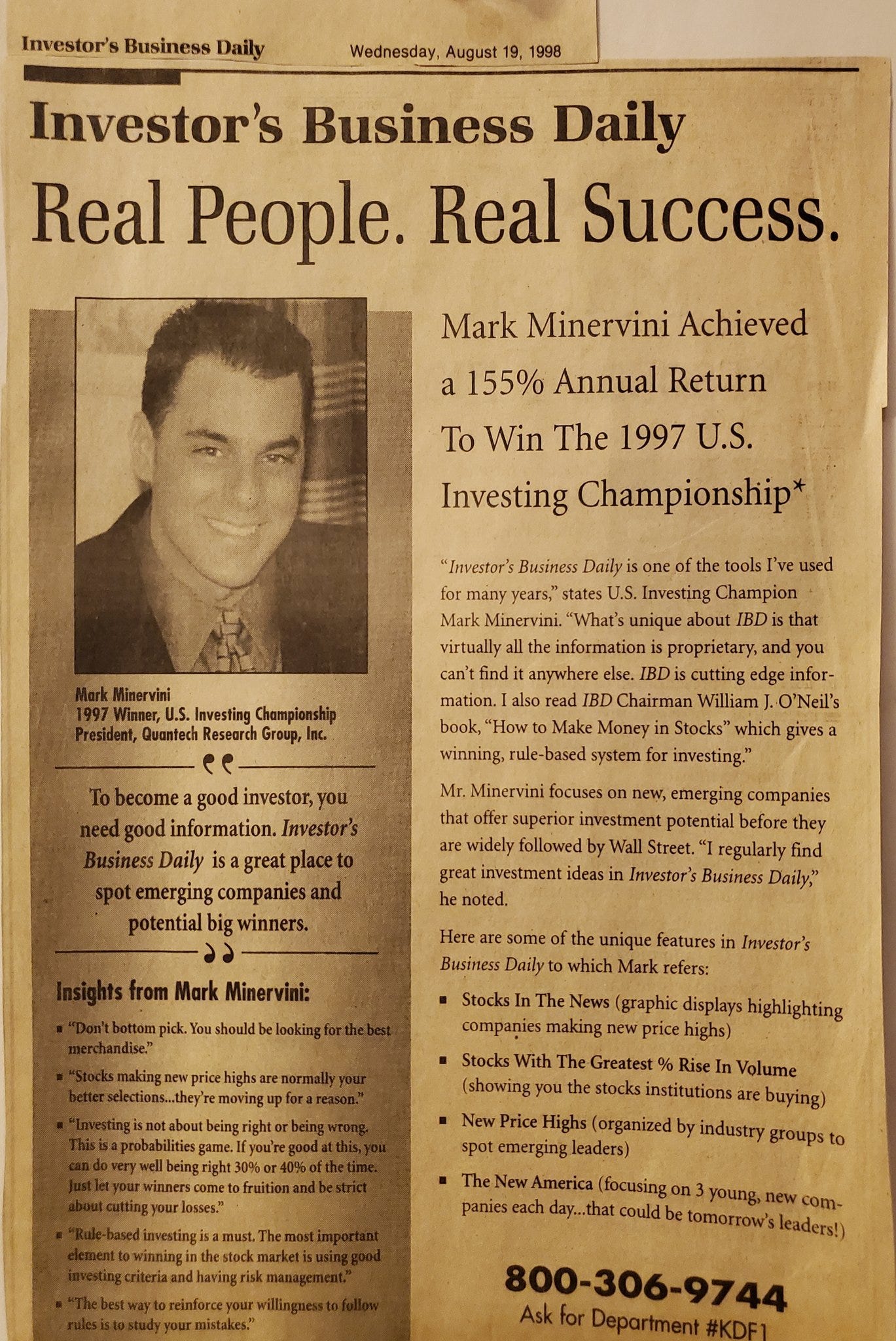

Mark Minervini is very well known in the trading world.

From 1994-2000 Minervinin achieved a 220% return per year.

That’s 6 years of impressive performance.

This feat set him apart from other traders and to this day he has a solid reputation in the trading world.

His story became quite famous in 1997 when he won the U.S. Investment Championship with a 155% annual return.

His story didn’t end there.

In 2021, once again, he won the U.S. Investing Championship with a record annual return of 334.8%.

Today we are going to look into one of his strategies from his books, and his trading philosophy.

Strategy and Philosophy

Mark believes in mixing the technical side of trading with the fundamental side.

He’s not only looking at chart patterns, but also at the fundamentals of why stocks move.

He wants all the stars to line up.

Price

Volume

Fundamentals

There’s a methodology that he talks about, the Specific Entry Point Analysis (SEPA).

It’s a framework designed to identify optimal entry points in stocks.

SEPA can be characterized with five key elements:

Price must be in an uptrend, showing strength

Earnings, revenues, and margins must show improvement. This helps giving more weight to the position since the company is “healthier” than others.

A catalyst must be present to justify the stock’s trend.

The entry point must be at a low-risk base to minimize potential losses

Exit strategies are based on stop losses, ensuring the protection against market volatility.

Stages of Growth: Knowing When to Enter and Exit

Mark characterized the market in these stages of growth:

Stage 1 (Neglect or Consolidation): Characterized by price oscillation around the 200-day simple moving average (SMA) and stagnant or lower volume.

Stage 2 (Advancing Phase or Accumulation): Identified by increasing volume on rallies, price above the 200SMA, and a clear uptrend.

Stage 3 (Topping Phase or Distribution): Marked by price falling below the 200SMA, significant weekly declines, and increased volume.

Stage 4 (Declining Phase or Capitulation): Defined by a series of lower lows and highs, indicating a clear downtrend.

He only accumulates positions during the stage 2 of the market, which he refers to, as the growth phase.

He then identified “pivot points” as the ideal buy signals.

These pivot points are identified with the cup-and-handle pattern.

The cup and handle is a technical pattern that is shaped, as the name refers to, a cup and then a handle.

It’s a visual representation of a new trend emerging out of a consolidation phase.

The picture above represents it.

Risk Management

The overall idea that I get from Mark is about risk mitigation.

He emphasizes that the stop loss shouldn’t be more than 10% from the entry point.

The average loss, long-term, should be around 6%-7%.

Now, this is not the loss on the portfolio.

This is the maximum distance from entry, to your stop-loss.

You can still adjust how much of the account you want to allocate to a specific trade, given the width of the stop loss.

If it becomes too wide, the risk is a lot higher so positioning should decrease.

Once in a trade, and as the stock trends, Mark trails the position to ensure he locks in a profit.

Mark uses a rule that if the total return is already above 1x or 2x of what was initially risked, he raises his stop loss to a price that, if invalidated, it breaches the 200SMA but still gives a profit.

This way he ensures that no winner turns into a loser and that when he exits, the trend has changed.

How many stocks to hold at any given time?

Mark suggests typically having 4-6 stocks and for larger portfolios up to 10-12.

This provides sufficient diversification but not too much.

He says that super performance normally isn’t achieved by a overly-diversified portfolio.

Final Thoughts

Mark’s achievements are quite impressive, no one can deny it.

He also trades in a similar fashion to the way I trade.

He aims to take advantage of momentum, in a strong market, and in the strongest of assets.

The way he picks his positions might be discretionary, in the sense that people can define a “cup and handle” differently.

However at the core of his ideas is something fundamental about risk and positioning.

He talks a lot about how much to risk on each position, and risk at the portfolio level.

After that, he lets the market takes care of the winners.

I did enjoy reading his story and it shows how simple systems can outperform, when you base them on something fundamental about markets.

Sponsor Of Today’s Article

A billionaire told us the holy grail of trading:

Uncorrelated strategies.

But for 99% of us don't have access to quant teams or researchers to help us test and find them.

That's where QEDium comes in.

It's a small Quant team founded by @GoshawkTrades providing:

26 strategy research papers released bi-weekly crafted by @GoshawkTrades and other fellow quants (I will be featured as well).

A mixture of stock, futures, and crypto to diversify between markets.

Live calls every month for interactive discussion, brainstorming, and Q-As.

Feedback on strategies you and other members have. • Access a network of fellow traders with a variety of backgrounds.

A breakdown of common backtesting practices and insights into effective research methods.

The coding libraries/tools we are using.

Fill out this 1 minute form to potentially get access (limited spot). https://forms.gle/XDMfAXBSAJqQ2QZn6

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.

![Cup with Handle [ChartSchool] Cup with Handle [ChartSchool]](https://substackcdn.com/image/fetch/$s_!jSTc!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5851c3f3-24e7-4343-9084-d9056956217e_515x400.png)