Research Article #38 - Crypto Moving Average Crossover Strategy

Testing a simple moving average crossover on a multi-asset portfolio in crypto

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

Join over 5K+ readers of the newsletter!

I try not to hold very strong opinions on anything related to the markets.

To be honest, I try not to hold strong opinions on anything.

I am decisive on what I believe and stay away from what I don’t.

But I am always willing to change given a new set of facts.

One of my core beliefs is that simple systems tend to be more robust over the long-term.

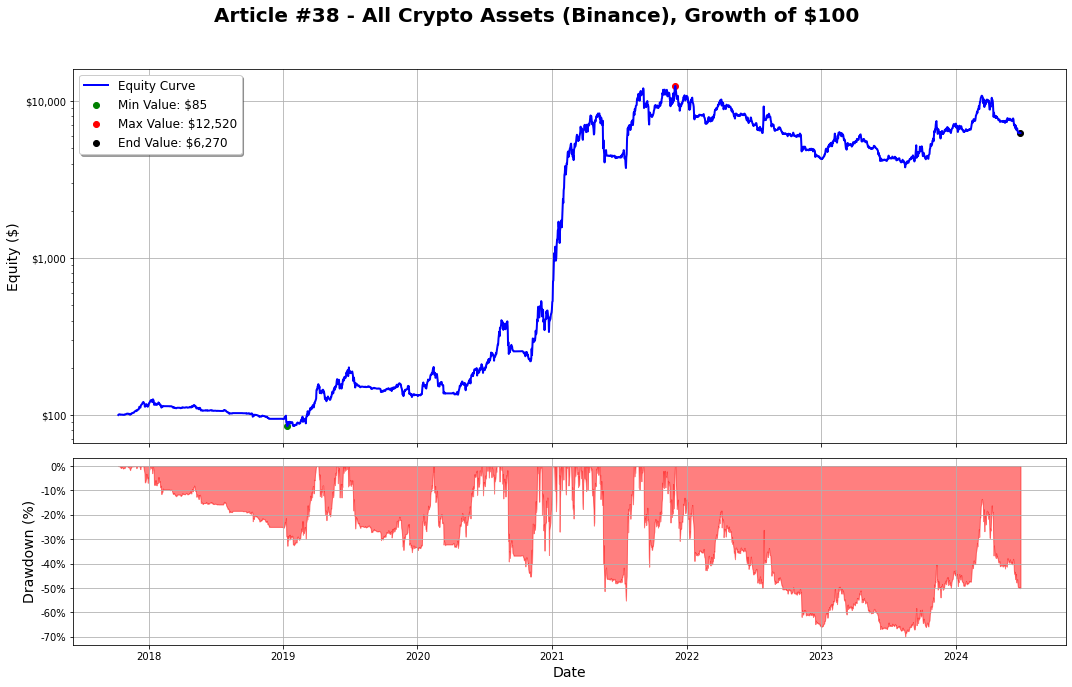

Consider the performance of the system we will be covering today.

As the title mentions it is a simple moving average crossover system.

The only core assumption of this model is that trends will emerge somewhere in the future and they will cover for our losses during worse periods.

And we try to get some exposure to that positive skew by opening positions when average prices display some positive inclination.

That’s it.

The assumptions, the rules, the whole model is based on an unique idea of what we want to extract from the market.

Here’s the best % return trade of the model:

Now, here’s a few important notes from this project:

Today’s article is an initial study of a possible trading strategy. On the next article we will be going deeper into drawdown and volatility reduction by incorporating some volatility targeting rules, adding short positions, we’ll study the effect of adding stop losses, testing of different signal lengths, and some robustness techniques we’ve measured in the past.

This backtesting infrastructure will be evolving as we go, as we add more features to the code, so that it is streamlined for future strategy’s development.

Let’s get into today’s article!

Index

Introduction

Index

Strategy’s Thesis

Parameter Settings Overview

Strategy’s Performance and Results

Conclusion

Python Code Section