Research Article #27 - Bitcoin Sell-In-May Phenomenon

Is the anomaly also present in cryptocurrencies?

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter.

It is extremely time-consuming to find viable trading strategies. The average finance research paper spans 11,800 words and is 25 pages long.

In this series, I share trading strategies researched by us. I include their full Python code and performance in a short, simple-to-read article.

My mission is for you, the reader, to have access to a library of researched trading strategies. We cut through the academic complexities and focus on practical application.

Join over 800+ readers of the newsletter!

Introduction

There’s this saying in traditional markets…

“Sell in May and go away”

Today, we will analyze if this pattern also appears in the crypto market.

Some patterns are specific to the asset class and they don't apply to other asset classes.

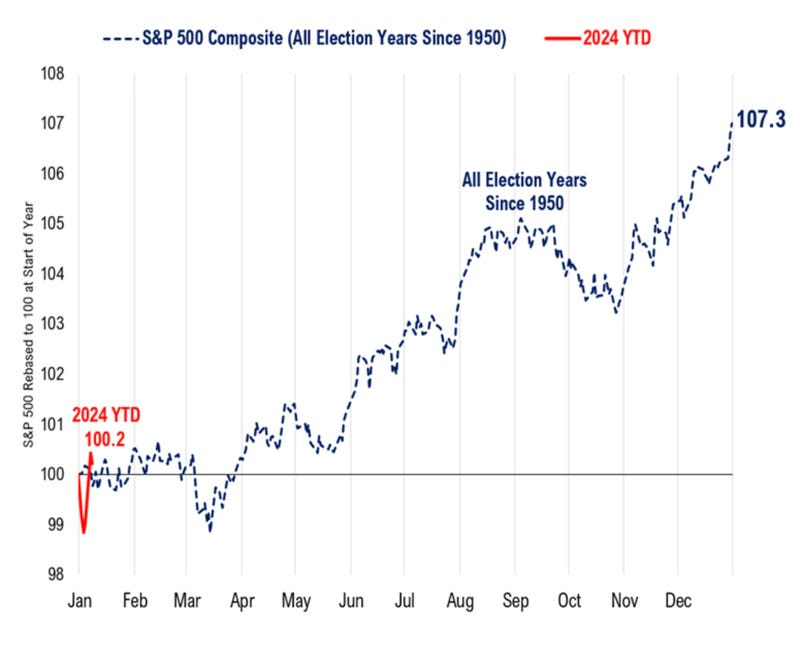

An example that comes to mind is the impact of election years on equities prices.

There’s a positive bias during these years.

We could get into the factors of why this happens, but it misses the point of this article.

All we need to know is that they exist, for whatever reason.

Source of today’s study: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=643583

Let’s investigate the “Sell in May and Go Away” idea applied to the cryptocurrencies market below.

Index

Introduction

Index

Thesis for the Strategy

Strategy Parameters

Strategy Performance and Results

Python Code Section

Sponsor Of Today’s Article

Thesis for the Strategy

On average stocks deliver close to zero returns in the 6-month period from May through October.

The hypothesis is that this seasonal pattern is caused by an optimism cycle.

Towards the end of the year, investors start to look towards the new year with overly optimistic expectations.

This in turn results in attractive returns for stocks.

However this is just speculation on the reason for this anomaly.

We tend to seek to understand the fundamental reason behind some idea.

Most of the times, the truth is, that the true reasons are not so obvious.