Pedma's Portfolio Management Journal - 01/18/2024

Personal Portfolio Management Journal

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, in this series, I share my personal trading experiences and journey, offering you the behind the scenes into how I manage my own portfolios, my trading performance, new research for trading strategies and general content aimed at helping traders with the experience I’ve accumulated for the past 6 years.

My mission is full transparency by building a public track record of my performance. As I navigate through the markets, I'll be sharing every step of the journey – the ups, the downs, and everything in between. It's not just about trading; it's about growing together as a community.

Introduction

Hey everyone!

The crypto market continues showing weakness today. We’ve seen a slow down in recent behavior from what we were used to in previous months and that is reflected all across the board.

With our momentum models triggering negative momentum, we can’t expect much from these times and we just have to go through them. The problem with most traders is that they use these times as excuses so mess with their systems or completely change them and that is not a good long-term decision.

We want to stay focused on the mission and that is to keep taking every signal we get and sticking with the trend. If there’s no trend, we hold to the positions we have, exit positions that are weak, and maintain a solid management of risk. There’s no reward without risk and bad times will always be there, perhaps even most of the time, and we need to handle them appropriately.

Let’s get into today’s report!

Pedma

Today’s Market Journal Content

General Market Analysis

Momentum Scans

Seasonality Analysis

Strongest Coins this Week

General Thoughts

Internal Market Analysis

Personalized Momentum Scans

How Does Momentum Link with My Current Performance

List of Coins I am Looking to Add to the Portfolio

Personal Portfolio Performance

Binance Performance Dashboard

Deconstructing Trading Ideas I Find Online for Research

Thoughts on Recent General Market Behavior

The altcoin market has been in this weird range for a few weeks now. Considering this I can’t expect much change in my portfolio because my returns are generated in times where the market is directionally strong as we’ve experienced the past few months.

But this is why we are here, to manage risk, and to be exposed to a market where the returns can be way above what’s offered by traditional markets. We need to remain focused and keep going forward. I have experienced far worse and lengthy drawdowns, this is nothing, but I know for newer or less experienced traders this can be quite challenging as it was for me back then.

You need to understand that this is the nature of markets, the ebb and flow, from weakness to strength, and that’s how things are. You can’t expect a consistent stream of returns every week, month or sometimes even year. Depending on the depth of a bear market, it will be times where you won’t be able to make money within a year. This is fine and expected, you need to embrace it and know that the possibility is there despite being quite rare. The question is, how do you manage risk during those times? Can you survive to be present for a possible next cycle? Those are the important questions because you need to survive to continue to play the game.

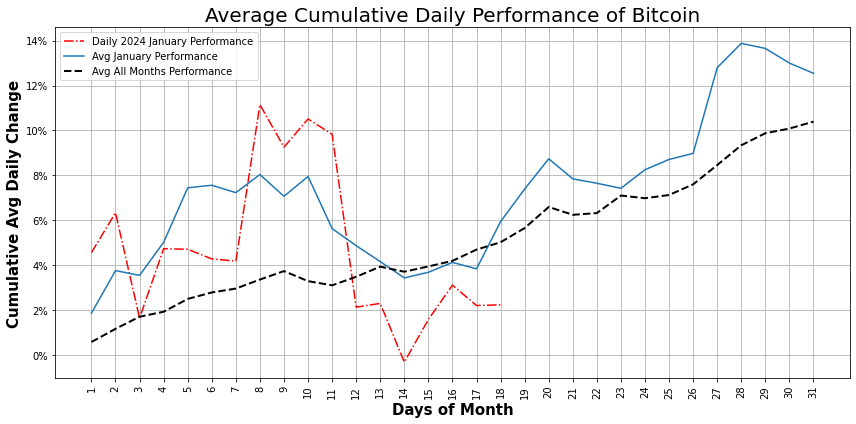

If we look at the seasonality of BTC in January we can see that we’re trending a bit lower than average even though the path quite resembles what has been the historical average. We’re entering now an historically strong period for January, let’s see how it plays out until the end of the month.

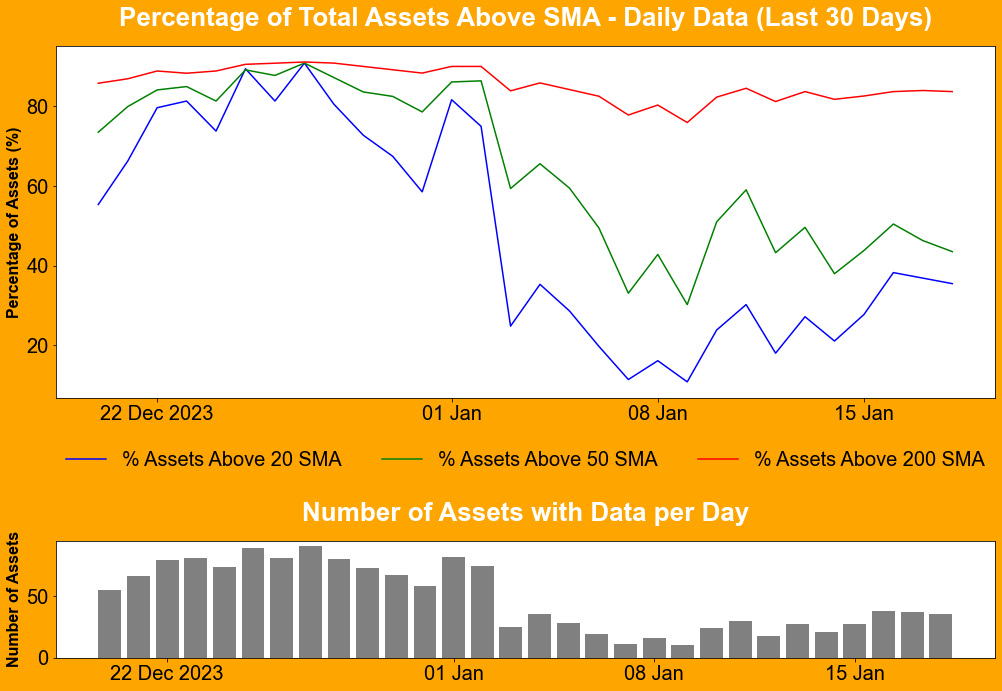

The percentage of coins above their short-term moving averages have declined quite aggressively from that 90% peak around late December. While the percentage of coins above their long-term (200) moving average remain rather stable around the 85%-90% figure, which is a good indication of short-term weakness but long-term uptrend.

Strongest Coins for the Past Week

Above are some of the strongest charts this week. I am already positioned in a few of those as we’ll see in my portfolio analysis below. These are the coins that have been the strongest for the past week and that continue to show some relative strength to the market they’re in.