Pedma's Portfolio Management Journal - 04/28/2024

Portfolio management, market scans, and more

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, I release a new research article with a trading strategy, its code, and much more.

Join over 4K+ readers of the newsletter!

First, I’d like to start by apologizing for the delay in sending this week’s newsletter. I went on a short vacation to Germany, got quite sick, and for the past few days, I’ve spent most of my time in bed.

In any case, we’re back and let’s get going with today’s article.

I’ve really enjoyed writing last week’s update on my portfolio and you also seem to have enjoyed it. So let’s do one of these a week, at least. This way I can share with you my thoughts on the market, on my portfolio and add some insights I found interesting during the week.

Bitcoin has been in this weird range between 74k and 59k for the past 42 days, which is a considerable period.

If you trade trend or momentum, like I do, most likely you’ve been in a drawdown ever since the top in early March. That is normal due to the nature of our systems. We are paid to take on directional risk. When directionality is against us or inexistent, there isn’t much we can do to make money in such a market right?

Over the years I’ve learned to look at performance from a zoomed out perspective.

Imagine that you have a restaurant by the beach. You make tons of money during the summer during tourist season. Would you be mad about losing money when the winter comes along, and your number of customers start to decline? No. You understand that your business is seasonal.

Our business, as trend-followers or momentum traders, is also seasonal. There’s nothing you can do to change that. Sure you can add more markets to your model, but regimes will always be there and there will be months and even years where you’ll lose money. This is a hard game and not everyone can do it.

The higher the sharpe of your portfolio, the smaller the drawdowns. The thing is that, high sharpe scales with competition too. Everyone wants the shiny, low drawdown, low volatility strategies. It’s human nature to seek the best shiniest objects (in this case trading systems). So you will have a lot of competition on those.

I personally can’t compete on speed due to my lack of IT skills. So I have two options:

Trade less competitive strategies with lower edge

Hire a team of engineers to compete at those “shinier” strategies

Option number 1 is the most straightforward and one that we can all follow. We accept the risks of our exposure and move on. We know that we will go through deep and lengthy drawdowns and that expecting a monthly paycheck is naive.

Option number 2 is for the future, when you can fund your own firm, if that’s the path you want to follow. That is something that I have in my own plans for the future, but still a long way to go.

Whatever you do, just understand the underlying assumptions and risks of your decisions, accept them, and move on. If you don’t truly accept the risks you’re taking, it will be very hard to be profitable in this business in the long-term.

Now, let’s get into today’s article.

Index

Introduction

Index

Weekly Top Quantitative Trading Content

Crypto Market Report

Personal Portfolio Performance

Weekly Top Quantitative Trading Content

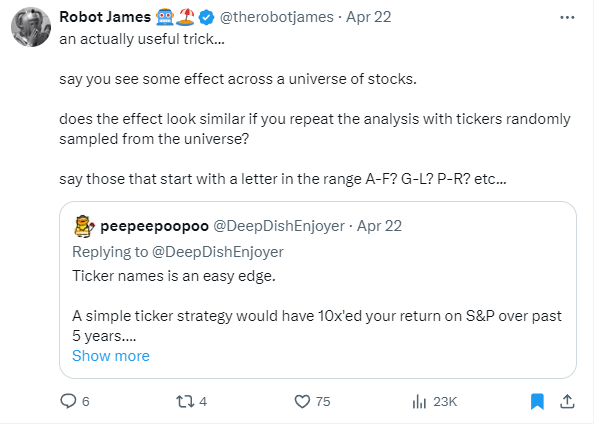

Robot James critiques a common fallacy amongst traders that try to look for edge. Let’s start by what he claims to be a wrong approach to find edge:

Assuming the market is full of inefficiencies that can be easily exploited.

Trying a bunch of random trading rules without a solid rationale.

Finding something that seemed successful in the past and assuming it will continue to work in the future.

Believing that trading is easy.

When you run a simulation with trading rules that you can’t explain, you’re basically saying that these “inefficiencies”, that you’re trying to find, can be easily found in the data.

This is a bad assumption to make because everyone is looking for the same thing, and everyone has access to the same information as you have. If you truly have an edge in the market, do you think it’s widely available to everyone or easy to extract?

There’s far more sophisticated players, with far better computing process trying to find inefficiencies all day, every day, at capacity. You think you’re going to beat them in highly liquid markets?

You need to be a bit more creative in order to find something that works for you, and that you can exploit.

Here’s a few ideas:

Taking risks that others can’t/won’t

Trading low edge strategies

Operating in lower capacity markets

It’s all about doing things that are useful to markets, that these larger funds might neglect because it isn’t worth the human capital to find them or trade them.

Then you might find your own edge. Assuming that you can run a machine learning model, to find edge in 5-minute data in the S&P500, is just naive and you will soon find out that, it can’t be applied outside a simulation.