Hey there, Pedma here! Welcome to this free edition of Pedma’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this month so far:

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Introduction

Hey everyone, Pedma here!

I hope that you’re having a fantastic week, I know that the market has been pretty weak, but there’s things more important than just performance.

Today’s performance article is open to all free subscribers. I want to show you a sample of what we talk about every week on these shorter articles.

These take me 1-2hours to write, that’s why I’ve decided to make these reviews available only for premium subscribers.

I am constantly thinking about how I can provide you, the reader, with the most amount of value as possible in these newsletters.

Writing is new to me, I am a trader and researcher, not a writer. But as with every task that I take on, I want to give it my all.

I know that people really like the weekly articles I do on research, and those take more time, so that’s why I do them once every Sunday.

However these reports every two days, are more spontaneous, directed to show you the behind the scenes of a trader that does this for a living.

I’d love to hear your input on what you like most about these articles, how I can improve them, and what would give you the most value for your own trading career.

If you can leave a comment I’d really appreciate it!

Another thing, I’ve decided to push the portfolio performance section up, as it seems to be the portion of the article people are more interested on.

Just wanted to let you know so that if you see difference in the structural aspect of the email, it’s due to that.

Let’s get on with today’s article!

Pedma

Index

Introduction

Index

“Tldr” (Too Long; Didn’t Read)

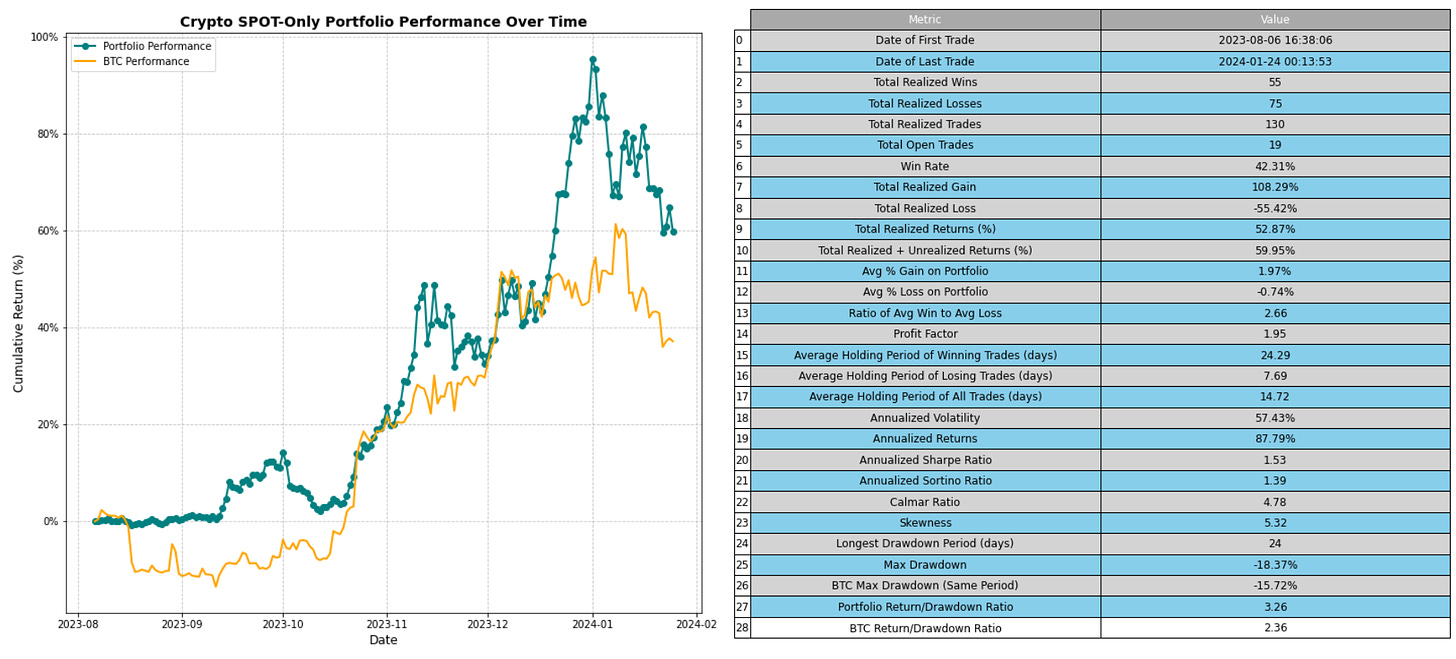

Personal Portfolio Performance

Crypto Market Report

Trading Tip of Today

“Tldr” (Too Long; Didn’t Read)

Portfolio till in drawdown.

Market shows sustained weakness once again today.

21 days in sustained weakness, every day it becomes less likely to continue.

Having a systematic approach to deal with drawdowns.

Practical application of your craft is key for success. Theories get you nowhere outside of academics.

Personal Portfolio Performance

We’re still in a drawdown and things haven’t changed much.

Yesterday I did notice some slowing down of the negative momentum trend, but we’re back in weakness land as I am writing this article.

We all know the stories of those people that make it big in the industry.

But we never stop to realize why.

Most of them have been in this game for many years.

Went through massive bear markets, desperate conditions, worst than we’ve ever had.

Imagine being a Bitcoin adopter back in 2015, or 2013. How much conviction did you have to have to continue betting on the industry?

Yet they did. They kept at it and they were rewarded.

This is what every trader goes through.

There will be days you feel like you want to quit, you can’t see the light at the end of the tunnel.

That feeling is what should motivate you to keep going. If you want to quit, so do many others.

The winners kept at it, regardless of how they felt.

Have a proven system, with solid fundamentals, and stay in the game.

This is a game of survival and not one for the faint of heart.

Crypto Market Report

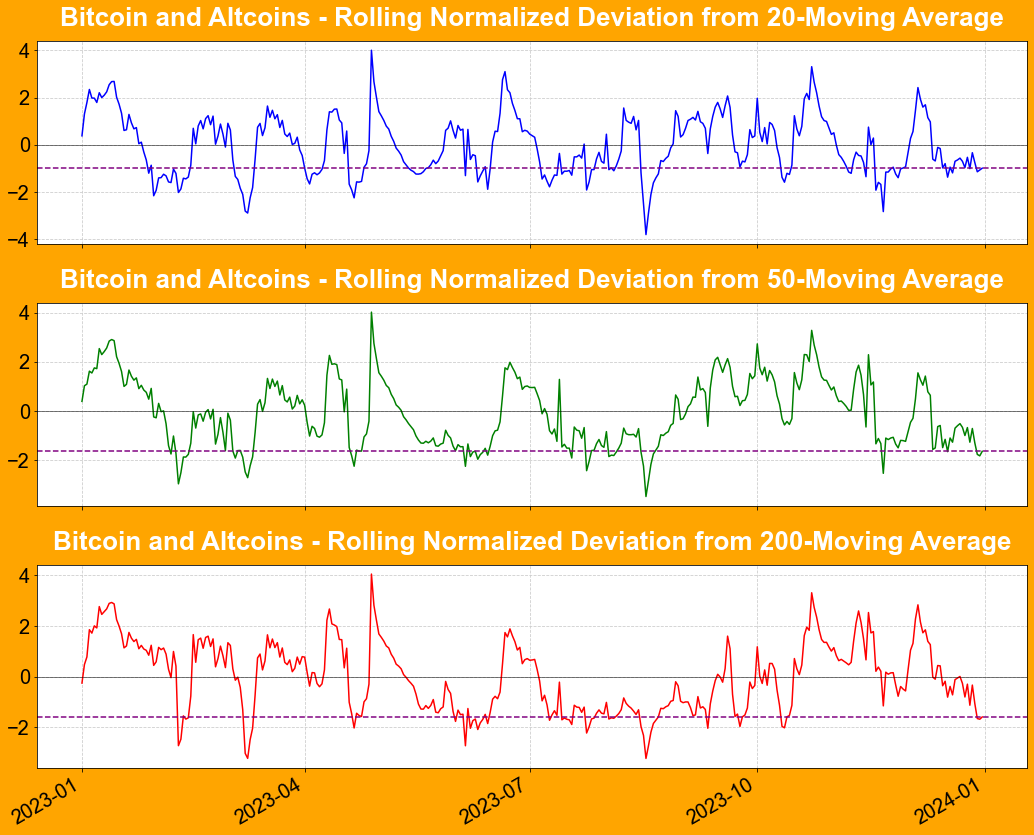

The market did catch a bid the past few days, but it’s still very weak and nothing of significance came out of it.

I personally don’t like to see weak bottoming action.

I want to see something volatile that really shakes off the weaker players off the table.

This type of weak, slow action, typically seems to lead to nothing significant.

We want to see bursts of strength on one direction, followed by the opposite force to get more conviction on a side.

Think of it from the perspective of a seller on an orange store.

You are not selling any oranges for the past few days.

So you decide to do a 50% discount.

The next day you go to the store and there’s a marginal increase in sales.

What does that show you?

That people are not interested in buying your orange at the price you set yet.

Might have nothing to do with price, but that’s the reality.

So you make another discount of another 50%.

Next day your store is filled.

Now you know where people are happy to buy your product.

Similar situation with trading.

We need to find strong action where people will be happy to buy the asset.

It’s not it… at least yet.

Momentum is like a rubber band.

You can stretch it and stretch it, and eventually it gives in.

We’ve been stretching sustained weakness for quite a while and it will eventually give in.

The market doesn’t tend to stay at -2 standard deviations of deviation from average pricing for too long.

Like I always say, it doesn’t mean it will revert.

It just means it should at least pause soon.

Today we’re in 21 days of sustained negative momentum.

That’s a pretty long period too.

You can see that the more we go to the right side of the distribution, the less occurrences there is.

It’s normal as these deviations occur to be more rare for something to persist forever.

Just another data point for our thesis.

Looking at the current leg of negative momentum.

We can see that we’re way above average.

We’re also at the point of that mini decline we had in August last year, where I also experienced a decent drawdown.

Things are getting pretty extended.

We just need to eat through the drawdown and keep moving forward.

There’s no guarantees of recovery, but that’s the bet we are willing to make.

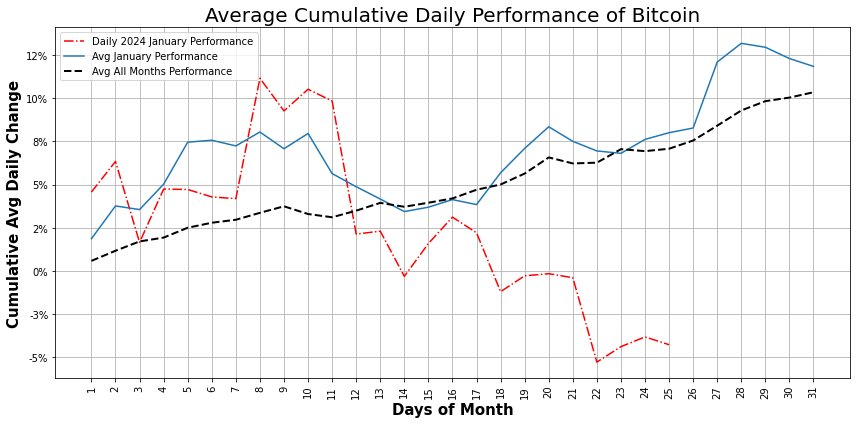

Looking at it seasonally.

Still a pretty weak month compared to historical average.

Nothing changed here.

Trading Tip of Today

The best research you can do is through the practical application of your craft

In the markets a lot of less experienced researchers have the tendency to go directly at the data to find patterns to exploit.

The problem with this approach is that everyone has access to the same information as you.

Think about this, if everyone knows what you know, to whom are you going to sell your inventory at a disadvantage to that party?

Who’s going to buy something at worst price, having the same information as you do?

Certainly there’s certain ideas that can be taken from only looking at the data, like calendar stuff, price persistence, extensions, etc.

However, in my opinion, the real work comes from going into the pits of the market and observing what’s going on, interacting with other market participants, see where you can add value.

The data will only take you so far. It is like opening a store and expecting the business to succeed merely by projections and data.

Even though that is a good thing to have, we must keep in mind what they are… Mere numbers.

It is the practical application of your craft that will give you more feedback about what you’re doing and if that makes sense.

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.