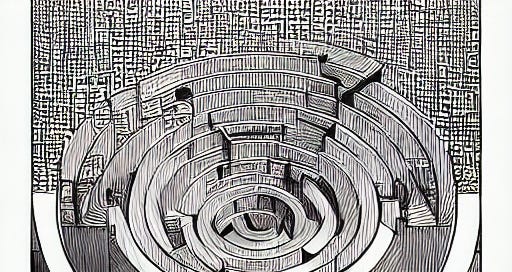

Navigating the Market Maze: Understanding Directional Edges in Trading

Unraveling the complexities of directional trading models, edge decay, and the quest for system robustness.

Introduction: A Foray into Directional Trading

The dynamic world of trading is a vast universe filled with various strategies and models. Today, we shall journey through the realm of directional trading models, deciphering their nature, and exploring their inherent complexities. Bear in mind, this is not an absolute gospel but rather a humble effort to shed light on these intricate models.

1. The Essence of Directional Trading Models

At the core, a directional trading model is one that willingly embraces directional risk exposure. You might find yourself purchasing an asset, firmly anticipating its growth in the near future. These systems starkly contrast with arbitrage models, where you are usually immune from directional risk and instead capitalize on immediate opportunities.

In directional trading, you're essentially banking on your current bet's potential to influence market movement, hoping it will lead to a price surge or plunge. You also rely on this influence remaining constant for future bets. Herein, you're positing that your chosen signal will consistently trigger a market response superior to random fluctuation, nudging it towards your favored direction.

2. The Dual Assumptions: Persistence and Continuity

Delving into this further, we identify two foundational assumptions in play:

The directional persistence post-position entry

The sustained trigger of price movement by the signal

The first assumption is fairly straightforward, yet the intricacies lie within the second. Why should this signal continually instigate price movement that favors your bet? To fathom if we retain an edge, we need to consistently measure the potency of the signal. This should serve as a starting point to track potential edge decay and evaluate the signal's efficacy post-position.

3. Signal Strength and Equity Curve

Could we merely determine the signal's strength by scrutinizing our equity curve? Maybe, given that a more potent signal should translate into a more consistent equity curve. Thus, tracking recent performance against past outcomes serves as a useful tool to detect any significant performance dips, potentially signaling edge decay.

4. Exploiting Market Dynamics

If we probe further, considering what we're truly capitalizing on, we realize we're attempting to exploit knowledge that current market events will trigger further aggressive volume inflow in line with our bet. It's a bold presumption to sustain over lengthy periods. Markets are perpetually evolving and traders constantly shifting their stance. How can we expect this signal to continually yield the same aggressive volume influx it did previously? This fundamental question underscores why directional systems often succumb to overfit as traders search for an elusive 'perfect' signal that, in reality, is typically weak.

5. A Survivalist Approach to Trading Systems

This very conundrum leads me to adopt a 'survivalist' approach when designing trading systems. Instead of trying to validate the system, I endeavor to break it. If the system truly captures the signal and not mere noise, it should withstand the rigorous tests I impose. Consider this: would your system crumble with a 5% win rate reduction? How would it fare with increased slippage, or if you entered a couple of bars later?

If the strategy crumbles under minor deviations, it may lack the much-needed robustness. Although High-Frequency Trading (HFT) strategies are markedly more susceptible to such deviations, we exclude those from this discussion.

6. The Pursuit of Robustness

When crafting trading systems, I urge you to prioritize robustness and relegate performance to a secondary role. Remember, in the tumultuous tides of the trading sea, it is not the biggest or the fastest ship that survives, but the one that adapts to the changing winds and currents.