Navigating the Market: A Dynamic Approach to Investment Strategies

Unveiling the Process of Broadening Portfolio Exposure for Efficient Detection of Market Fluctuations

Section 1: An Evolving Investment Strategy

In my quest to optimize my portfolio, one of my principal pursuits has been enhancing market exposure. Why is this significant? The crux of this move lies in the desire for rapid identification of systems that either lose their edge or fail entirely due to overfitting or similar factors.

Section 2: Portfolio Composition - Balancing Momentum and Mean Reversion

At present, my portfolio comprises three strategies. However, plans are in motion to incorporate three additional ones before the day ends. To give you a clearer picture, three of the existing strategies revolve around momentum, while the new inclusions will primarily focus on mean reversion.

One might wonder why I have chosen different types of strategies. The answer is simple: to lower the correlation of outcomes among these strategies.

Section 3: Exposure and Effectiveness - A Risk Worth Taking?

By diversifying my strategies, I have increased my market exposure to roughly 55% of the time - a move that is fairly suitable for my long-only portfolio. Although some quants propose that less exposure is ideal, I tend to lean towards the opposite. The less active your trading is, the longer it takes to detect when your systems cease to function optimally.

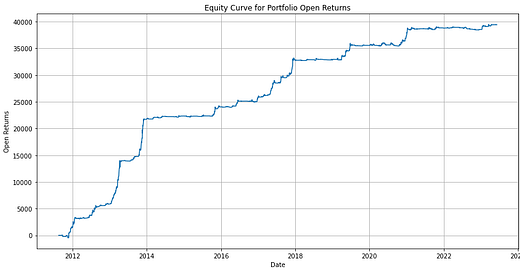

Let me be clear: this is still a work in progress. I don't claim to know it all, but it strikes me as logical that the more frequently a strategy is tested, the quicker its effectiveness (or lack thereof) can be identified. So, how can we verify this hypothesis? We apply it, which is precisely what I'm doing. The results will be shared live in due course.

Section 4: Strategy Performance - A Focus on Robustness

The performance of each strategy appears fairly commendable, and my confidence is bolstered by the rigorous stress-testing each strategy has undergone. While success isn't guaranteed, the likelihood of survival certainly seems higher.

A casual glance at my strategies might lead some to point out, "But some don't have a Sharpe ratio greater than 1." Indeed, that's correct, but a high Sharpe ratio isn't the beacon I'm steering towards. My specific interest lies in robust, sub-optimal strategies that fly under the radar, lessening the likelihood of their discovery and potential arbitration.

Section 5: The Low Hanging Fruit - Simplicity as a Strength

The fundamental truth in any profit-yielding edge is that you're bound to face competition. Minimizing this competition inevitably results in a larger share of the pie for you. While I believe I could take on funds or highly skilled quants, my goal isn't to vie with them. Rather, I'm interested in plucking the "low hanging fruit" - that's why I prioritize robustness over sheer performance.

Instead of focusing on maximizing the optimization of a signal, I question its longevity. In my opinion, excessive optimization often leads to overfits and similar pitfalls that I intend to sidestep.

I avoid the allure of the "shiny" edges. The ones I seek are those that most investors would dismiss without a second glance. These are the simple, enduring strategies built to withstand market fluctuations.

Section 6: Keeping You Informed

I am committed to keeping you updated on the performance of my algorithms. Your understanding of my investment philosophy and strategies is as important to me as the strategies themselves. Together, we can navigate the ever-changing terrain of the market.