Massive volatility in markets.

Surviving through market volatility

Markets are going crazy today, following the concerns around the YEN carry trade, negative unemployment numbers and manufacturing numbers.

I was writing today’s article on a volatility effect, but had to stop to write this email.

The VIX is at levels that have not been seen since 2020.

The S&P is opening almost 5% below than yesterday’s closing price.

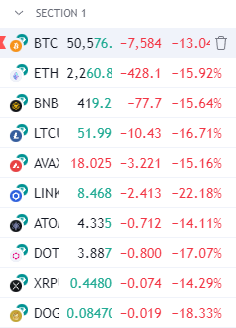

I don’t even need to say anything about crypto right?

The total crypto market, excluding BTC and ETH (which are doing terribly also), is down 40% from all time highs.

A lot of traders and investors are seeing their hard earned gains from the previous year, dissipate in front of their eyes.

If you’ve been reading my articles, you know that I don’t shy away from showing my performance, both good and bad.

This is my portfolio, adjusted to monthly returns, already factoring in today’s data.

I’ve been mostly cash for the past few weeks/months.

The large contributing factor to why traders destroy their portfolios, is lack of a robust approach to their trading.

I was reading this story that really resonated with today’s email:

“Lost it all leverage trading -200k, only 20k left (Age 24)”

How does one justify to themselves losing -200k, when their total net worth is around 220k?

Here’s the list of reasons, that he claims, for why he had such large losses:

Had a bunch of early successful leverage trades

Using 60x leverage

The more he earned the higher risks he took

A single good trade would make back all losses

Claims he had a 80% success rate (highly unlikely)

Holding trades through massive losses in the hopes of reaching breakeven

On top of this, he got laid off from his job.

Some of the reasons are actually fair, and I think they were large contributors to his failure.

But they all stem from one single factor…

A lack of a systematic approach.

A systematic trader doesn’t use leverage he knows he can’t afford long-term.

A systematic trader doesn’t take higher risks because of recent wins.

A systematic trader doesn’t use future wins as justification for taking larger losses

A systematic trader doesn’t put too much weight on win rate as a factor to the risk he takes

A systematic trader doesn’t hold through massive losses if it’s not part of his models

We all read the stories from the amazing traders that turned a few thousand dollars, into millions, in a short span of time.

Those are the stories that we read, because those are the stories that are the most interesting to the general public.

Ask yourself.

Where are they now?

Where are all of those amazing traders right now?

Everyone can make money in a bull market. It’s easy, and simple. Anything you touch, in a strong sector, makes money.

The problem is, when the music stops, will you have a chair to sit on?

A robust and systematic way is what has saved me from a lot of pain during the years.

That is why I am such a strong proponent for that style of trading.

I know nothing else that works as efficiently.

To start trading systematically, the basic first few steps are:

Find a model that is reasonable and that has been quantified and used for many years or decades. Give it your own twist.

Define every single aspect of the model.

Entry

Exit

Stop Loss

Position Sizes

Backtest that model

Understand historical expectancy

It seems simple, but there’s way more that goes into it.

Once you have your own systematic model, you no longer feel the stress you once felt when volatility shocks happen again.

Because odds are, it has already happened in the past.

And if it didn’t, you know that you’ve built your model to survive tough regimes.

I’ve traded through the 2020 markets, when the entire global markets were crashing, and massive uncertainty was the norm.

I’ve traded through the 80%+ drawdowns of the crypto market during 2021-2022.

I am still here.

Is it because I am better than all of the other trades?

No!

I am just consistent in applying what I believe is the best bet any trader can make.

The markets will eventually come back to normality.

But never forget the tough times.

These are the times that we, that focus on surviving for the long-term, prepare for.

Be like a turtle.

Despite being slow to finish the race, they eventually do finish it…

To help you really speed up your learning curve, I’ve decided to open a few spots to one-on-one coaching, to share my knowledge and passion for trading, with you. I’ll show you exactly how you can go from unprofitable, to profitable trading, as I did.

If you’re an individual or enterprise, feel free to book a call:

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.