Market Journal - 12/25/23

Market Journal from an Active Crypto Trader

👋 Hey there, Pedma here! Welcome to the 🔒 exclusive subscriber edition 🔒 of Trading Research Hub’s Newsletter. Each week, in this series, I share my personal trading experiences and journey, offering you the behind the scenes into how I manage my own portfolios, my trading performance, new research for trading strategies and general content aimed at helping traders with the experience I’ve accumulated for the past 6 years.

My mission is full transparency by building a public track record of my performance. As I navigate through the markets, I'll be sharing every step of the journey – the ups, the downs, and everything in between. It's not just about trading; it's about growing together as a community.

Introduction

Every day I start the day by doing the most simple work and scanning the market to understand the current theme for the day.

Is it up?

Is it down?

What’s the sentiment on twitter?

This gives me a general idea of how the sentiment around the market. I don’t use that information directly on my trading, as it is systematic, but I do consider it an interesting part of my work. Going through twitter on a daily basis as allowed me to dodge the FTX fiasco when it started and many other situations. I am always monitoring news around platforms/protocols/assets which I am personally allocated to and if there’s some credible negative news I consider removing allocation right away. For trading it’s different, I don’t allow negative coverage to determine my positioning as that risk should already be imbedded in my allocation.

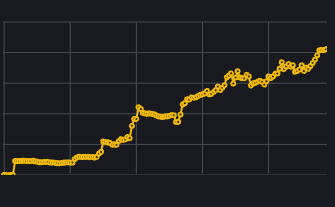

In terms of portfolio, it keeps steadily rising even though it has slowed down a over the last few days. I don’t expect much going into the holidays as those are naturally slower times but we’ll see happens.

One of the things I remind myself on a daily basis is that this performance is extraordinary and I don’t expect it to last forever. Trend and momentum trading is much harder over large periods of time than it has been for the past few months. A lot of new traders will be piling in into these systems because they are working right now but they do not understand the perseverance that will be required to go through the drawdowns I’ve went through. They really don’t understand the amount of pain that is required to go through to be where we are today. But that’s part of the learning curve and if they do indeed endure, and get out on the other side with their portfolios intact, than maybe, one day, they might make it.

New Articles

As we speak I am mostly done with a research article for the newsletter into an 8-figure swing trader. This is one of the most impressive traders I know and I’ll be sharing his strategy and the actual backtest applied in crypto for his system.

My goal with this newsletter is to provide you with unique content by not only sharing my own trading experiences but also on the research that I do. I already put almost 6 hours into this article mostly into coding of his system. I aim to have at least 1 research piece each week so that you can look at different strategies and be able to have a better understanding on what works and what doesn’t and perhaps in the future apply them to your own trading.