In-Depth Review of my 2023 Portfolio Performance

👋 Hey there, Pedma here! Welcome to this free edition of Pedma’s Newsletter. Each week, I'll share with you a blend of market research, personal trading experiences, and practical strategies, all aimed at making the world of systematic trading more relatable and accessible.

If you’re not a subscriber, here’s what you missed this month:

My non-traditional journey to become a profitable systematic trader

Crypto Portfolio Management: Degrossing - A Method to Deal with The Volatility Dragon

If you’re not yet a part of our community, subscribe to stay updated with these more of these posts, and to access all our content.

Introduction

I am very satisfied with the growth I’ve achieved in 2023, both financially and more importantly in terms of knowledge. We never know if the knowledge we acquire is useful or not, but to me, it definitely felt as progress. The year didn’t start as well as it ended despite the market being really strong. I still had a lot of issues in my assumptions and I had too many things going on at the same time in my life, which removed my focus away from what actually matters to me. Going into the mid of the year, it was choppy for most people in the space of crypto, a lot of fake outs, and the market didn’t seem to have great followthrough after that initial drive at the start of the year. Despite that, we closed the year very strong and looking bright for 2024.

I will get into all of this in detail in this article. My objective is to make it as real as possible, so that people can relate and also to show the ups and downs of this brutal, at times, yet intellectually stimulating business.

The Binance dashboards calculate differently the percentage returns from my own calculations. I was calculating my returns on the total capital I had allocated to crypto at any given time, and Binance calculates the returns on capital at Binance at any given time. And through 2023 I didn’t have all my capital at all times on Binance, so that makes the percentage returns different from my own dashboards, not that significant, but still I want to point that out. Also there has been some futures trades I’ve made, that I’ve included on my own consolidated dashboard, and that are not reflected on the spot performance.

Key Performance Statistics:

Total Trades: 109

Win Rate: 41%

Total Returns on Capital: 78.96%

Average Win to Average Loss Ratio: 3.59

Maximum Drawdown: -12%

Maximum Days in Drawdown: 33 days

Let’s now get into the detailed review of my year. I’ll write this review with the perspective that I’ll be reading it at the end of 2024, and evaluating where I was at today, versus where I’ll be at in one year from now. So I will keep it as real as possible because that’s what I want to read.

Brief Overview of 2022

To paint the picture of the start of 2023, I must briefly mention the events in 2022 that led us here. We were coming out of a massive declining market in the crypto sector.

(My 2022 performance review: link)

Bitcoin alone was down on that single year -65%, and the large majority of the other altcoins down over -85% and more. The sector looked really bad. If that was not enough, we had the FTX fiasco to close the year. Every piece of news around crypto was negative. Anyone that has gone through that time and survived, I believe is very well positioned to do great things in this space of trading. An incredible amount of perseverance was required to go through that.

In 2022 I had very limited exposure. I came from 2021 knowing that I’d need some filter for bad regimes so that I didn’t get exposed to them as a long-only directional trader at the time. It was a dumb filter, but it kept me out of trouble for the majority of the year.

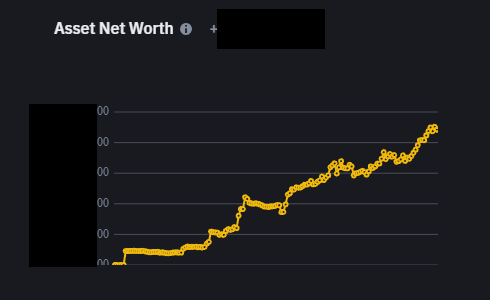

Above is my ledger wallet assets from 2022 up until now. The decline you see on the right side is me moving funds into the exchanges to deploy on my current system. Looking back, by luck or some degree of skill (doubtfully), I did preserve capital quite nicely and grew it to a considerable amount to me. The growth of that curve is not only due to returns directly from the market, is also services I was taking at the time in the crypto space and adding to my account. My ledger wallet was a consolidated place where I kept all of my crypto assets, while the market was uncertain, and nothing to be done to my style of trading. It was a hard year without a doubt, but we went through it and manage to survive.

The Start of the Year

Going into 2023 I was in capital preservation mode, but I did quickly adapt as things started to trend. I didn’t have a proper system yet at this time. I had a decent idea of a system, but I was still taking tons of risk I didn’t consider, and when the market turned, I eventually round tripped the gains once again. It was frustrating, I am not going to lie. Here’s a guy that spends so much time on research and validating his ideas, but when the market presents itself, he can’t properly take advantage of it yet. Why is that? Is it the market and I can’t avoid it? Or am I taking so much risk, so many signals, that the cuts to the portfolio are too profound to endure?

Everything looks great in a backtest, you see a massive spike in performance during strong regimes because you’re taking so much risk, that you forget about the months of drawdowns and think that you can get through them. The reality is that, going through those months with real hard earned money on the line, is not the same as looking at those months on a sheet of paper. Something had to change and I needed to get more serious about my trading business. I had to cut all distractions and focus on what mattered, my trading.

We did have a strong impulse at the start of the year, but it was rapidly erased going into the summer. Without the proper ideas about risk and frequency of signal, I was doomed to take too many cuts that led me to give back a large chunk of the gains. Something had to change.

I was all over the place testing new systems, new edges that I thought made sense, managing more failures in my code than actually trading. Also I was taking a lot of services at this time and trying to build some sort of brand on twitter, so time was limited. I didn’t take advantage of what the market offered at the start of the year.

The realization that I wasn’t fully ready for a great market environment, was what forced me to scale back on everything else that wasn’t trading and research. After all, I am a trader first, and all else in the business is secondary. If I am underperforming what I find to be acceptable, something needs to be changed right away.

I’ve preserve capital well during an intense down regime where most people lost significant portions of their capital, why am I going to waste all that energy, by not giving it my best going forward. It was time to put all the research I’ve worked so much for to work.

Narrowing my Focus

I want to make clear that a lot of what I am going to write, and that have written in this article, I’ve learned from incredible people on twitter and other places. It may be a very toxic place at times, but if you filter the people you follow, you will find a lot of great stuff. Just like building a trading model, we look at the data, and our objective is to filter actual signal from the noise.

I had a lot of conflicting activities in my life at this point, which I am grateful for, but that needed to be scaled back. A few examples:

Services for different companies.

Building trading systems for all kinds of styles. At one point I was attempting to build a market making system.

Growing my twitter account. This seems trivial but it did require some time to produce some of the content I was doing. Those backtests I used to release more often, took me many hours to construct from scratch.

I needed to focus on one thing and one thing only. Something I thought I had some understanding for and that could really fit my life. That was trading momentum and trend. That was the style of trading that always worked for me. I understood it, I knew what I was modelling for, I understood the risks associated with it and the drawdowns I’ll have to incur. So that was my focus.

The Improved System

I already had a variation of my current system going into 2023, despite the fact that it didn’t have the proper assumptions about risk and allocation. So I took that system and started to work on it. I removed all the complexities that didn’t add value to the system and started with a few basic assumptions. I want to buy things that are up, sell things that are down, and understand what’s the maximum risk I can incur, that I can stomach, whilst still taking proper advantage of momentum.

I realized that trading a very wide spectrum of assets, the lower the timeframe I go, the higher the degree of filtering will have to be used. The higher the degree of filtering that I have to use, the higher the complexity of the model thus increasing the risk of an overfit and decay. I am not a mathematician or a brilliant theoretical thinker about how to model for these things. So the path was to dumb it down, so that even someone as me, can’t mess it up. I had to reduce the frequency of the signal I was getting, and the solution I found to that, without adding complexity to the model, was just to increase timeframes. I started to get signals from a weekly timeframe rather than daily or even below. For many people that is too high and they can’t go through it. I find it peaceful and I truly understand what I am doing.

August - Mid October Performance

I deployed this new improved system around mid August on a spot-only portfolio. I wanted it to be consolidated in a single place instead of all scattered on wallets, decentralized and centralized exchanges, etc. August and September were great and I was beating the returns from BTC by quite a decent margin, despite the overall market still being down during that period. This to me showed that at least I was doing something right in regards to selection this time.

October came around and I took a decent hit to the portfolio. I didn’t round-trip the gains like before but it was hurtful. I was trading very volatile coins at this point and some of them when they came down, they came down really hard. I was using a very low sensitive exit signal at this point, and until I closed the position, I gave back a lot of the unrealized returns. The exit strategy is something I’ve also worked on pretty hard and that I improved right after this happened. Again I didn’t add complexity to the model, but rather changed the model to use a more sensitive exit that really helped with historical returns.

We never know how these improvements will play out without going through the actual tides of the market. I have a decent idea from the validation tests I’ve built, but we never TRULY know. And the market hasn’t had a decent pull back ever since October. I want that pullback to test my ideas. The thing about momentum/trend is that you can do all the fancy work to avoid drawdowns or give back too much of the returns. At the end of the day, you will have to go through that in order to keep playing the game. It’s a never ending battle with your emotional response to how much cash is on the table, and how much you can keep of it. If you try too hard to keep the majority of it, you will end up adding complexity to the model and possibly destroy it. If you do too little of it you’ll give back far too much returns back to the market, and won’t be able to efficiently capture what the market offers on a given regime. It’s all about that balance that many struggle with. The equilibrium between the extremes. I guess that’s also a lesson about life ain’t it?

Mid October - December

The performance after that dip in October was pretty smooth. I ended up beating BTC’s returns for the period and I am happy about it. There’s not much to say here other than the fact that a rising tide lifts all boats and we need to keep in mind that it is positive because the market is positive. I am a long-only directional trader and if nothing trends up, I will also not have returns on the account. It is the ticket I have to pay to enjoy the roller coaster in a possible future momentum regime.

Plans for 2024

I have a lot of plans for 2024 in regards to my career.

Build a portfolio of uncorrelated trading strategies that are more focused on unique edges rather than only directional risk.

Diversify my portfolio allocation to multiple sectors instead of being just focused on crypto. A big task but something that must be done as my portfolio grows and my need for preservation grows with it.

Continue to build my brand on twitter by focusing on providing whatever I perceive as value, to the best of my abilities.

Build this newsletter so that people can follow the journey into 2024 and maybe learn something from it. Will also be used as a public track record of my own performance for accountability and future review.

Continue to narrow down my attention on trading and research. Decreasing the percentage of tasks outside of what I am really interested to do. I have a big one ahead, that will require risk on my side, but that needs to be done. I am a risk taker after all.

I don’t like to make trading goals as that is irrelevant. You take from the market what the market gives you not what you have as an arbitrary goal. I am a directional trader who benefits from strong regimes, if there’s no strong regime I don’t have returns. That’s simple as that. We can try to write any goals we want, at the end of the day it is the market that will dictate what you take, and you can’t predict that. Focus on following a process rather achieving some arbitrary goal.

To close this review I want to say thank you to everyone that has helped me through this year. It has been an incredible year of growth and I can’t wait for what I’ll be writing next year and the years that follow. If I had to give a piece of cringy advice is to continue to go forward, improve on your mistakes, and try to get a little bit better every day. Testing a new concept every week, even if it seems small, it will compound massively into the future. Don’t get discouraged by people ahead of you, focus on what you can improve, learn from them and keep getting better. There will always be someone ahead, it doesn’t mean you are not going there also.

I wish everyone has a great 2024!

Disclaimer: The content and information provided by the Trading Research Hub, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making any investment decisions. Trading and investing can involve significant risk of loss, and you should understand these risks before making any financial decisions.