Daily Crypto Report - 12/03/2023

Comprehensive Daily Report: Analyzing Crypto Sentiment, Strategic Portfolio Allocations, and Key Risk Factors

Hey everyone!

If you like the content you see here, consider sharing as word of mouth is how this newsletter gets spread. I appreciate your support!

Let’s start with today’s report!

We’ll stick to the usual agenda below:

Update on my Own Portfolio Allocations

Current Exposure Status

Summary

Potential New Trades For my Portfolio

Market Scanning

Commentary on Potential Trades

Sentiment and Momentum report

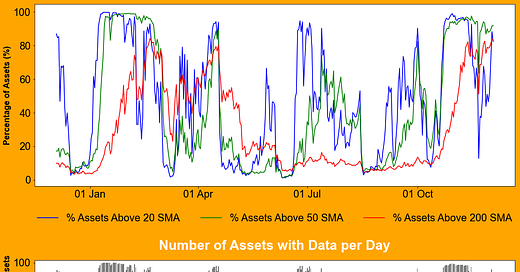

Percentage of coins above their moving averages

Measurement of Current Momentum Extension

Analysis of Bitcoin and Alts performance

Seasonality Charts

Summary of today’s article:

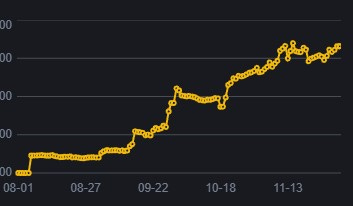

The portfolio is experiencing growth, in line with the recent upward trend in the cryptocurrency market.

Portfolio composition includes a mix of major and promising cryptocurrencies.

Largest holdings, characterized by significant unrealized returns, are performing well.

A noticeable increase in the number of assets above their short-term Simple Moving Average indicates a momentum recovery.

Market deviations are within an optimal range for considering new investment opportunities.

The performance of alternative cryptocurrencies is closely tracking the market leader.

The portfolio has recently shifted from a period of negative momentum to positive momentum.

Seasonal performance this December is stronger compared to historical averages.

Evaluating a potential new addition to the portfolio, based on technical breakout indicators.

Despite a relatively quiet week in the market, there's an optimistic outlook for capitalizing on upcoming momentum-driven opportunities.

Update on my Own Portfolio Allocations

Crypto has been quite slow for the past few weeks but it seems to be picking up back up again in the past few days. The portfolio has been reflecting that with some growth following this recent trend. Let’s see how long this will last and if it is to last. We just manage risk.

Commentary on Today’s Most Interesting Position in my Portfolio

I will comment on the most interesting position in my portfolio at the moment and what other trades I am looking to add in the remaining of the article. If you’d like to support our research, consider joining the newsletter.