Daily Crypto Report - 11/29/2023

Comprehensive Daily Report: Analyzing Crypto Sentiment, Strategic Portfolio Allocations, and Key Risk Factors

Introduction

Good morning everyone!

These reports are taking me around 45 minutes every day to produce, I hope you’ve been enjoying them. As this newsletter grows, so does how much I post here as it will be a better investment on my time. I love writing, but sometimes I have other priorities that might take time away from that.

If you like the content you see here, consider sharing as word of mouth is how this newsletter gets spread. I appreciate your support!

Let’s start with today’s report!

We’ll stick to the usual agenda below:

Update on my Own Portfolio Allocations

Current Exposure Status

Summary

Potential New Trades For my Portfolio

Market Scanning

Commentary on Potential Trades

Sentiment and Momentum report

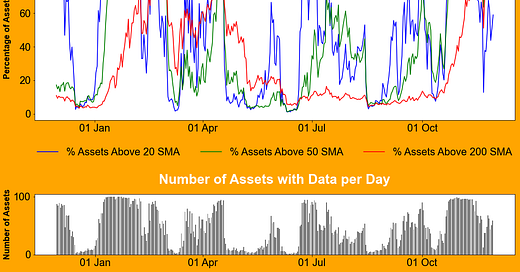

Percentage of coins above their moving averages

Measurement of Current Momentum Extension

Analysis of Bitcoin and Alts performance

Seasonality Charts

Overview of the most relevant news in the crypto sector (if there’s any)

Summary of today’s article:

Portfolio Performance: My portfolio is experiencing steady growth, albeit not significant, in line with the current market conditions. I emphasize the normalcy of periods without progress in profit and loss (P&L) for a trader focused on momentum and trend.

Key Holdings Analysis:

SEI: This is my best-performing position with a 91% gain since November 13th.

USDT: Represents 12.39% of my portfolio.

Bitcoin (BTC): Comprising 8.66% of the portfolio, it has been a profitable holding for nearly two months.

GAL and PNT: These are recent additions to my portfolio, showing profits but not significantly.

Other Holdings: Constitute 55.5% of your portfolio.

Sentiment and Momentum Report:

The market is currently indecisive with a noticeable chop.

I express concern about deviations on higher timeframes, particularly weekly, from the 200-week moving average.

I prefer adding to positions when there is significant room for growth.

Market Dynamics:

The current momentum period has lasted 8 days, with historical trends suggesting a potential continuation.

Bitcoin's performance in November is positive but below its historical average for the month.

Potential New Positions: I am considering a few coins for their strong charts and social media momentum.

Closing Remarks:

I acknowledge the instability of current price levels and anticipate a potential reset.

Your trading approach is systematic, focusing on long-term sustainability rather than prediction.

Update on my Own Portfolio Allocations

No major changes to the performance of the portfolio at the moment. We keep steadily going up but nothing too significant given the current conditions of the market. As trader focused on momentum and trend, there will be long periods of time with no progress in terms of P&L which is normal and expected.

Commentary on Today’s Most Interesting Position in my Portfolio

I will comment on the most interesting position in my portfolio at the moment and what other trades I am looking to add in the remaining of the article. If you’d like to support our research, consider joining the newsletter.