Daily Crypto Report - 11/23/2023

Comprehensive Daily Report: Analyzing Crypto Sentiment, Strategic Portfolio Allocations, and Key Risk Factors

Introduction

Good morning! It’s 8AM again, which means time to write another report. I intend to expand these reports as we get more and more research out but for now we stick to the most important things I look at every day.

I will try to keep a consistent line of work everyday so here are the main topics for the day:

Update on my Own Portfolio Allocations

Current Exposure Status

Summary

Potential New Trades For my Portfolio

Market Scanning

Commentary on Potential Trades

Sentiment and Momentum report

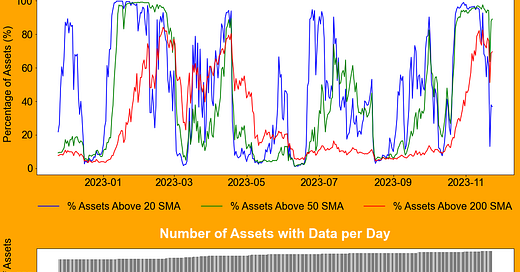

Percentage of coins above their moving averages

Measurement of Current Momentum Extension

Analysis of Bitcoin and Alts performance

Seasonality Charts

Overview of the most relevant news in the crypto sector (if there’s any)

Update on my Own Portfolio Allocations

The chart above is my portfolio on Binance. Yesterday we did have a decent lift from the lows after Tuesday’s overall weakness. The market is currently very hard to get a read on, especially from an observation standpoint. It’s always hard to get any read on the market. Discretionary observations, most of the times, will be wrong and predictions with a low degree of accuracy. Anyone who tells you otherwise is probably lying and trying to sell you something. We as traders try to navigate uncertainty with appropriate risk management and reasonable assumptions about underlying factors. Traders like us, that are actually trading, don’t base our trading off of our opinions or discretionary “macro analysis”.

Commentary on the Currently Most Interesting Position in my Portfolio

I have entered SEI 10 days ago. One of my latest entries into this momentum cycle. I didn’t expect much from this one as it was having weak performance but it’s turning out to be a decent unrealized winner. Every trade that I enter, depending on the current regime, has low odds of working out on an individual trade basis. This is due to the nature of the models I am trading. So a loss is not only expected but also a reasonable assumption to every trade I take. This is how I look at my trading. I am trying to pick a few trades here and there that will be the big shiny winners, and I usually do a good job on being allocated the best ones. But until I get those winners, I have to pick up a lot of “trash”. Also I’ll go through many periods where there’s no big winners around due to market conditions. It’s a hard strategy and yet that’s why it retains edge in my opinion. If it was extremely attractive, it would have been arbed out of the market by other people trading it.

My Current Portfolio Exposure

Stables: 55.4%

Bitcoin: 9.5%

This one remains one of the largest gainers on my portfolio. We first entered it back in the 1st of October at around 27.9k. Always remember to let your profits run to their maximum extent when the trends end. As someone doing trend strategies, I need outlier wins. In order to have outlier wins, I need to remove the urge of trying to cover positions just because we have too much unrealized gains on the table. Zoom out to a larger time horizon and think about you portfolio in the next year, 3 years, 10 years, not in the next month.

I will comment on the remaining of my exposure and what other trades I am looking to add in the remaining of the article. If you’d like to support our research, consider joining the newsletter.