Daily Crypto Report - 11/22/2023

Comprehensive Daily Report: Analyzing Crypto Sentiment, Strategic Portfolio Allocations, and Key Risk Factors

Introduction

Good morning! It’s 8 am Portugal time, and time to write today’s report on the crypto market. These will be the main topics for the day:

Update on my Own Portfolio Allocations

Current Exposure Status

Summary

Sentiment and Momentum report

Percentage of coins above their moving averages

Measurement of Current Momentum Extension

Analysis of Bitcoin and Alts performance

Seasonality Charts

Potential New Positions For my Portfolio

Overview of the most relevant news in the crypto sector

Update on my Own Portfolio Allocations

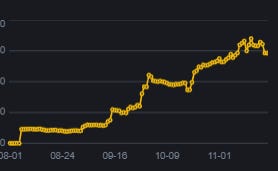

The chart above is a screenshot taken from Binance with my portfolio performance trading a long-only, low frequency trend model this year.

Yesterday the altcoins across the board displayed significant weakness and I had to close a lot of exposure. One of the best trades I’ve had this year also had to be closed and that was $SOL in the chart below. (Green horizontal line represents the average price I got in and the red arrow on the right of the chart represents the bar I’ve exited the position)

My Current Portfolio Exposure

Stables: 57%

BTC: 9%

Bitcoin trend looks quite amazing. Every dip has been getting a lot of buying and we don’t see any significant sign of weakness on higher timeframes. We’ve seen some slowing down around this local top, but it’s normal on these massive trends.

I will comment on the remaining of my exposure and what other trades I am looking to add in the remaining of the article. If you’d like to support our research, consider joining the newsletter.