Daily Crypto Report - 11/21-2023

Comprehensive Daily Report: Analyzing Crypto Sentiment, Strategic Portfolio Allocations, and Key Risk Factors

Opening Thoughts

Hi! First and foremost welcome to the starting stages of this newsletter. I hope that my daily reports provide you with more tools to navigate the volatile sector of cryptocurrencies. In the future I will be adding other sectors, but for now I want to focus on what I specialize on, and that is, crypto currencies. I want to provide as much value as I can with this newsletter. That is what I aim to do with any endeavor I commit myself to do.

Always feel free to send suggestions and questions around ideas and data you’d like to see presented as my plans is to grow this newsletter into this full report on markets and get you a broad sense for the day.

Let’s begin!

Analyzing Crypto Sentiment

When we think about sentiment, what does come to mind? The strength of the market? The strength of all assets within that sector? But what do we mean by “strength”? Is it a measure of performance? But performance in 2021 vs in 2022 is far different. What we classify as strength back then differs from what we classify as strength in 2022-2023 right? So we need to start thinking more clearly and systematically about our assumptions.

Summary of Paid Report Today:

Market Properties:

Identifies three main properties of markets: Trend, Momentum, and Mean Reversion.

Emphasizes the impact of human behavior, particularly greed and fear, on market dynamics.

Understanding Market Dynamics:

Discusses how social influences and personal decisions contribute to market trends.

Explores the concept of momentum as a combination of trend direction, performance, and speed.

Examines mean reversion in the context of investor behavior, especially in terms of profit-taking decisions.

Analytical Approach:

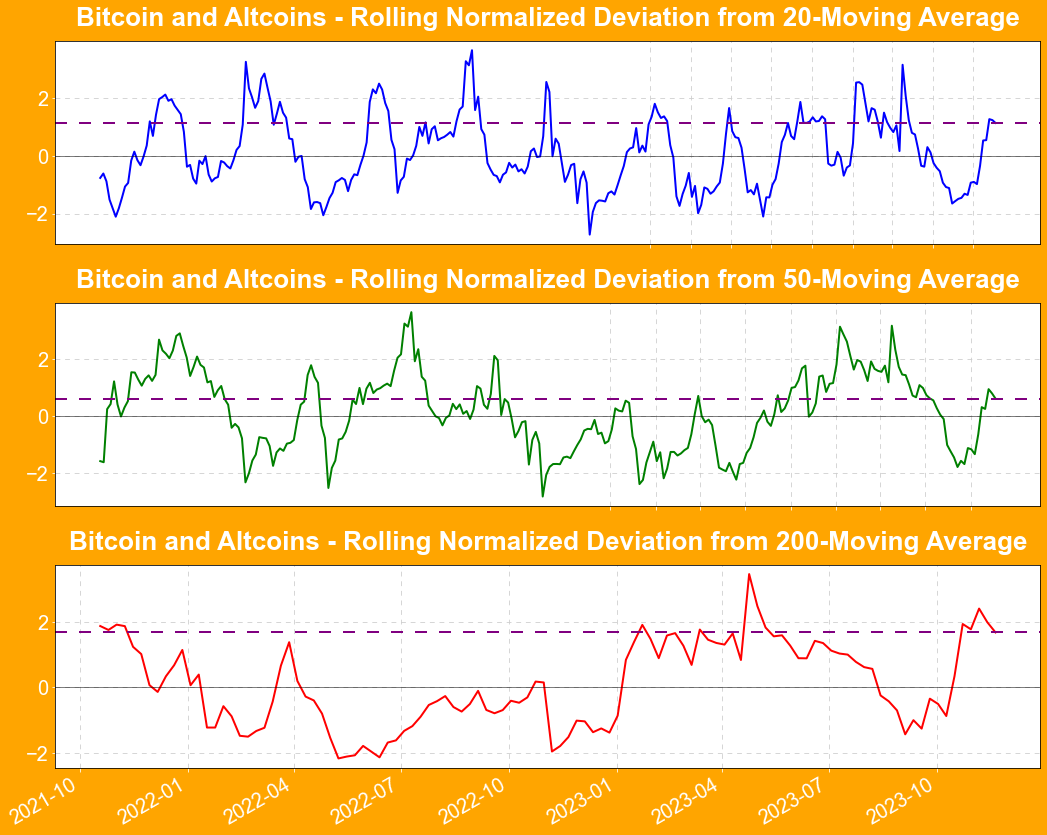

Focuses on normalized deviation analysis to compare different market datasets, like Bitcoin and S&P 500.

Uses rolling basis measurements to adapt to current market regimes, avoiding outdated comparisons.

Current Market Analysis:

Presents current normalized deviations (Z-Scores) for 20-Day SMA, 50-Day SMA, and 200-Day SMA.

Interprets these deviations as within normal ranges, indicating no extreme market conditions.

Momentum Period Analysis:

Observes the current length of the momentum period in the crypto sector.

Highlights the risk of overexposure during extended momentum periods.

Differentiates between measuring momentum and trend.

Strategic Exposure and Risk Management:

Advocates for strategic capital allocation, particularly at the beginning of momentum periods.

Cautions against adding exposure during extended periods of positive momentum.

Future Momentum Predictions:

Analyzes the likelihood of sustained momentum based on the duration of the current momentum period.

Seasonal Trends in Cryptocurrency:

Examines Bitcoin's performance in November in the context of historical averages.

Acknowledges the influence of real-world factors on seasonal trends, especially in Q4.

Report Summary and Strategy:

Summarizes current market conditions, emphasizing caution in adding exposure during extended momentum periods.

Focuses on managing existing positions rather than overextending in current market conditions.

Invites feedback and suggestions for future reports.