Most people have day jobs and don’t have time to track every event that is happening about crypto. But being updated on everything that is going on in the industry is one step forward to be informed and better prepared.

It is part of my job as a trader to keep track of everything that is happening in the crypto space, and where best to do that? Crypto Twitter!

In this series I want to make a summary of the data and major events happening on crypto twitter every day. The goal for me is to keep a daily log of what is happening in the crypto space and why not share it also? Let’s begin.

Let’s look at the top individual content for the day on Crypto Twitter:

Amazon has become the first company to lose 1$ trillion in market value. As the equities market decline so does this large companies give back large chunks of already historical gains. It’s all a matter of perspective. In the previous recent years we’ve seen historic gains in traditional markets. This will also lead to historic losses if we look at dollar value. However interesting news nonetheless.

Apparently the team at FTX has located 1$ billion in assets which is quite interesting. I wonder how does a company suddenly find 1$ billion? Is that sum of money like lost keys? You just misplace it and one day you find it again. Definitely interesting things happening over there. I just hope that eventually people that lost money there can be paid at least partially and even better in full.

Sam will be extradited to the US.

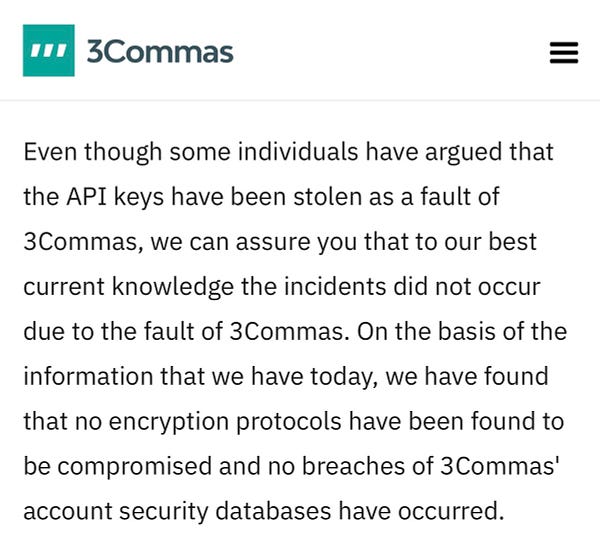

There has been apparent unauthorized trading from accounts that were connected to 3commas. 3commas is a service provider that offers signals via third-party providers. In order to receive those signals you must give them your API keys so that they can connect to your broker. The problem is that apparently there were phishing attacks on 3commas and some keys were leaked, leading to unauthorized trading on those users broker accounts.

Best way to proceed here is to delete API keys and regenerate any that you may have forgotten. Make sure security is priority.

Now let’s look at the data of the top influential accounts on Crypto Twitter:

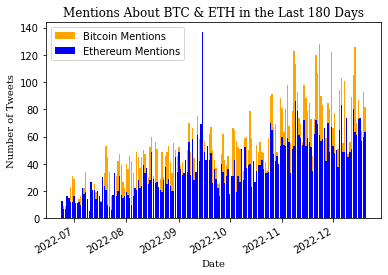

Bitcoin keeps winning in total mentions but the overall mention number of Bitcoin and Ethereum is declining. When prices decline interest gets lower also and people fade away from posting.

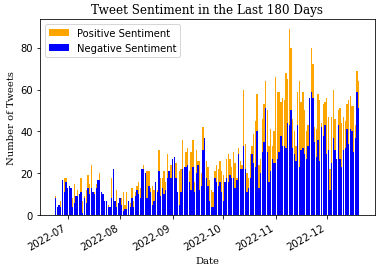

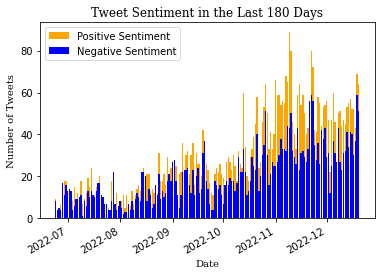

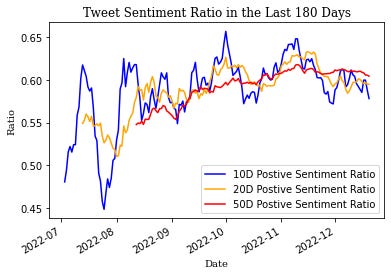

Sentiment in crypto twitter continues rather low as the moving averages move lower. We should expect to see this trend keep heading lower as prices decline and when prices do recover this sentiment will also recover.

Market bottoms occur on peak bearish sentiment and market tops occur on peak bullish sentiment. With this analysis the goal is to understand which stage we’re on and to move carefully when extensions occur to either side.