In this series my plan is to make a summary of the data and major events happening on crypto twitter. The goal is both for myself to keep a log and to share with all of you.

It is part of my job as a trader to keep track of everything that is happening in the crypto space, and where best to do that? Crypto Twitter!

Let’s look at the data:

For this analysis I’ve tracked the most influential accounts on twitter based on number of followers, general credibility and visibility. This is completely discretionary based on my experience. Right now we’re tracking about 50 top accounts and we’ll keep adding.

In the chart below we can see the accounts that are tweeting the most today from these major accounts.

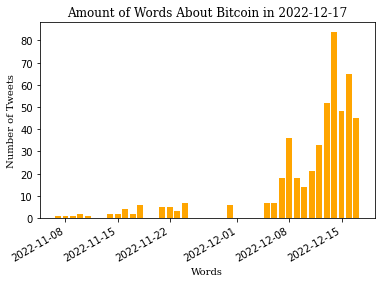

Let’s also look at the amount of times people are talking about Bitcoin and Ethereum:

Understand that this data is newly tracked so it may not be 100% accurate as I don’t have enough tweets for all of these days. However with the tracking of data that I am doing we will get more and more accurate as we go.

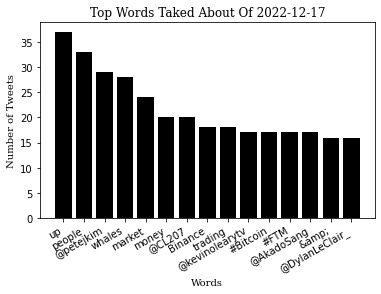

Let’s also take a look at the topics that these major accounts have been talking about most of the time today:

Let’s look at the top individual content for the day:

Most of the crypto assets are declining as we’ve seen for most of this year, and especially on weekends when volume dries we get a lot of random conversation from bored people. So today most of the conversation on twitter seems to have been around Binance FUD and all the debate about their strategic reserves.

Satoshi Flipper has a good argument. Even though I don’t trust any company blindly, as no one should, they are definitely attempting to show transparency. Recently Binance shared the wallets in which they keep company assets as proof of reserves with a very liquid position with 97% of customers deposits collateralized by the exchange assets (according to cryptoquant). This wallets are now tracked 24/7 by the space and any irregularities will sure be caught quite quickly. When a company makes publicly available their financial reserves, that shows me confidence in the underlying structure of the business.

So for all the talk about the liquidity of the company, they are pretty liquid and open about their reserves. I don’t get where all the negativity is coming from but it’s the current space in which we are in.

CZ has a good point here, usually the majority is a good counter-signal to follow. If everyone was right all the time there would be no edge to exploit. We need someone taking the other side of the trade in order for something to have a valid risk-reward over large iterations. If you are longing when everyone is long is usually a bad sign and also the opposite.

Out of context tweet but also interesting. Again another example of what we’ve talked yesterday. If you are buying when everyone is buying at already over-valued pricing, you are exposing yourself to large risks. Obviously it’s not as simple as that, but something to consider both in trading and also other large purchases.

Some traders when backtesting their systems think that they found goal on a random 30min TF trading system only later to find out that fees have a HUGE impact on their trading. This is exactly what Tree of alpha is showing here. He is a great trader with a verified track record, but still paying massive amounts of $ to exchanges to be able to trade. Without correct risk and position management, fees can be a huge problem to some traders. Always consider fees and slippage in your own trading.

People that tweet these kinds of assumptions have no idea what they are talking about. Focus on what matters and that is price. This guy has been more wrong than anyone out there.

Really enjoying this series, Pedma! Keep up the good work!