Crypto Market Sentiment Report - 29/05/2023

Sentiment Report Analysis

Section 1: Overview

The morning sentiment report for 29-May-23 provides a snapshot of the current conditions in the cryptocurrency market, particularly focusing on Bitcoin and Alt-coins, as well as their moving averages (SMA), performance increases, and the Relative Strength Index (RSI). This information presents a mixed bag of signals, highlighting an array of market trends that need to be dissected to make sense of the present landscape.

Section 2: Simple Moving Average Analysis

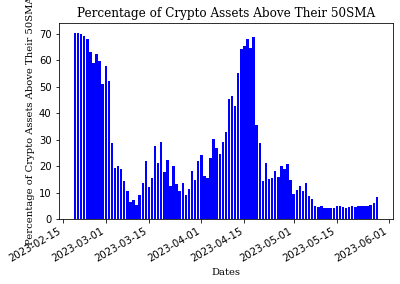

Beginning with the moving averages, the report states that 52.63% of Alt-coins are above their daily 20 Simple Moving Average (SMA), which is a relatively bullish signal. This suggests that more than half of these coins are experiencing a short-term upward trend.

However, only 8.24% of Alt-coins are above their daily 50 SMA, which is considerably bearish and suggests that less than a tenth of these coins are on an upward trend in the medium term.

For the long term, 18.54% of Alt-coins are above their daily 200 SMA. This metric again hints at a somewhat bearish outlook as fewer than a quarter of these coins are on an upward trend over the longer term.

Section 3: Top Performing Coins

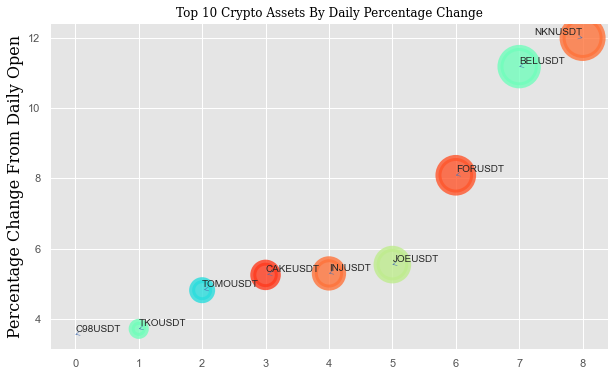

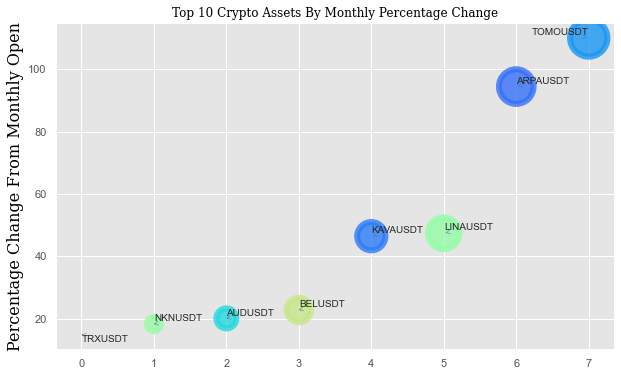

Moving onto individual coin performance, the report highlights the strongest performers on a daily, weekly, and monthly basis.

NKN has emerged as the strongest daily and weekly coin, with a 12% increase from its open price on the day and a 13% increase for the week.

For the monthly timeframe, TOMO leads the pack with a whopping 110% increase from its open price. This might indicate a bullish outlook for TOMO in the short-to-medium term, especially if it continues to sustain such robust growth.

Section 4: Relative Strength Index Analysis

In terms of the Relative Strength Index (RSI), a key indicator of market momentum and potential price reversals, Bitcoin and Alt-coins show varying dynamics.

The average daily RSI for Bitcoin is 55, which suggests moderate bullishness. As for the Alt-coins, the average daily RSI is slightly bearish at 46, indicating that most of these coins might be slightly oversold.

On a weekly scale, Bitcoin's RSI is moderately bullish at 58. However, Alt-coins are showing a bearish average RSI of 43, suggesting that they might be further into oversold territory.

Section 6: Connecting the Analysis

The three sections reveal a blend of bullish and bearish signals. Moving averages present a largely bearish outlook for Alt-coins, yet there are outliers like NKN and TOMO showing strong growth, indicating that individual coin performance can diverge significantly from the broader market trend.

Meanwhile, the RSI data shows a mixed signal, with Bitcoin appearing moderately bullish while Alt-coins lean towards being bearish. The RSI and SMA data complement each other by giving a fuller picture of the market's overall health. For instance, while the SMA data presents a bearish sentiment for Alt-coins, the RSI suggests these coins could be nearing a bottom and could potentially rebound.

Section 7: Conclusion

In conclusion, the morning sentiment report presents a complex outlook for the cryptocurrency market on 29- May-23. The moving averages hint at a bearish sentiment for Alt-coins, although individual performers like NKN and TOMO challenge this narrative. Meanwhile, the RSI analysis suggests that while Bitcoin may be moderately bullish, Alt-coins could be nearing oversold conditions, setting the stage for potential rebounds.

Investors should consider these mixed signals and use further technical and fundamental analysis to make informed decisions. As with any investment, the risk should be considered alongside potential rewards, and a diversified portfolio can help manage these risks.