Introductory Note:

Hey everyone, I owe you all an apology as my presence here has been rather sparse over the recent weeks. My travels and a new project, which I'll discuss today, have diverted my attention, resulting in my writing taking a backseat.

In the vast universe of market trading, we encounter a myriad of "traders" who boast about their high performance and peddle their courses and materials as the golden key to understanding the markets. However, one can't help but notice the lack of verified performance from these traders.

Now, you may argue that they occasionally share some of their trades as a testament to their prowess, but let's clear the air – that's not a genuine measure of performance. Real performance emerges from a substantial sample size of trading over extended periods, and not just from a selection of successful trades.

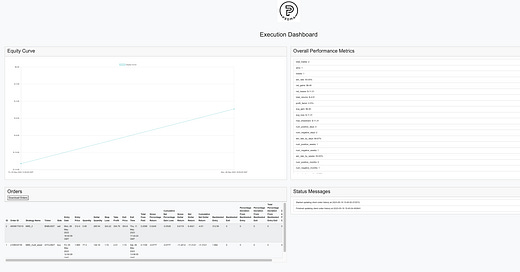

So, as I dive into this space, I intend to be recognized as a transparent trader, one who takes the initiative to share performance data. Hence, I am in the process of developing a straightforward performance dashboard for all my trading algorithms.

Disclaimer - I am not a tech whiz. My background lies in finance and accounting, and I learned coding independently to write my algorithms. The purpose of this dashboard is neither aesthetic appeal nor user-friendliness. Instead, it's a tool to present actual performance and live test my algorithms.

Objectives of the Dashboard:

To ensure transparency concerning my performance.

To live test trading strategies prior to incorporating them into my primary account.

To demonstrate growing a small account using a quantitative approach.

To share performance data on a monthly/yearly basis.

I plan to kickstart this journey with the minimum possible investment and gauge its potential growth. While this will entail a higher risk than my regular account, it's a calculated part of the experiment.

Lessons Learn this Month:

The process of setting up an AWS instance to keep the dashboard operational round the clock.

The importance of segregation in a portfolio with both short and long systems. Keep them separate by sub-accounts, market types, or brokers to avoid unintentional closure of positions.

The need for vigilance in sizing allocation. Monitoring how drawdowns evolve with different types of allocation to each strategy is crucial. Understanding the portfolio-level risk from multiple simultaneous strategies is a must.

Working with databases and the significance of ensuring the accurate recording of data.