A review of 2022 - Crypto Trading

My performance and thoughts about 2022.

My 2022 performance is not what it seems.

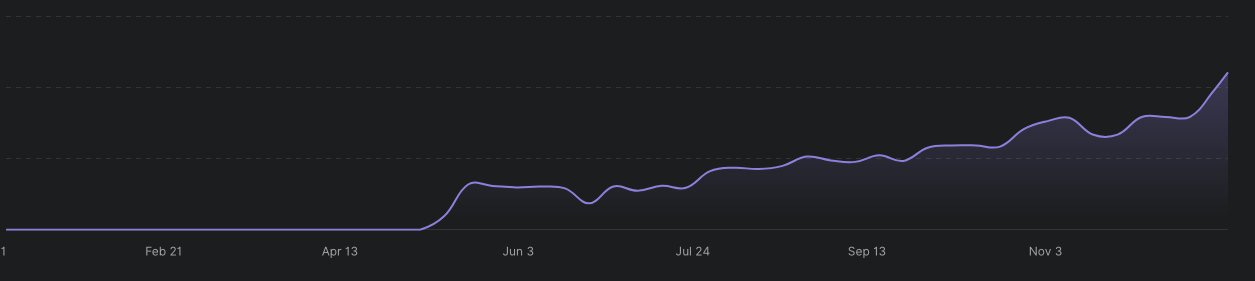

People often ask me how I was able to generate returns in a market where most traders lost money. The answer is that I didn't achieve this through active trading. In fact, I barely traded at all in 2022, with a few exceptions throughout the year. This was due to the fact that it was one of the toughest markets to trade in recent history.

Instead, my systems are primarily focused on swing trading on the long side. They analyze market data and determine the current market regime. If the market is in a bear regime, I don't engage in trades that go against the trend. I believe that a significant advantage can be gained by simply doing nothing and waiting for more favorable market conditions, where making money is relatively effortless compared to a bear market.

While there are certainly opportunities for short selling in bearish markets, I have not yet found a consistent way to do this over extended periods of time. It is more challenging in a market where the long-term trend is upwards. However, I am working on finding a solution.

Trading is all about increasing your chances of success. As the saying goes, "A rising tide lifts all boats." Waiting for that rising tide is crucial for a trader. Patience is often misunderstood in the trading world, but it was put to the test in 2022, when swing traders barely traded at all for the entire year. It takes discipline to refrain from trading in a hot market like 2020 and 2021, but it is essential to follow the data and stop trading when it is not favfavourable.

As Jesse Livermore once said, "There is a time to go long, a time to go short, and a time to go fishing." The market is not a 24/7 casino where you can always extract profits. Those who claim they can make money every day, week, or month by simply using a "simple setup" are lying and trying to take your money through their services. There will be times of inevitable drawdowns and periods where nothing seems to work. The key is to keep your losses small and keep going.

Trading is a business, and in a successful business, your products or services should generate a profit after taxes and expenses. If your trading business is not profitable, it is time to reevaluate your business plan and strategies.

Lessons from 2022.

The crypto industry has faced a lot of challenges in 2022 that have further damaged its reputation. These have included events such as LUNA, FTX, bankruptcies, and increasing instances of "rug pulls" from influential figures.

This has taught us that anything is possible and nothing is completely safe. Even placing your money in seemingly "reputable" exchanges does not guarantee protection. It's crucial to consider all the potential risks to your trading business and take steps to prevent them.

I almost fell victim to the FTX incident myself. This highlights the importance of being vigilant and taking the necessary precautions.

As I mentioned in a tweet before withdrawals were halted, I have no loyalty to any particular exchange. If I hadn't been paying attention to Twitter and the first indications that FTX might be insolvent, I could have lost a significant amount of money with them.

This serves as a reminder that it's important to act quickly when you see trouble. It doesn't matter if it's FUD (fear, uncertainty, and doubt) or not. Anything is possible, and your main goal should be to protect your capital. Without capital, you can't keep betting on the market. It's your responsibility as a trader to prioritize preserving your capital and consider all the risks.

We've also learned not to blindly trust any project and prioritize price action over narratives. It doesn't matter if a project you're holding on to claims to be the future if it's down 90%. Is your goal to make money for your future or to be part of some kind of cult? You need to focus on what matters, and that's price.

Price is king for a reason. Fundamentals are not useless, and incorporating strong fundamentals into your trades can be a great way to filter out bad trades and focus your exposure on the best projects. However, when prices start to drop, it's the market telling you to exit, and you must respect that.

Holding on to a losing position, or "bagholding," is not a viable option. Just because someone on Twitter made a lot of money from holding a large quantity of SHIBA doesn't mean it's a viable long-term strategy. It just means that individual won the lottery. Don't you agree that the probability of winning the lottery is extremely low? When you see someone claiming to have made a profit by holding a large position from a low price, understand that they are the "survivors." It doesn't mean they know more than anyone else; it just means they got lucky with a bet. If there's no process involved, they will likely lose those profits just as quickly as they gained them.

In conclusion, it's important to prioritize protecting your capital as a trader and consider all the risks involved. This includes being vigilant about potential issues with exchanges and acting quickly when trouble arises. It's also crucial to prioritize price action over narratives and avoid "bagholding" or holding onto losing positions. It's essential to have a process in place and not rely on luck or blindly trust any particular project or individual. By following these principles, you can increase your chances of success in the volatile and unpredictable world of crypto trading.